Prices

June 28, 2018

Ferrous Futures Pause

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures market was written by David Feldstein. As the Flack Global Metals Director of Risk Management, Dave is an active participant in the hot rolled futures market, and we believe he provides insightful commentary and trading ideas to our readers. Besides writing futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Metals website, www.FlackGlobalMetals.com. Note that Steel Market Update does not take any positions on HRC or scrap trading, and any recommendations made by David Feldstein are his opinions and not those of SMU. We recommend that anyone interested in trading steel futures enlist the help of a licensed broker or bank.

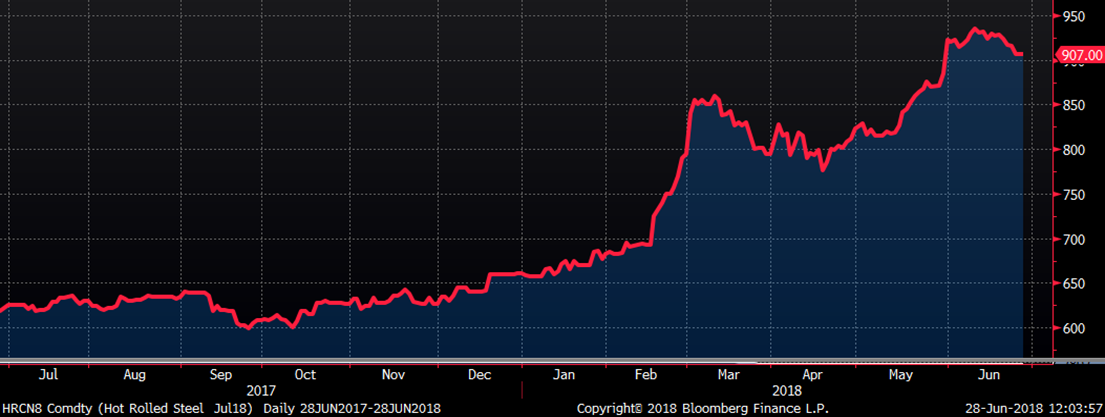

Despite the extensive media frenzy around trade and tariffs this week, futures prices have been little changed. Since the CME Midwest HRC futures rallied following the Trump administration’s removal of tariff exclusions for Canada, Europe and Mexico on May 31, the market has taken a breather with July trading at $907, down $10/st this week. Trade volume has plummeted with the Steel Success Strategies conference in New York this week, as well as the upcoming holiday week.

July CME Midwest HRC Future

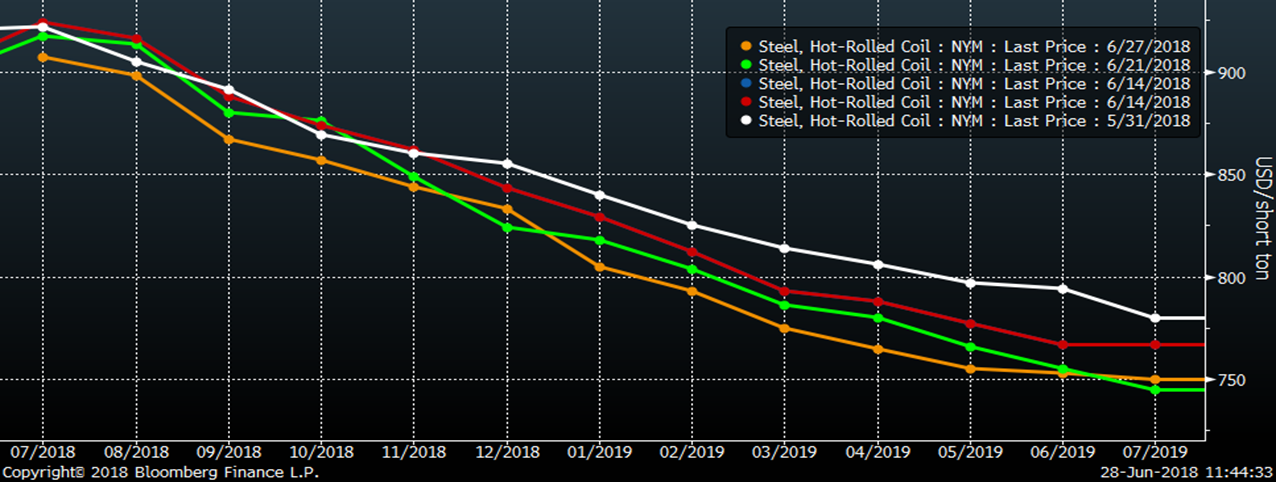

As prices have moved slightly lower over the last month, the shape of the curve has seen little change. The curve continues to maintain its downward slope with Q4 trading around $835/st and Q1 around $800.

