Market Data

June 1, 2018

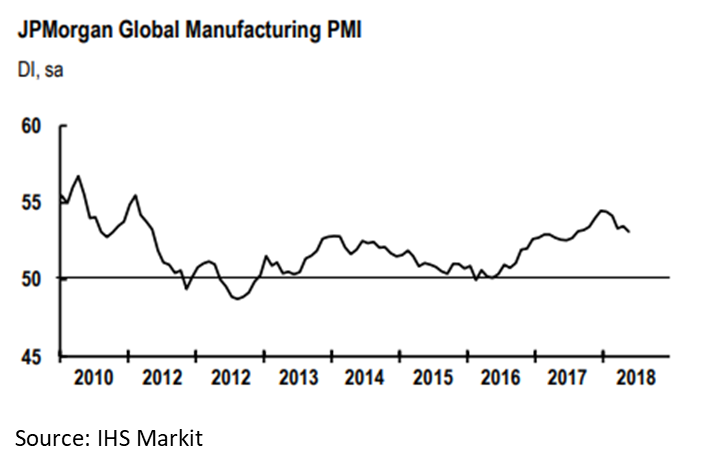

Global Manufacturing Slows in May

Written by Sandy Williams

Global manufacturing was at a nine-month low in May, according to data from J.P. Morgan and IHS Markit, in association with ISM and IFPSM. The composite Global Manufacturing PMI dipped to 53.1 from 53.5 in April. The second-quarter PMI average shows “mild growth deceleration” compared to the first quarter, said J.P. Morgan. The U.S. outperformed the Eurozone for the second consecutive month.

Commenting on the survey, David Hensley, Director of Global Economic Coordination at J.P. Morgan, said: “The May PMI data suggest global manufacturing output growth is holding up well. Output growth is down from the robust pace of 2H17, but it remains solid. Our separate measures of global final goods demand are firming this quarter, supporting output growth. However, the PMI suggests that inventory growth may be decreasing. Such a shift in the mix of demand would be positive for the future.”

Eurozone manufacturing slowed in May as growth in output and new orders eased. The IHS Markit Eurozone Manufacturing PMI was at a 15-month low of 55.5, falling from 56.2 in April. Expansion has been recorded in the region for 59 months, hitting a high in December 2017, but has been slowing ever since. Slower export sales, in particular from the U.S., were cited as a key reason for declines in production and orders. Supplier delivery times lengthened and were widespread across the region.

Manufacturing expanded only marginally in China during May. The Caixin China General Manufacturing PMI was unchanged at 51.1. New orders and production rose only slightly as new export sales continued to decline. Employment levels were reduced to cut costs and improve efficiency while input and output costs continued to rise. Higher prices were noted for chemicals, metals and oil. Backlogs continued to rise but at a more moderate rate than April. Firms remained optimistic that output levels would increase during the second half of 2018, but sentiment was weaker than the series average.

Manufacturers in Russia saw business conditions worsen for the first time since May. Employment numbers were down, as well as stocks of purchases. Output and new orders eased as demand waned from traditional customers. Export orders were at the weakest rate in four months. Input costs rose sharply in May and were linked to exchange rate weakness. The IHS Markit PMI dropped to 49.8 in May from 51.3 in April.

“There are signs that the soft patch has further to run,” said Chris Williamson, Chief Business Economist at IHS Markit. “Not surprisingly, manufacturers’ expectations of future production have sunk to a 20-month low, underscoring the gloomier economic picture.”

Manufacturing in Mexico took a dip in the middle of the second quarter. Uncertainty about the upcoming presidential election and subdued demand slowed production and new orders in May. A favorable peso versus the U.S. dollar helped exports, but made imports more expensive for producers. The rate of cost inflation reached a 15-month peak. The IHS Markit Mexico PMI registered 51.0, down from 51.6 in April. Until the political situation is sorted, manufacturers are cautious about economic conditions.

The IHS Canada Manufacturing PMI was at its highest level in more than seven years. The PMI advanced to 56.2 from 55.5 in April. New orders growth contributed to the PMI growth helped by a marked rise in export sales. Manufacturers reported pressure on manufacturing capacity and extended backlogs. Supplier’s performance was the second lowest since late 2010 due to higher input buying and tight truck availability in the U.S. Concerns about raw material availability and rising prices resulted in a push to build pre-production inventory.

Manufacturing in the United States continued to expand in May with production and new orders robust. The PMI registered 56.4, barely changed from 56.5 in April. Backlogs grew at the fastest rate in two and a half years, prompting new hiring. Prices continued to remain elevated for both input and sales. Higher input costs were attributed to suppliers increasing prices in response to demand. Firms increased inventory to protect against supply chain pressures.

“The past two months have seen the strongest back-to-back improvements in order books since the fall of 2014, fueled by strengthening domestic demand,” said Williamson. “New orders have in fact now grown at a faster rate than output in each of the past five months, highlighting how producers have struggled to boost production to meet sales. In the words of one manufacturer, ‘we’re selling more than we can make.’

“With sales growing faster than production, backlogs of work are accumulating at the fastest rate for nearly four years, which should support further production growth in coming months. Business expectations regarding future production in fact picked up again to one of the highest levels seen over the past three years, adding to signs that strong growth will persist through the summer months.”