Market Data

May 13, 2018

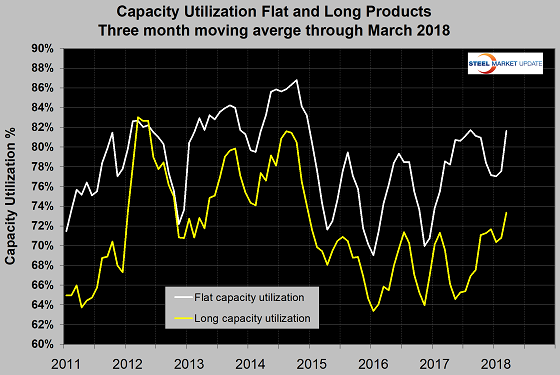

Flat Rolled and Long Products Capacity Utilization

Written by Peter Wright

For steel producers, there’s a strong correlation between capacity utilization and profits. Steel Market Update tracks capacity utilization for both flat and long products and both have been on the upswing since early 2018, at least in part due to the effects of the Trump administration’s plans to impose tariffs on steel imports.

From January through March, domestic flat roll capacity utilization jumped from about 77 percent to 81.6 percent, while long product capacity increased from about 70 percent to 73.3 percent, as three-month moving averages. The uptrend appeared to continue in April and May. Although it is difficult to gauge actual mill production capacity, this chart represents SMU’s best estimate. While the industry average for raw steel production averaged about 76 percent in the first week of May, flat roll producers have topped the 80 percent threshold desired for healthy profitability.