Government/Policy

June 14, 2018

Section 232 Auto Comments Due Next Week

Written by Sandy Williams

Foreign-made automobiles and parts may soon be facing tariffs if the administration is successful in its investigation to determine whether imports of automobiles and auto parts threaten to impair national security.

On May 23, the Commerce Department initiated a Section 232 investigation on imported automobiles and parts, noting that during the past 20 years imports of passenger vehicles have grown to 48 percent of the U.S. market.

Said Commerce in its press release: “From 1990 to 2017, employment in motor vehicle production declined by 22 percent, even though Americans are continuing to purchase automobiles at record levels. Now, American-owned vehicle manufacturers in the United States account for only 20 percent of global research and development in the automobile sector, and American auto part manufacturers account for only 7 percent in that industry.”

According to a fact sheet issued by Commerce, Section 232 of the Trade Expansion Act of 1962 authorizes the Secretary of Commerce to conduct comprehensive investigations to determine the effects of imports of any article on the national security of the United States.

Section 232 investigations include consideration of:

- domestic production needed for projected national defense requirements;

- domestic industry’s capacity to meet those requirements;

- related human and material resources;

- the importation of goods in terms of their quantities and use;

- the close relation of national economic welfare to U.S. national security;

- loss of skills or investment, substantial unemployment and decrease in government revenue;

- and the impact of foreign competition on specific domestic industries and the impact of displacement of any domestic products by excessive imports.

The deadline for written public comments on the investigation is next Friday, June 22. Public hearings on the issue are scheduled for July 19-20.

If a tariff of 25 percent should be issued, LMC Automotive estimates the U.S. auto industry will lose 1 million in annual vehicle sales, assuming that manufacturers absorb half of the tariff. If the tax is passed on in full to consumers, lost sales could double to 2 million or 10 percent of the annual U.S. automotive market.

Potentially, a tariff would not just hurt vehicles manufactured in Europe and Asia, but those produced by American manufacturers who have assembly facilities in Canada, Mexico and other countries.

Republicans have expressed frustration with the administration for its use of Section 232 to bypass consultation and approval by lawmakers before imposing trade restrictions.

“While we share a common goal of pursuing a pro-growth, pro-America agenda, I have made no secret my concerns with the administration’s use of 232 tariffs,” said Senate Finance Committee Chairman Orrin Hatch (R-UT). “These tariffs are ultimately paid by American consumers and cause harm to American manufacturers, undermining the success of tax reform.”

Hatch called the national security investigation into imported vehicles “deeply misguided.” Recent reports indicate that the Trump administration hopes to complete the investigation before the November elections. Having an announcement in hand in October just before elections would make it less likely for Republicans to mount a challenge to Trump, say some sources.

