Market Data

June 1, 2018

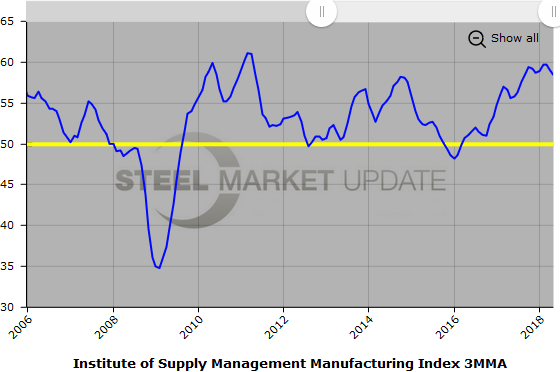

ISM PMI Indicates Strong Demand in May

Written by Sandy Williams

Supply executives polled for the Manufacturing ISM Report on Business reported strong business conditions in May.

The PMI rose 1.4 points to 58.7 percent as new orders, production and employment continued to expand. Inventories are struggling to keep pace with demand. Longer supplier lead times and freight uncertainty is impacting inventory levels, said Timothy R. Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey Committee. Customer inventories were considered too low for the 20th month.

Manufacturers report that a diminishing labor market is constraining production and supply. The supplier delivery index registered 62 percent, the highest level since the hurricane season in 2017 when the September index was 63.4. The order backlog index gained 1.5 points in May to register 63.5.

“Lead-time extensions for production materials, supplier labor shortages, transportation delays and ongoing uncertainty in the steel and aluminum markets continue to restrict production output,” said Fiore.

Supply executives noted that raw materials prices continue to climb across all industry sectors.

New export orders decreased 2.1 points from April, but continued a 27th month of growth. “Five of the six big industry sectors continued to expand export activity during the period in spite of comments noting the strength of the U.S. dollar,” said Fiore. Imports continued to expand, but at a slower rate in May.

Survey respondents had the following comments:

• “Industry demand is causing price increases. Fuel prices are also on the rise, and there have been (price) increases associated with that.” (Primary Metals)

• “We are currently overselling our forecast and don’t see an end to the upswing in business. We are very concerned, however, about the tariffs proposed in Section 301 and are focusing on alternatives to Chinese sourcing.” (Transportation Equipment)

• “We are concerned about the strong dollar affecting our export orders, as well as the steel tariffs, which are causing domestic steel prices to rise.” (Fabricated Metal Products)

• “Sales remain strong. Lead times and direct material costs are soaring.” (Machinery)

• “Suppliers are seeing price increases and trying to pass them on.” (Miscellaneous Manufacturing)

• “Continued talk around steel tariffs has resulted in price increases for domestic line pipe, while HRC seems to be moving sideways. Temporary exemptions for allies and an agreement with South Korea have not calmed the market.” (Petroleum & Coal Products)

• “Severe allocation, long lead times and upward price pressure, particularly in the electronic components market, continue to hamper our ability to meet customer demand and our shipping schedule.” (Computer & Electronic Products)

Below is a graph showing the history of the ISM Manufacturing Index as a three-month moving average. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.