Prices

July 31, 2018

CRU: July Jump in Iron Ore Price Only Temporary

Written by Tim Triplett

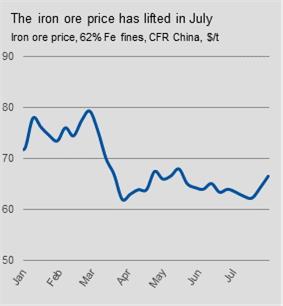

Iron ore prices have jumped from about $62 to $66 per ton in the past month, but the change is only temporary, said CRU senior analyst Erik Hedborg. “Ore prices are slightly higher in July, but we expect them to continue to fall for the rest of the year.”

Hedborg attributes the July bump to a slowdown of production in Australia following a surge in June as the nation’s fiscal year came to an end. “We see quite a lot of new supply coming onto the market in the next few months, especially from Brazil and Canada. So that is why we foresee prices falling in the second half of the year,” he said.

In CRU’s July Iron Ore Market Outlook, Hedborg reported that after a strong start to 2018, the iron ore benchmark price fell in the second quarter as restocking in China stopped and seaborne supply improved, especially from Australia and Brazil. During the quarter, the market experienced very low volatility and prices never moved more than $2 in either direction.

Heading into the second half of the year, CRU expects continued strong supply on the seaborne market, especially from Vale, Roy Hill and Canadian producers that are ramping up production to full capacity. CRU forecasts that the second half of the year will see seaborne supply increase by 4 percent, despite producers in both India and Australia leaving the market. On the demand side, a new round of “heating season” restrictions in China will cut capacity of hot metal, sinter and pellet production. Together with JKT (Japan, Korea and Taiwan) and Europe, two other regions that import large volumes of iron ore, hot metal production will increase by around 2 percent compared with the first half of 2018. Most of the increase will take place at the start of Q3, before dropping gradually throughout the rest of the year, Hedborg said.

“With iron ore prices currently sitting at the 93rd percentile on the cost curve, looming supply additions that will outpace demand growth will add pressure to prices, especially towards the end of the year. Therefore, we maintain the view that there is room for price falls, especially considering the high inventories at ports and at mills throughout China,” he added.

(Chart courtesy CRU Group)