Market Data

July 8, 2018

SMU Steel Buyers Sentiment Index: Finding Stability

Written by John Packard

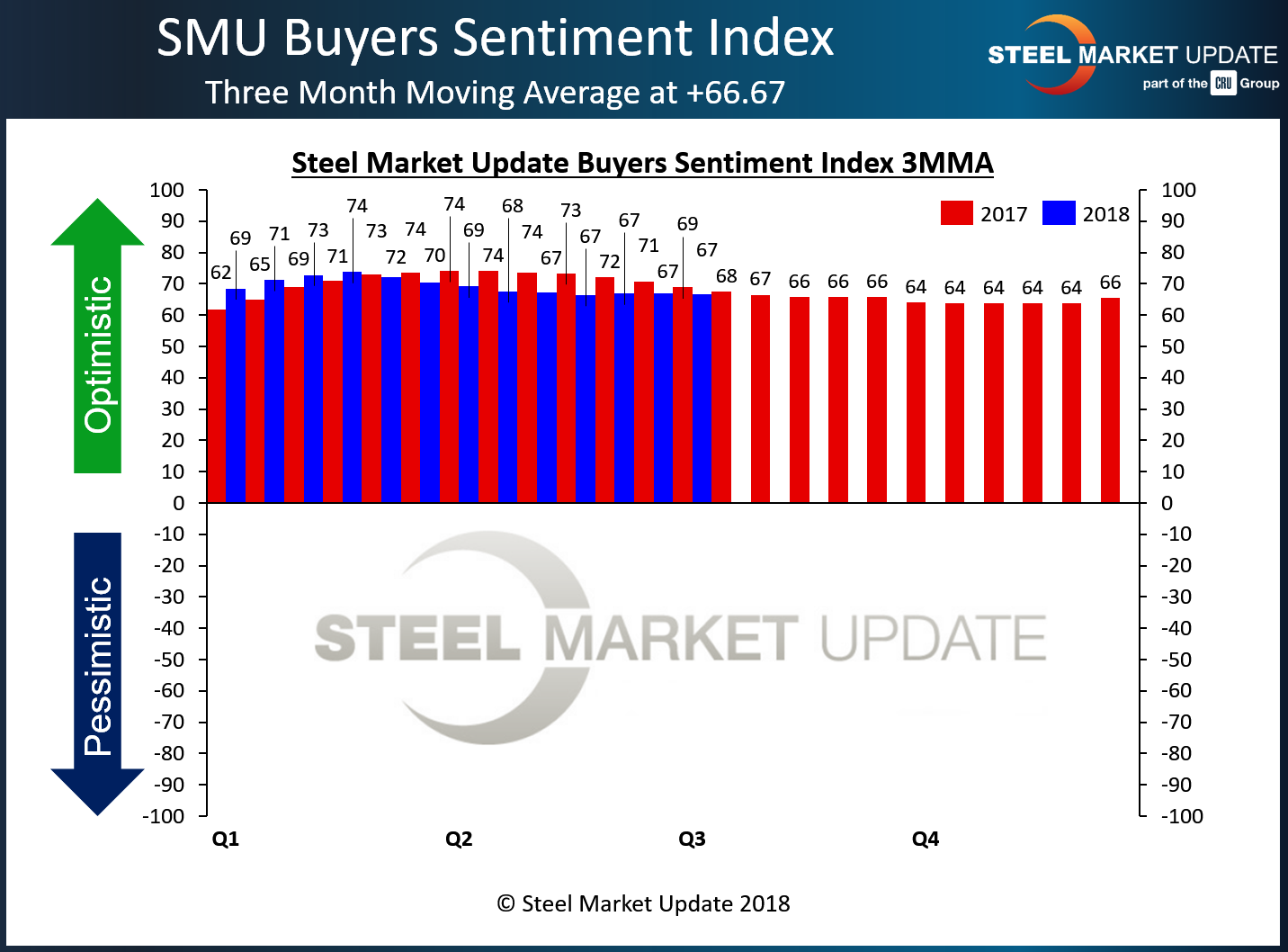

The data from Steel Market Update’s latest market trends questionnaire shows mixed feelings when it comes to Current vs. Future Sentiment. The SMU Steel Buyers Sentiment Index measures how buyers and sellers of flat rolled and plate steels feel about their companies’ ability to be successful both now (Current) and three to six months into the future (Future). Buyers and sellers of flat rolled steel generally remain optimistic about their company’s chances for success. The lower optimistic trend that we were capturing on our Current Sentiment Index 3MMA has returned to the levels seen at this time last year. Looking at the past few months, our Current Sentiment Index appears to have found stability and continues to be within the optimisitc range of the index.

SMU’s Steel Buyers Sentiment Index registered +64 out of a possible +100 this week, down 2 points from mid-June. Calculated as a three-month moving average (3MMA) to smooth out the data, the index dipped slightly to +66.67, just above the low reading of the year of 66.50 recorded in mid-May. The Current Sentiment Index continues to be optimistic, albeit at lower ratios than what we saw earlier this year and for most of 2017. The 3MMA has stabilized after peaking ealier this year at +74.

We saw buyers complaining of too many unknowns in today’s market to make them feel as comfortable as they did prior to the Section 232 announcements being made.

