Market Data

June 22, 2018

New SMU Regional Analysis of CTL Plate Imports

Written by Peter Wright

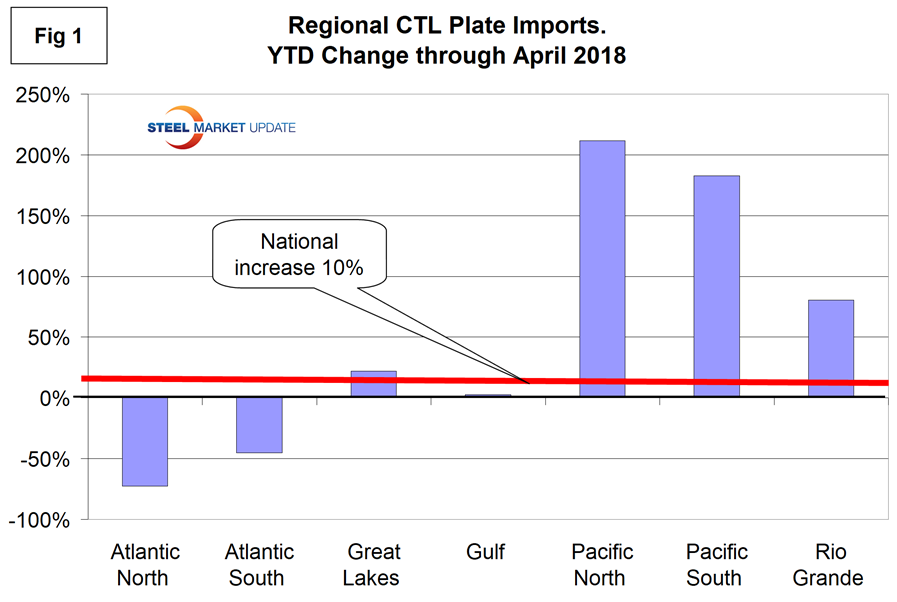

There are big differences in the year-to-date increase of cut-to-length plate imports on a regional basis.

Last week, we published new regional import reports for HRC, CRC and HDG. This week, we are publishing reports for coiled and cut-to-length plate based on the new format. SMU produces import reports by product at the national level and very detailed reports for premium subscribers by product at the port level by source nation. These new reports are designed to bridge the gap between those two. Our intent is to demonstrate and measure the fact that an import report at the national level can miss regional differences that may be substantial.

In the first four months of the year, CTL plate imports were up from 208,915 tons in 2017 to 228,967 tons in 2018, an increase of 9.6 percent. Figure 1 shows the year-to-date change for each of seven regions and the change at the national level. Differences between regions are extreme for this product. In 2018, the Pacific North was up by 212 percent year to date and the Atlantic North was down by 72 percent. By far the highest volume region in both years was the Great Lakes with an increase of 22.2 percent. To dig deeper into the current situation, it is necessary to go to our detailed report by district and source nation. For example, such an examination of the Pacific North shows firstly that tonnage into Seattle is low with only 765 tons in the first four months of 2018. The big tonnages were Korea into Columbia Snake with 11,777 tons and Japan into San Francisco with 3,891 tons in 2018.

