Prices

August 14, 2018

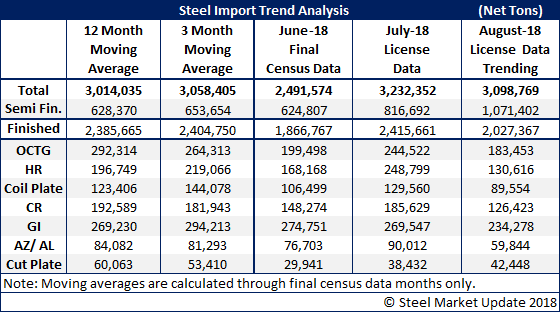

August Imports Trending Toward 3 Million Ton Month

Written by John Packard

If nothing else, foreign steel imports are resilient. After June imports came in at 2,491,574 net tons, July headed right back to 3.2 million net tons on the back of the domestic steel mills who imported approximately 800,000 of slabs. Now, based on August license data through today (Tuesday, Aug. 14), the domestic mills are once again leading the way as imports are “trending” to another 3 million net ton month. As of today, slab imports (semi-finished steels) are trending toward a 1 million net ton month. However, when looking at finished steels the month is trending toward a 2-million-ton level, which is significantly lower than the 12-month moving average (2.4 million tons) and the 3-month moving average (2.4 million tons).

We are seeing significantly lower numbers, again based on license data through the 14th, on OCTG, hot rolled, coiled plate, cold rolled, galvanized and Galvalume products. With the new tariffs on Turkey, we can expect to see these number potentially drop further depending on how the Turkish traders react to the ships that are on the water headed to the United States.

We are reporting these numbers as “trending” as they are based on license data through the 14th of the month. We assume the rate will continue at its current pace, which provides us a daily import license number. We then extrapolate that number over the course of the entire month to determine the monthly “trend.” At this point in the month, the trend could vary by as much as 200,000 net tons (+/-).