Prices

June 26, 2018

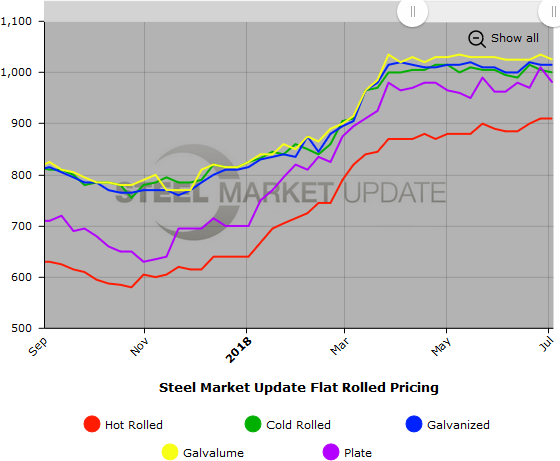

SMU Price Ranges & Indices: Modestly Lower

Written by Brett Linton

We are in the middle of a U.S. holiday week, and the Fourth of July on a Wednesday gave plenty of steel buyers and sellers an excuse for taking the week off, or at least an extended long weekend. Benchmark hot rolled prices were seen as being modestly lower based on the responses received from our data providers this week. The other flat rolled products were either flat or down slightly. SMU is not taking this as a sign of weakness, but we are watching market developments carefully.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $880-$940 per ton ($44.00/cwt-$47.00/cwt) with an average of $910 per ton ($45.50/cwt) FOB mill, east of the Rockies. The lower end of our range fell $10 per ton compared to one week ago, while the upper end rose $10 per ton. Our overall average is unchanged compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Hot Rolled Lead Times: 4-8 weeks

Cold Rolled Coil: SMU price range is $960-$1,040 per ton ($48.00/cwt-$52.00/cwt) with an average of $1,000 per ton ($50.00/cwt) FOB mill, east of the Rockies. The lower end of our range fell $20 per ton compared to last week, while the upper end rose $10 per ton. Our overall average is down $5 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU base price range is $49.00/cwt-$52.50/cwt ($980-$1,050 per ton) with an average of $50.75/cwt ($1,015 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,066-$1,136 per net ton with an average of $1,101 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-12 weeks

Galvalume Coil: SMU base price range is $50.00/cwt-$52.50/cwt ($1,000-$1,050 per ton) with an average of $51.25/cwt ($1,025 per ton) FOB mill, east of the Rockies. The lower end of our range fell $20 per ton compared to last week, while the upper end remained the same. Our overall average is down $10 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,291-$1,341 per net ton with an average of $1,316 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-11 weeks

Plate: SMU price range is $960-$1,000 per ton ($48.00/cwt-$50.00/cwt) with an average of $980 per ton ($49.00/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end fell $60 per ton. Our overall average is down $30 per ton compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to rise over the next 30-60 days.

Plate Lead Times: 4-10 weeks, allocation/controlled order entry

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.