Market Data

May 1, 2018

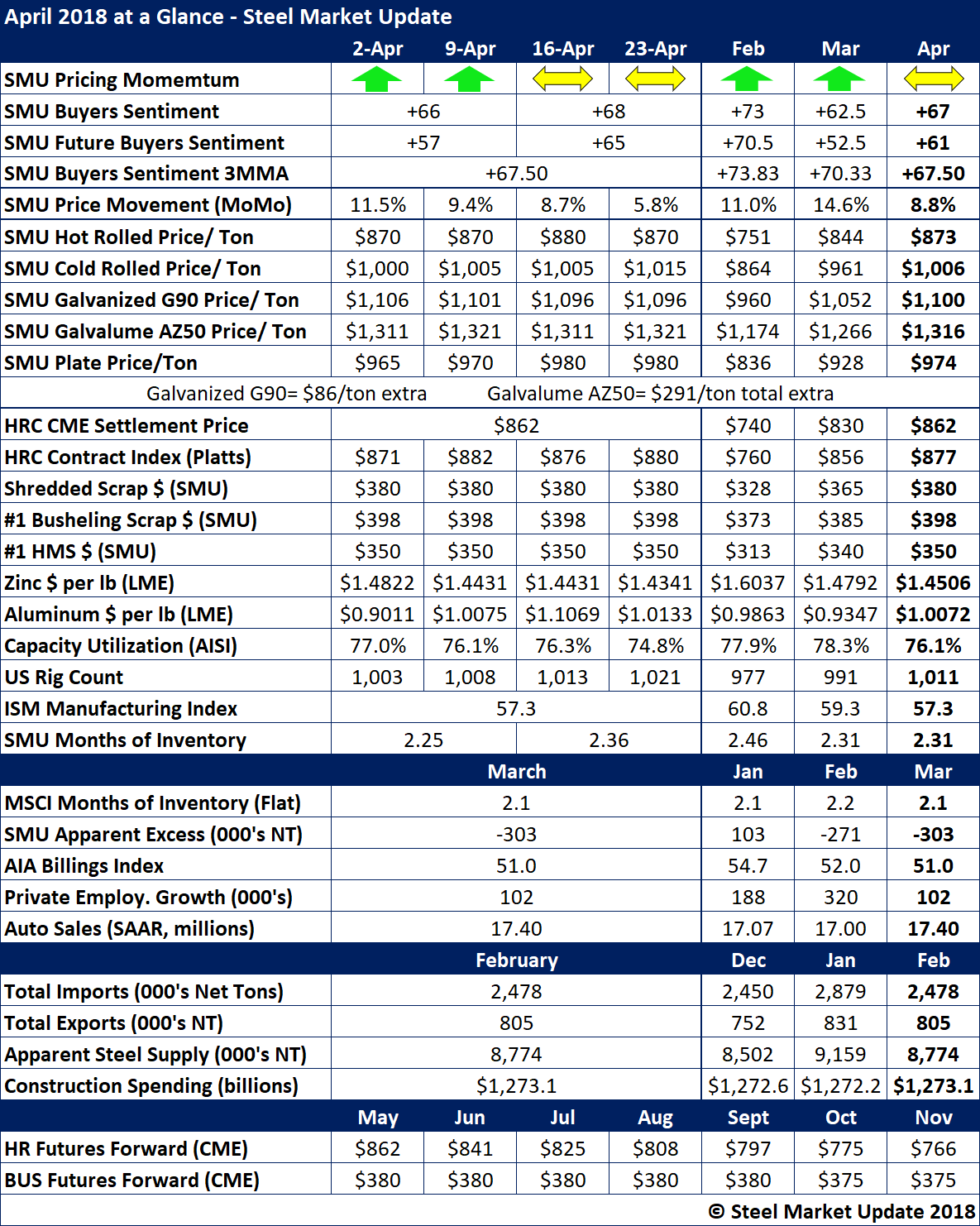

April 2018 at a Glance: Prices Plateau?

Written by Brett Linton

Steel Market Update downshifted its price momentum indicator from higher to neutral in late April as steel buyers reported stability in most products and prices appeared to have plateaued, at least in the short term. At month’s end, hot rolled was selling for about $873, cold rolled for just over $1,000, galvanized for around $1,100, and plate for about $974 per ton. Steel prices have increased by 16 percent in the past three months.

Steel shipments continue strong in the second quarter as seasonal demand picks up. Buyers sentiment remained at optimistic levels ahead of the Trump administration’s decision May 1 on steel tariffs. Late yesterday, the administration announced that it would extend some tariff exemptions for another month to give countries more time to negotiate quotas or other import measures.

Scrap prices saw modest $10 to $15 increases in April, but are forecast to experience normal seasonal declines in May as scrap flows increase and boost supply in the post-winter months.

The energy market is heating up as oil topped $70 a barrel. The U.S. rig count has now moved back over 1,000, which is good news for producers of OCTG.

Service center inventories in April saw little change from March at about 2.31 months of supply, according to SMU inventory data. Distributors are running fairly lean as the tariffs have made import offerings scarce and many are waiting to see if there’s a price correction in the second half.

Those are some of the highlights for the month of April. See the month-at-a-glance below for much more information on market conditions.

To see a history of our monthly review tables, visit our website.