Prices

July 19, 2018

Hot Rolled Steel and Scrap Futures: HR Volumes Up

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

HR futures volumes rose sharply this week as decent volumes were traded in all months from Aug’18 through Jun’19. Over 72,000 ST of HR futures were traded primarily in the latter half of 2018. However, there was some decent volume trading in the 1H’19, which was likely linked to some spreading versus the 1H’18. The forward curve shape shifted as the near dates declined approximately $12/ST, while the 1H’19 rose about $15/ST. Today, Aug’18 was trading at $895/ST versus Dec’18 trading last at $810/ST leaving the spread at $85/ST, which is $9/ST narrower than last Thursday basis the settlements. It is also worth noting that early buying in the week of HR, which moved prices up, was met with strong selling today. Continued sideways spot prices this week could be behind the selloff. In addition, a strong U.S. dollar and weak yuan are raising concerns that commodity prices have the potential to slide.

Natural buyers of hedge protection seem reticent to lock in futures prices even with the steep discounts to the spot price because the absolute prices are well above the previous year’s levels. As an example, today Q2’19 traded at $776/ST, which is a $143/ST discount to the Jul’19 $919/ST settlement.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

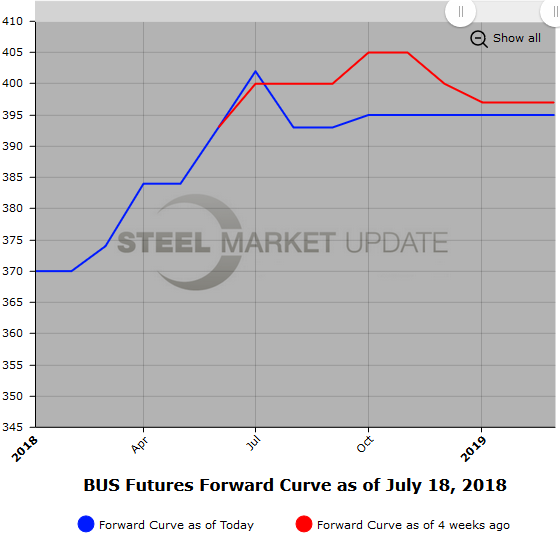

BUS futures have come under some selling pressure this week. Today, Sep’18 futures were traded as low as $383/GT, which is a $10/GT decline from Wednesday when it traded at $393/GT. It must be noted that the $383/GT trade was for 10,000 GT. Aug’18 BUS $385/$400.

In shred (USSQ), the early market chatter has shred spot dropping about $20/GT. Current Aug’18 USSQ market offers are at $350/GT with bids about $10 lower. This week, a number of export shipments had shred trading in the low $350 range.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

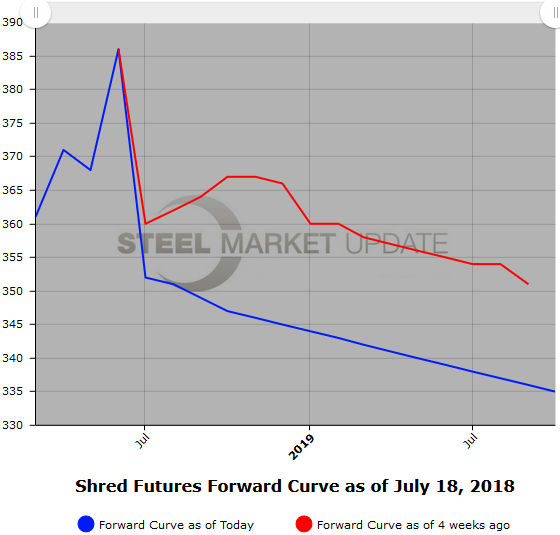

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizeable database, we will add this data to our website.