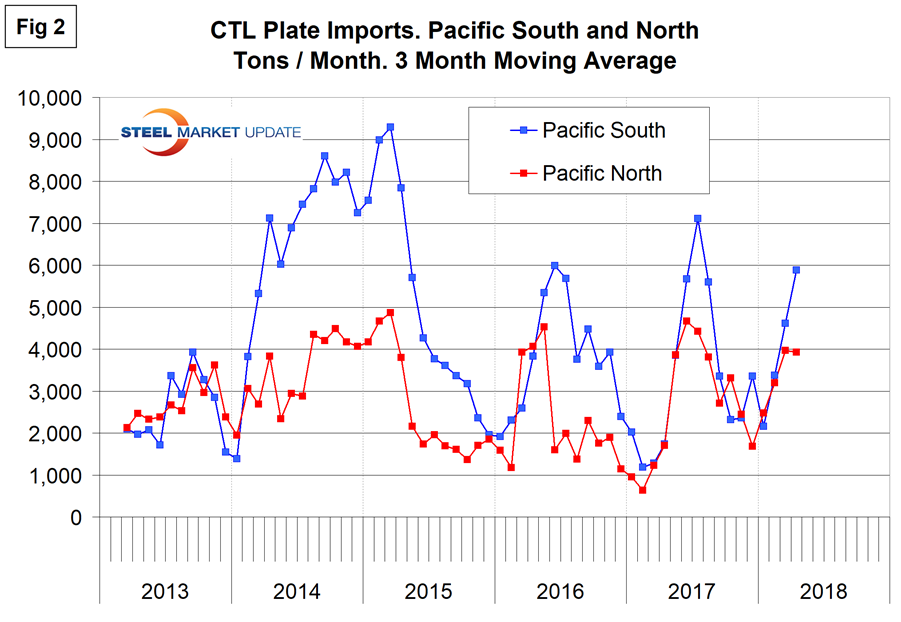

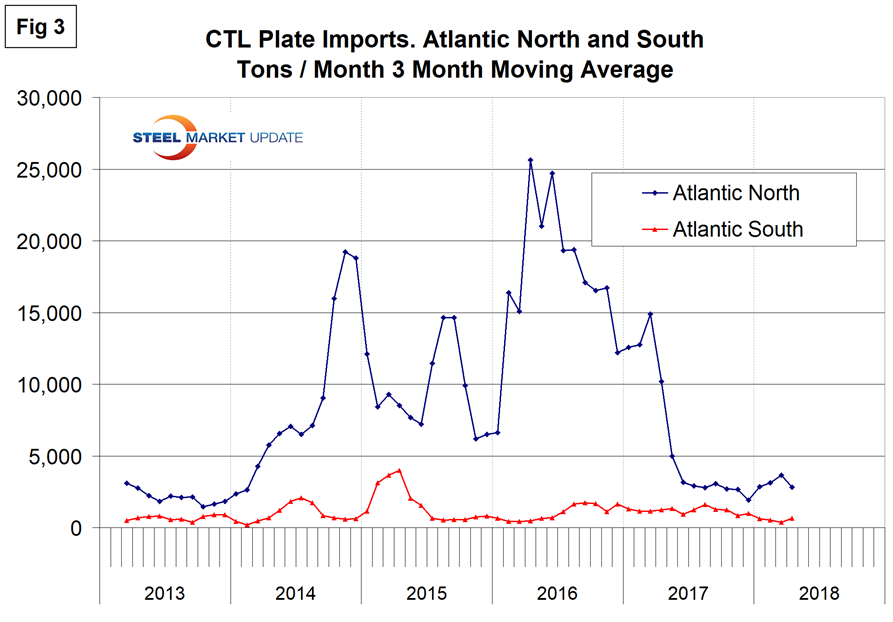

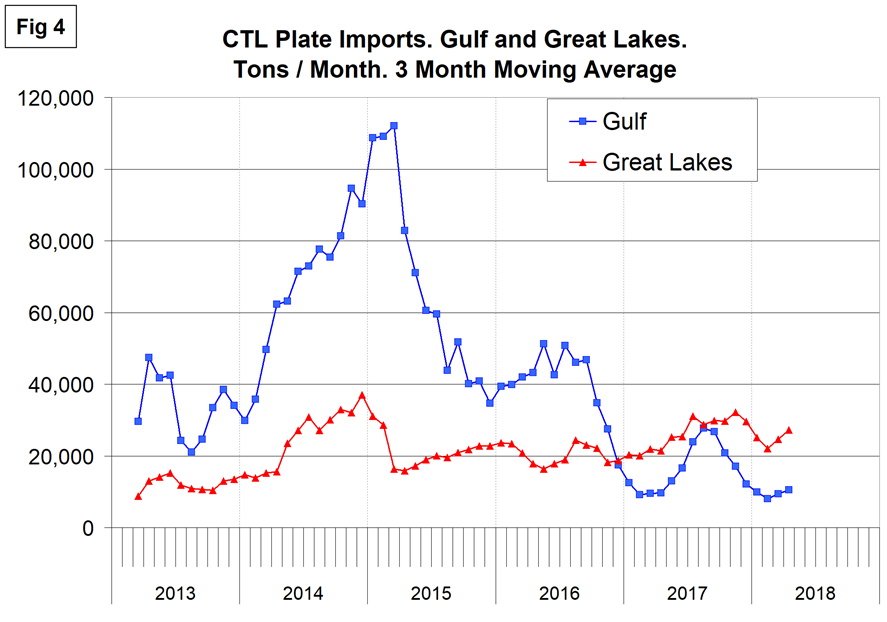

Figures 2, 3, 4 and 5 show the history of CTL plate imports by region since March 2013 on a three-month moving average basis.

The recent increase in volume into the Pacific South is shown in Figure 2. Tonnage into the Pacific North has been more consistent in the timeframe examined.

Tonnage into the North Atlantic ports peaked in early 2016 and has declined drastically since then. The South Atlantic region received only 2,311 tons in year-to-date 2018 and receipts have been minimal in the whole time frame studied here.

Imports into the Gulf have also declined drastically since early 2015. Volume into the Great Lakes has been fairly consistent in the same timeframe.

Tonnage crossing the Rio Grande into Laredo and El Paso has been quite erratic since March 2013 with a peak last December.