Canada

May 29, 2018

Canada Initiates AD/CVD Investigation into Cold Roll Imports

Written by Sandy Williams

The Canada Border Services Agency initiated an investigation on May 25 into the dumping and subsidizing of certain cold-rolled steels in coils or cut lengths from China, South Korea, and Vietnam.

The investigation was prompted by a complaint from ArcelorMittal Dofasco. Cold rolled imports under the investigation increased from 85,075 metric tons in 2015 to 133,440 tons in 2016, and 146,116 tons in 2017. ArcelorMittal states that the subject imports captured over one-third of the Canadian market in only three years by undercutting domestic pricing and depressing margins.

The problem has been compounded by excess capacity in the steel and cold rolled sectors, especially in China, and weak market demand in China, Korea and Vietnam. Exports of CRS are expected to increase from China and Korea in 2018 and 2019. Vietnam is increasing capacity with two mills that were expected to come on line last year.

In its complaint ArcelorMittal Dofasco stated: “The imposition by the United States of tariffs on Chinese and Vietnamese CRS as a result of the section 232 investigation, and the agreement by Korea to reduce steel shipments to the United States by 30 percent, has created an incendiary situation, threatening to exacerbate the turmoil in global steel markets and divert increasing volumes of CRS to the Canadian market.”

A safeguard inquiry regarding CRS initiated by the European Commission in late March 2018 is expected to worsen the problem for Canada.

“These circumstances pose an unprecedented threat of injury to the Canadian domestic industry,” added Dofasco.

The complaint was supported by letters from Algoma and Stelco, who with ArcelorMittal Dofasco represent 100 percent of the Canadian production of cold rolled steel.

A statement of reasons regarding the initiation of the investigation will be released on June 8. Importer responses to CBSA are due by June 18 and exporter and government responses by July 3.

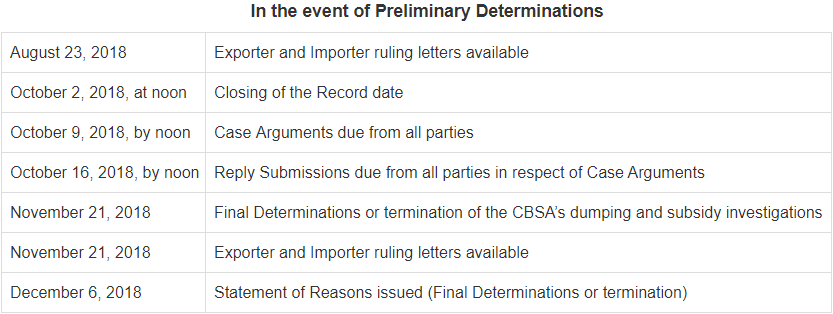

A preliminary determination will be made by Aug. 23 with reasons to follow by September. If an affirmative determination is made by CBSA, the following schedule for the investigation will be implemented.