Government/Policy

August 9, 2018

CRS Report Delves into Trade Tariffs

Written by Sandy Williams

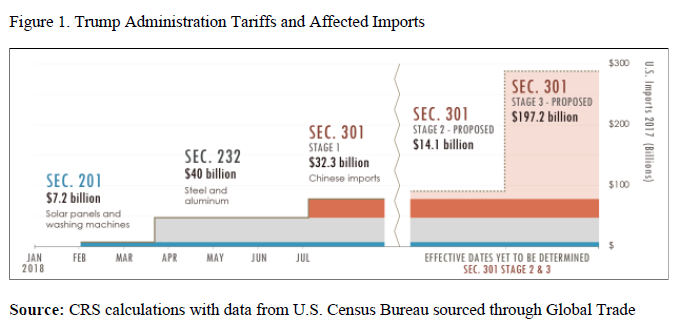

The numbers 201, 232 and 301 are getting a lot of headlines recently. They are sections under three U.S. laws that President Trump has used to impose tariffs on a variety of goods and countries.

Section 201 of the Trade Act of 1974 was used to place tariffs on imports of washing machines and solar products to the U.S. after commerce determined that the quantities and pricing of imports were injuring domestic producers.

Section 232 of the Trade Expansion Act of 1962 allowed the president to unilaterally impose tariffs on imports of steel and aluminum and, potentially, uranium, autos and auto parts in the name of national security.

Section 301 of the Trade Act of 1974 was used to place tariffs on goods imported from China as punishment/leverage to coerce China to change its trade policy on intellectual property and forced technology transfers.

A July 31 report prepared by the Congressional Research Service for Congress provides a timeline of the tariffs used by the administration including dates, goods and revenue impacted, and any retaliatory measures taken in response.

As of publication of the report, the administration formally proposed tariffs on $293 billion of goods with an expected $41 billion in tariff revenue. Approximately $80 billion of goods have actually been implemented with potential tariff revenue of $18 billion.

Tariffs range from 10 percent to 50 percent and in some cases include quota limits. The tariffs are in addition to any existing duties from antidumping, countervailing or other measures. “While the tariffs may benefit some import-competing U.S. producers, they are also likely to increase costs for downstream users of imported products and some consumer prices,” states CRS.

Retaliatory tariffs, not including the recently announced response from China to additional tariffs from the president, cover approximately $60 billion of U.S. annual exports, based on 2017 export values.

“Retaliation may be amplifying the potential negative effects of the U.S. tariff measures. Economically, retaliatory tariffs broaden the scope of U.S. industries potentially harmed, targeting those reliant on export markets and sensitive to price fluctuations, such as agricultural commodities,” said CRS.

CRS noted that some U.S companies have announced plans to shift production to other countries to avoid tariffs on U.S. exports. Retaliatory tariffs and new bilateral agreements between other countries could make U.S. exports less competitive in foreign markets.

The president’s ability to unilaterally impose trade restrictions has become a concern to many members of Congress, including Republicans who have historically endorsed free trade, and the chairs of the Ways and Means and Senate Finance committees. Several bills have been proposed to constrain the president’s authority in regards to trade matters. Congress is asking the following questions:

- Sections 232 and 301 give the president broad discretion on trade measures; only Section 201 requires an affirmative finding by an independent agency, the ITC, before the president can restrict imports. Are additional congressional checks on such discretion necessary?

- What are the administration’s objectives from the tariff increase and do potential benefits justify the potential costs?

- What are risks to the international trading system of continued unilateral action?