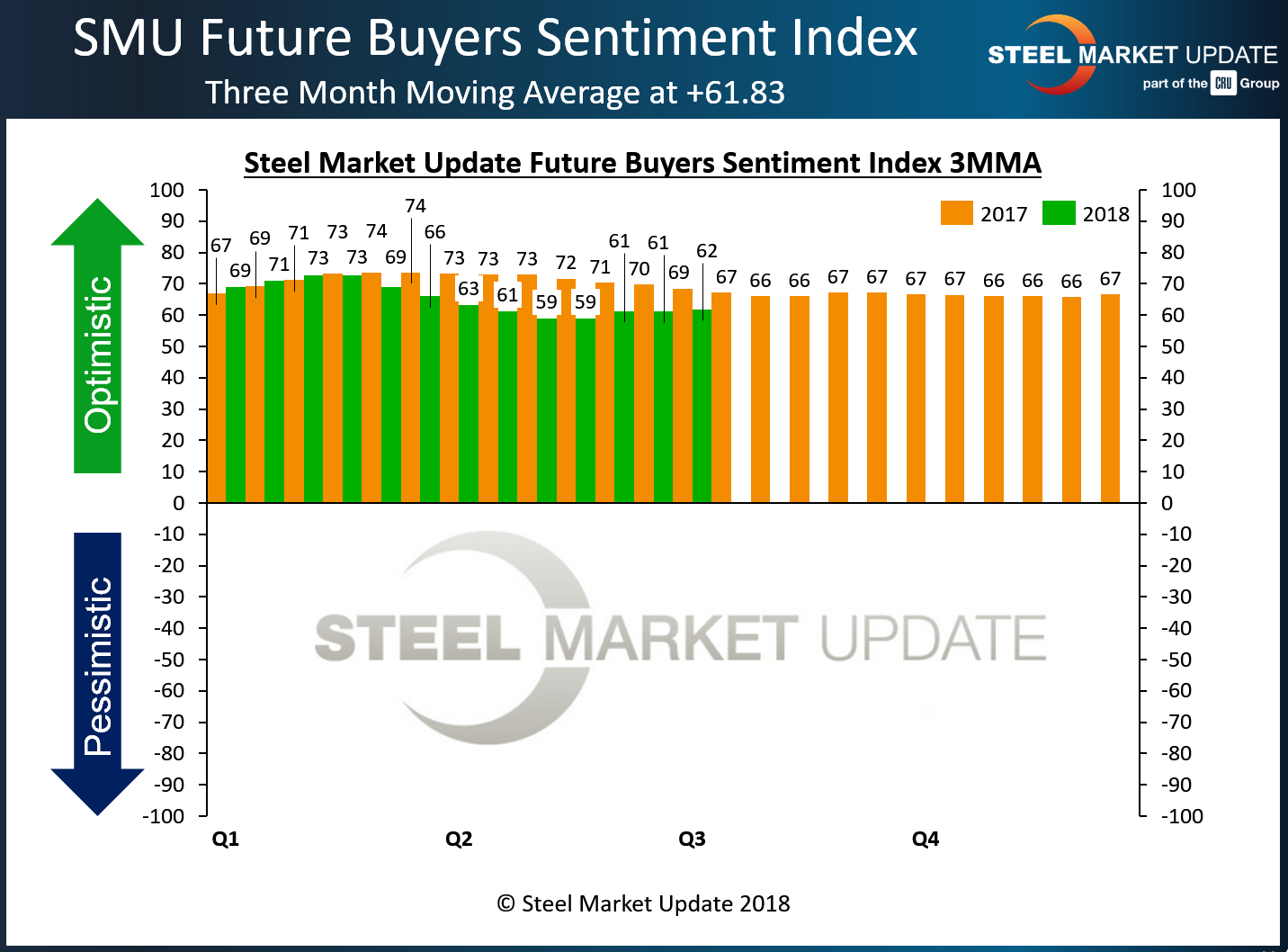

Future Steel Buyers Sentiment Index

Future Sentiment – companies’ view of their ability to be successful three to six months in the future – increased by 5 points to +61 from mid-June. The 3MMA for Future Sentiment inched up to 61.83 from 61.17 two weeks prior. SMU is seeing a small rebound, or at least stabilization of the Future Sentiment Index, but the index is still well below what we were collecting at this point last year.

To put the figures in perspective, both Current and Future Sentiment reached record highs for a single data point in mid-January with Current Sentiment at +78 and Future Sentiment at +77. Respondents are less optimistic than they were at the beginning of the year, but any shifts in sentiment have been modest over the past three months.

What Respondents are Saying

• “There are too many unknowns to feel comfortable.”

• “We’re losing manufacturing in the U.S. to Mexico, and losing customers to Chinese finished goods.”

• “We’re still not clear on the future direction of trade. Market demand remains strong, but various trade actions like Section 232 will hurt imports and keep adding costs that will put downward pressure the future business.”

• “We’re hoping trade issues, at least some of them, will be resolved

• “There’s so much uncertainty and contract season will be here in the three months’ time.”

• “Business is very strong in June and we are optimistic that trend will continue.”

• “If the tariffs are removed, the market will crumble.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 37 percent were manufacturers and 50 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.