CME Midwest HRC Futures Curve

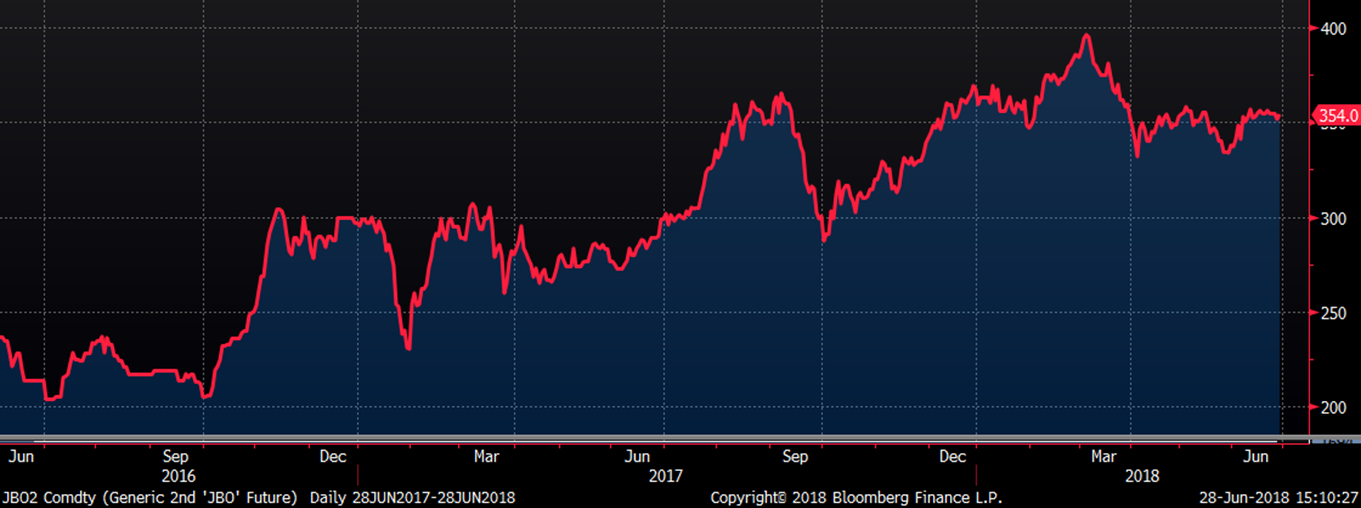

The July LME Turkish scrap future settled today at $354/mt, down $1.00 on the week.

