Prices

May 1, 2018

SMU Price Ranges & Indices: More-or-Less Balanced

Written by John Packard

Flat rolled and plate steel prices continue to show signs of stability as the market absorbs the most recent decision on Section 232 exclusions (countries) and awaits decisions about individual product exclusions. Steel Market Update continues to reference our SMU Price Momentum Indicator as being at Neutral, but I want to warn our readers that the next price move is not fully understood as there are many “Gray Swans” flying about… For now, we believe steel prices are holding at where we have seen prices over the past few weeks.

A general manager of a large flat rolled steel service center told SMU this morning, “The market currently is stable as it takes a breather from the frenetic pace from November to mid-April. Because lead-times are well into summer and because we’ve experienced higher amounts of imports having recently arrived, or arriving now, things are more-or-less balanced.”

A steel mill executive with whom we spoke earlier today had a slightly different take on current circumstances. “The market is fixing to see major changes. The quotas are supply restrictive if they take the form of the [South] Korean [quotas].” He went on to say, “…Might increase pricing later today. The ground is shifting again. [We] don’t know enough. Exceptions [to tariffs] are key, and nobody knows how they work yet.”

SMU Note: The mill quoted above has steel prices that are currently below the higher levels of our range (shown below). So, a price increase to their customers may only put them in line with some of the other mills.

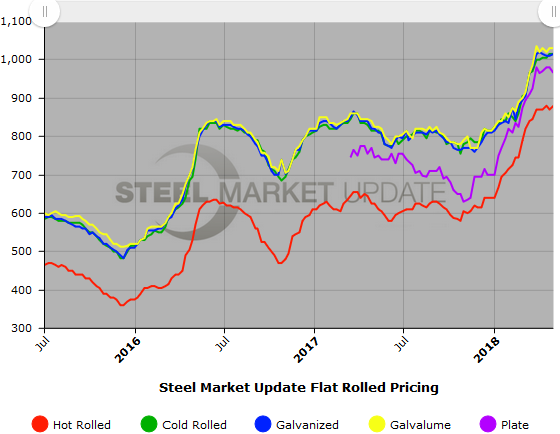

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $860-$900 per ton ($43.00/cwt-$45.00/cwt) with an average of $880 per ton ($44.00/cwt) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $10 compared to last week. Our price momentum on hot rolled steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 5-12 weeks

Cold Rolled Coil: SMU price range is $990-$1,040 per ton ($49.50/cwt-$52.00/cwt) with an average of $1,015 per ton ($50.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 5-12 weeks

Galvanized Coil: SMU base price range is $49.00/cwt-$52.50/cwt ($980-$1,050 per ton) with an average of $50.75/cwt ($1,015 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to one week ago, while the upper end declined $10 per ton. Our overall average is up $5 compared to last week. Our price momentum on galvanized steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,066-$1,136 per net ton with an average of $1,101 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-12 weeks

Galvalume Coil: SMU base price range is $50.00/cwt-$53.00/cwt ($1,000-$1,060 per ton) with an average of $51.50/cwt ($1,030 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,291-$1,351 per net ton with an average of $1,321 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-11 weeks

Plate: SMU price range is $930-$1,000 per ton ($46.50/cwt-$50.00/cwt) with an average of $965 per ton ($48.25/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end decreased $30 per ton. Our overall average is down $15 compared to last week. Our price momentum on plate steel is pointing to Higher indicating prices are expected to rise over the next 30-60 days. SMU Note: Because of controlled order entry and with not all the mills booking the same months, we are getting wide pricing spreads.

Plate Lead Times: Allocation/controlled order entry

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.