Analysis

July 5, 2018

Auto Sales Increase in June, But Tariffs Put Industry in Jeopardy

Written by Sandy Williams

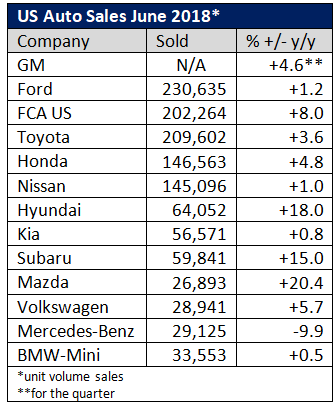

Detroit automakers reported higher sales in June as buyer enthusiasm for SUVs and pickup trucks continued. Ford sales for the month increased 1.2 percent year-over-year to 230,635 vehicles on purchases of SUVs and F-series trucks. Fiat Chrysler sales jumped 8 percent to 202,264 vehicles in June and General Motors, no longer reporting monthly sales, said quarterly sales increased 4.6 percent. Automakers from Toyota, Honda, Nissan, Subaru, Kia, Hyundai and Volkswagen all posted improved results for the month.

Tariffs Put Industry at Risk

Tariffs on imports of automobiles and parts proposed by President Trump may cut sales dramatically, however, as vehicles become more expensive to build and buy. LMC Automotive estimates the tariffs would reduce domestic car sales by one million to two million vehicles, while the Peterson Institute says 195,000 jobs could be lost.

“These losses would be a severe blow to the automotive sector, including automakers, parts suppliers and dealerships throughout the country,” said the Association of Global Automakers in comments to the Section 232 auto investigation.

The association argues that foreign vehicles are not being unfairly traded and points to the lack of antidumping or countervailing duties on autos or autoparts.

“No one has asked for protection against imports under our antidumping and countervailing duty laws because there are no unfairly traded imports,” the Global Automakers said. “And no one has asked for protection under our laws protecting against fairly traded imports because our automotive industry is thriving.”

“There is no question the U.S. auto industry is thriving: We are at or near record levels with regard to sales, also with regard to auto production and auto exports to countries all around the world,” said Global Automakers President and CEO John Bozzella in an interview with CNBC. “So, we have a really nice run going, and we’re very concerned that tariffs would put an end to that.”

All vehicles assembled in the United States contain foreign-made auto parts. The top two “American” cars by auto content from U.S. or Canada are the Honda Odyssey Minivan and Ridgeline, containing about three-fourths U.S./Canada parts, according to CNN Money. The highest ranked vehicle made by a Detroit automaker is the Chevrolet Corvette, in seventh place with two thirds of its content from the U.S. or Canada.

“There are no purely American vehicles,” said Michelle Krebs, senior analyst at AutoTrader in a comment to CNN Money. “These are global automakers who use global sources for all types of parts.”

“Tariffs are going to be bad news for the auto industry,” said Charlie Chesbrough, senior economist for Cox Automotive. “There will be a little time for the market to adjust, but we would see prices rise quickly across the board. A full-blown trade war could knock the economy into a recession.”