2nd Month Rolling LME Turkish Scrap Future

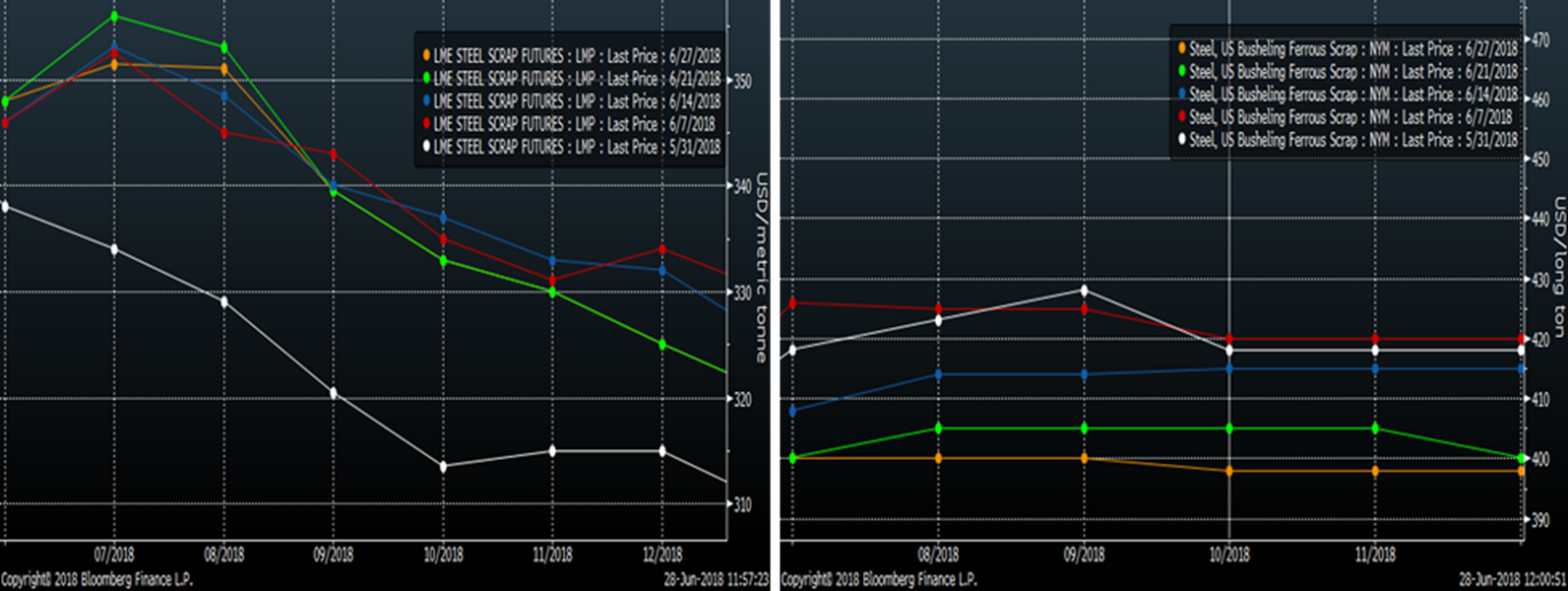

The LME Turkish scrap futures curve (left) continues to be downward sloping, similar to the iron ore futures curve, while the CME busheling futures curve is mostly flat starting in July.

LME Turkish Scrap (left) & CME #1 Busheling (right) Futures Curves

The 2nd month rolling SGX iron ore future continues to track the line from the uptrend that started in early 2016 after ore bottomed just below $40/mt. The trading range continues to tighten.

2nd Month Rolling SGX Iron Ore Future

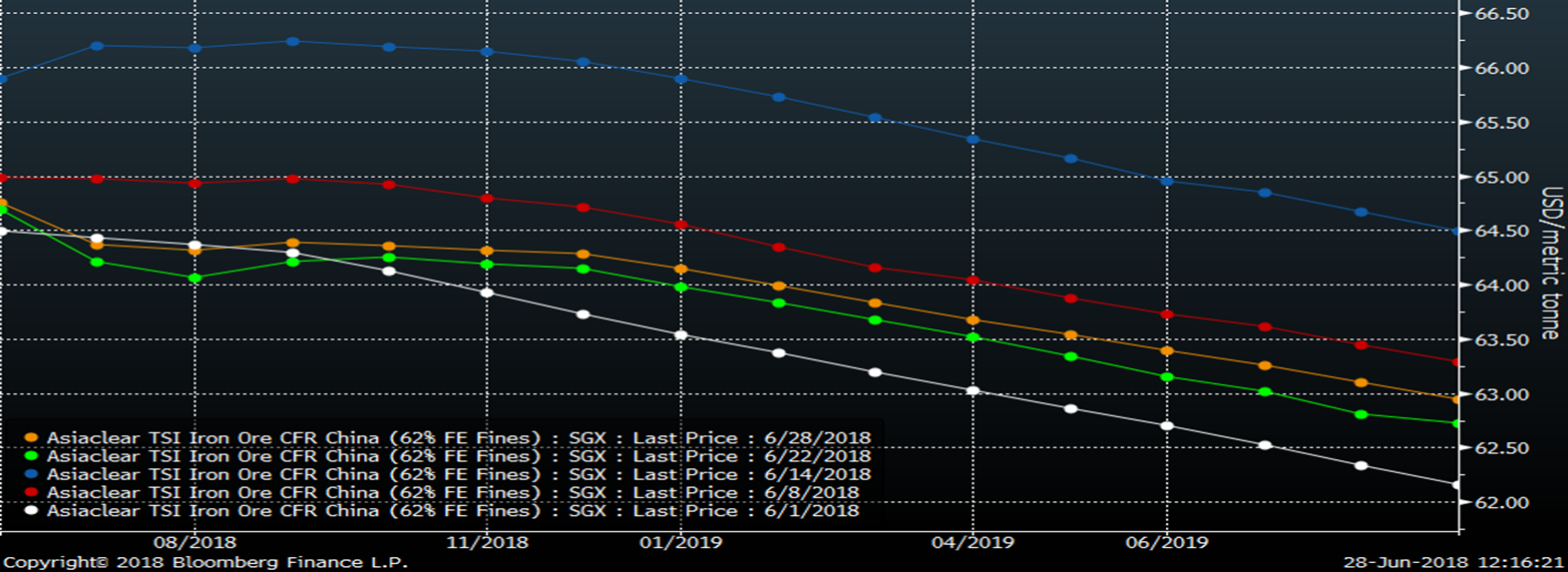

The SGX iron ore futures curve has flattened dramatically over the past month, with the back of the curve moving higher.

SGX Iron Ore Futures Curve