Prices

July 5, 2018

Hot Rolled Futures: Markets Thin

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

During the holiday week in the U.S., the HR futures markets have been thin, especially on the buy side of the market. We have seen lower prices trading in both Q3’18 and Q4’18 in modest volumes. The Q4’18 value was $841/ST for Q4’18 on June 29 versus $811/ST we traded earlier today, which reflects a fairly steep price drop in less than a week.

We have, however, seen a pickup in calendar spread trades and inquiries. Today, 2H’18 HR was traded versus 1H’19 HR at +82.25 (862.25/780). The latest HR spot levels, which were slightly softer, have left hedgers and traders split and lacking any conviction on market direction.

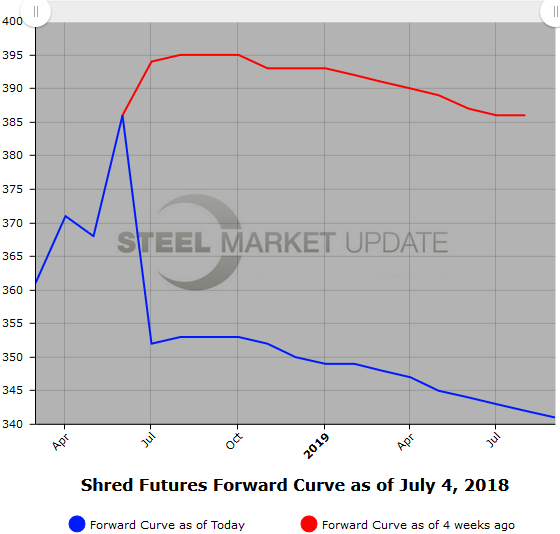

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

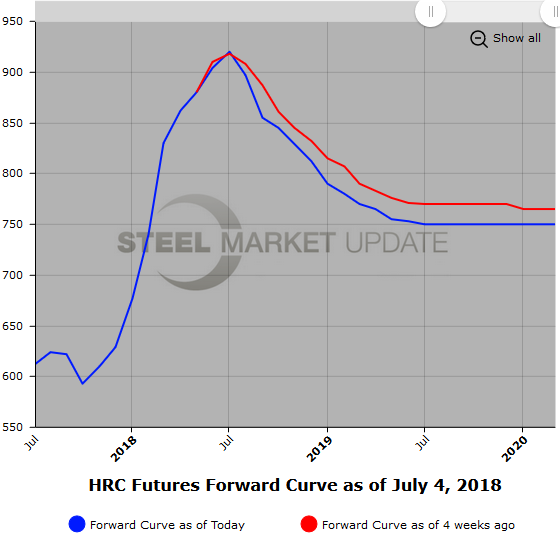

Scrap

Early chatter has shred trading sideways to a touch lower for July. (June Nasdaq USSQ settlement $363.88/GT). USSQ futures are reflecting a slight drop with the balance of Cal’18 valued at the mid $350/GT level.

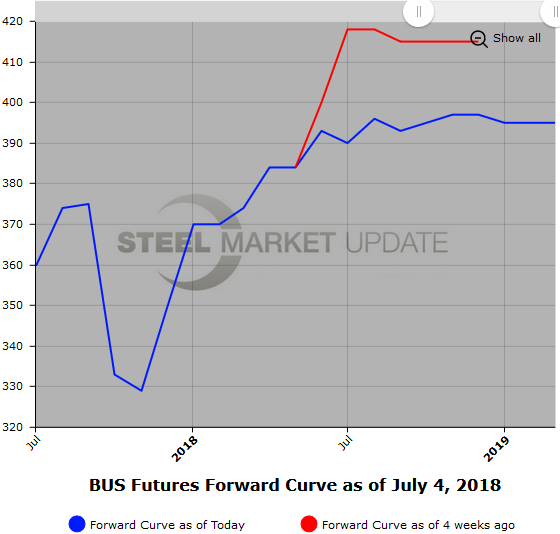

For prime scrap futures (BUS), the curve has remained relatively flat with $395/$405 per GT covering the latter half of 2018. Market participants have been expecting sideways to slightly higher negotiated prices for July. (June CME settlement $392.73/GT)

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizeable database, we will add this data to our website.