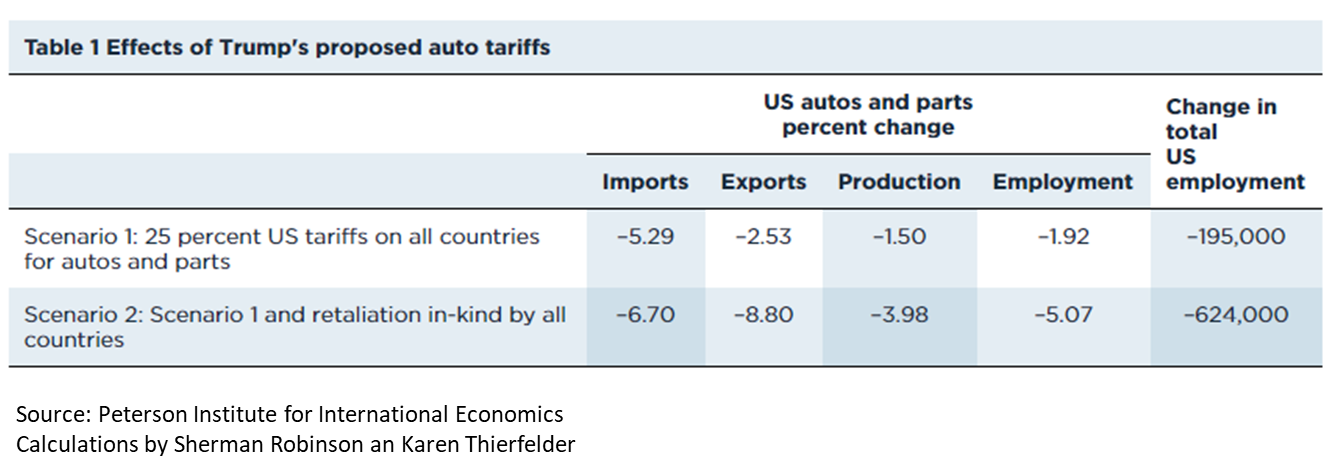

The administration is expected to tout auto tariffs as a strategy to create more American jobs. The Peterson Institute released a report on May 31 refuting the job creation benefit. Peterson says that 25 percent tariffs, assuming no country exemptions, would cause production to drop 1.5 percent in the auto industry and 195,000 U.S. workers would likely lose their jobs over a 1-3 year period. The industry would shed 1.9 percent of its labor force and more than $200 billion in U.S. vehicle imports (not including parts) would be affected. In comparison, Peterson estimates $44.9 billion of imports will be affected by the steel and aluminum tariffs.

The numbers increase exponentially if other countries retaliate. The two scenarios are shown in the chart below from the Peterson Institute report.

The president’s decision to use Section 232 to impose tariffs on imported vehicles is confusing, considering the U.S. industry has had several record years of sales and continues to thrive.

Following a tense G7 Summit in Quebec, Trump again brought up his intention to levy tariffs on autos during caustic statements regarding the Canadian Prime Minister Justin Trudeau:

“Based on Justin’s false statements at his news conference, and the fact that Canada is charging massive Tariffs to our U.S. farmers, workers and companies, I have instructed our U.S. Reps not to endorse the Communique as we look at Tariffs on automobiles flooding the U.S. Market!”

Last month, the American International Automobile Dealers denounced the proposition to levy tariffs on imported vehicles. “It can’t be repeated enough: Tariffs are taxes. American families who can least afford a 25 percent price increase on vehicles will bear the burden of this tariff,” said AIADA President and CEO Cody Lusk in a May 23 statement. “America’s 9,600 international nameplate auto franchises and their 577,000 American employees rely on competitively priced products to sustain their businesses and jobs. To treat auto imports like a national security threat would be a self-inflicted economic disaster for American consumers, dealers and dealership employees.”

The National Automobile Dealers Association was also concerned about consumer affordability. “A tariff on imported vehicles and auto parts equates to a consumer tax, and we are concerned that such a tax would mean higher prices and fewer choices for our customers,” said NADA President and CEO Peter Welch.

The Auto Alliance, representing the Detroit Three as well as BMW Group, Jaguar Land Rover, Mazda, Mercedes-Benz USA, Mitsubishi Motors, Porsche, Toyota, Volkswagen Group of America and Volvo Car USA, said in a statement on May 24: “We are confident that vehicle imports do not pose a national security risk to the U.S. Last year, 13 domestic and international automakers manufactured nearly 12 million vehicles in the U.S. The auto sector remains the leading exporter of manufactured goods in our country. During the last 25 years, 15 new manufacturing plants have been launched in the U.S. – resulting in the creation of an additional 50,000 direct and 350,000 indirect auto jobs throughout America – and new plants are on the way. We urge the administration to support policies that remove barriers to free trade and we will continue to work with them and provide input to achieve that goal.”

The United Steelworkers support the Section 232 auto import investigation with the caveat that Canada should be exempted as a trusted defense and trade partner. “Any student of history knows that it was the automotive sector that helped make America the ‘arsenal of democracy’ in World War II,” said USW International President Leo Gerard. “The automotive companies had the tools and engineering, and the workers had the skills and experience to make the weapons our men and women in uniform needed to fight for freedom around the globe.

“Today, many of the critical innovations that can contribute to our defense needs emanate from the automotive sector including basic industrial and manufacturing capabilities, new autonomous capabilities, sensor technology, advanced batteries and other technologies. The auto and auto-parts sector will be critical to our nation’s continued defense and the weaponry of the future, which will help preserve democracy and freedom.”

Gerard targeted China, Japan and South Korea as countries that have advanced their interests at the expense of U.S. industries while limiting access to their own markets. The USW also argues that Mexico is guilty of suppressing wages and workers’ rights, thus undermining the U.S. automotive sector.

United Autoworkers former President Dennis Williams told reporters last month, “I welcome the fact that they’re investigating this. The United States became a dumping ground for a lot of countries at a very low cost.”