Prices

August 14, 2018

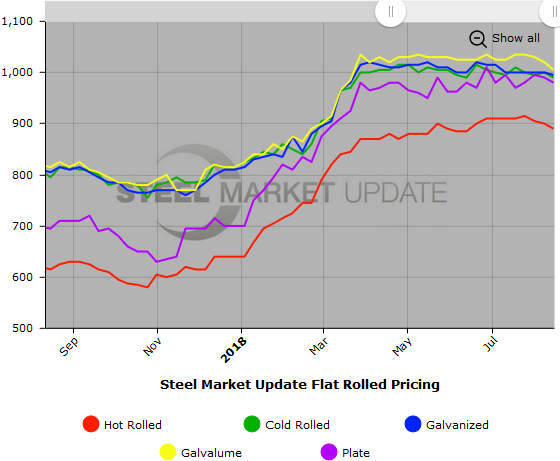

SMU Price Ranges & Indices: Prices Move Lower

Written by Brett Linton

We saw flat rolled steel prices as being lower this week compared to one week ago. As we reported last week, we are seeing lead times shortening and the mills more active and willing to discuss price during their negotiations. The ArcelorMittal USA price announcement on cold rolled and coated products is not a sign of strength. If not for the Turkey tariff situation, SMU would be adjusting our Price Momentum Indicator to Lower from Nuetral this week. However, we want to understand the ramifications of the change in tariffs and to see if there may be a tightening of inventories if orders are cancelled or moved outside of the United States. Stay tuned, we will discuss our thoughts more as this week progresses.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $870-$910 per ton ($43.50/cwt-$45.50/cwt) with an average of 890 per ton ($44.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to one week ago. Our overall average is down $10 per ton compared to last week. Our price momentum on hot rolled steel is Neutral meaning the product is potentially in transition. We are not predicting which way prices will move over the next 30 to 60 days. Our initial expectation is for prices to move sideways over the short term.

Hot Rolled Lead Times: 3-7 weeks

Cold Rolled Coil: SMU price range is $970-$1,010 per ton ($48.50/cwt-$50.50/cwt) with an average of $990 per ton ($49.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to last week. Our overall average is down $10 per ton compared to one week ago. Our price momentum on cold rolled steel is Neutral meaning the product is potentially in transition. We are not predicting which way prices will move over the next 30 to 60 days. Our initial expectation is for prices to move sideways over the short term.

Cold Rolled Lead Times: 5-9 weeks

Galvanized Coil: SMU base price range is $48.00/cwt-$51.50/cwt ($960-$1,030 per ton) with an average of $49.75/cwt ($995 per ton) FOB mill, east of the Rockies. The lower end of our range declined $10 per ton compared to one week ago, while the upper end remained the same. Our overall average is down $5 per ton compared to last week. Our price momentum on galvanized steel is Neutral meaning the product is potentially in transition. We are not predicting which way prices will move over the next 30 to 60 days. Our initial expectation is for prices to move sideways over the short term.

Galvanized .060” G90 Benchmark: SMU price range is $1,046-$1,116 per net ton with an average of $1,081 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-10 weeks

Galvalume Coil: SMU base price range is $49.00/cwt-$51.50/cwt ($980-$1,030 per ton) with an average of $50.25/cwt ($1,005 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to last week, while the upper end fell $10 per ton. Our overall average is down $15 per ton compared to one week ago. Our price momentum on Galvalume steel is Neutral meaning the product is potentially in transition. We are not predicting which way prices will move over the next 30 to 60 days. Our initial expectation is for prices to move sideways over the short term.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,271-$1,321 per net ton with an average of $1,296 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-10 weeks

Plate: SMU price range is $960-$1,000 per ton ($48.00/cwt-$50.00/cwt) with an average of $980 per ton ($49.00/cwt) FOB the customer’s facility for orders to be delivered during the month of October. The lower end of our range rose $10 per ton compared to one week ago, while the upper end declined $30 per ton. Our overall average is down $10 per ton compared to last week. Our price momentum on plate steel is for higher prices once the mills open their October order books. The plate mills are on controlled order entry and are expected to remain that way over the next 30 days or longer.

Plate Lead Times: 6-9 weeks, allocation/controlled order entry

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.