Market Data

April 30, 2018

SMU Analysis: Key Market Indicators High in December

Written by Peter Wright

Steel Market Update is sharing this Premium content with Executive-level readers. For more information about upgrading to a Premium-level subscription, email Info@SteelMarketUpdate.com.

Key market indicators in December were at an all-time high in the history of Steel Market Update’s analysis, but trends are deteriorating.

This report summarizes 36 data streams that we believe critically describe the state of and provide forward guidance for the steel market. Data released in December shows that 24 of the 36 indicators are historically positive with only five negative. The balance are within the band of historically normal. Trends took a small step back since November, falling from 23 positive to 22 positive in December.

See the end of this piece for an explanation of the Key Indicators concept. This will explain the difference between our view of the present situation, which is subjective, and our analysis of trends, which is based on the latest facts available.

Please refer to the table below for our view of the present situation and the quantitative measure of trends. Readers should regard the color codes in the present situation column as a visual summary of the current market condition. The “Trend” columns of Table 1 are also color coded to give a quick visual appreciation of the direction the market is headed. All data included in this table was released in December. The month or specific date to which the data refers is shown in the second column from the far right. All results are the latest available as of Dec. 31, 2018.

Present Situation

Since our November update, there has been no net change in the number of data points considered to be historically positive, though there were changes in the detail. The number of negative points remained unchanged at five; the numbers neutral and positive were unchanged at eight and 23, respectively. Our intent in using the word neutral is to say that this indicator is in the mid-range of historical data. Figure 1 shows our monthly assessment of the present situation since January 2010 on a percentage basis. The number of indicators that are historically positive continues to be the highest it has ever been in the history of this analysis. The following changes were observed in December: In the general economy section, the Chicago Fed’s National Activity Index (CFNAI) became historically neutral, falling from positive in November, while the Broad index value of the U.S. dollar changed from neutral to negative. In the long products section, the import volume declined to less than 300,000 tons and was reclassified from negative to neutral. There were no changes to our perception of the sheet market, construction or manufacturing indicators.

The situation of both construction and manufacturing indicators is good, the only negative being housing starts. Housing will not advance to even a neutral performance in the foreseeable future.

Trends

Most values in the trends columns are three-month moving averages (3MMA) to smooth out what can be very erratic monthly data. Trend changes in the individual sectors are described below together with some general comments. (Please note that in most cases this is not December data but data that was released in December for previous months.)

Figure 2 shows the trend of the trends and the pre-recession situation at the far left of the chart. The proportion of trends that are deteriorating is now 30.6 percent of the 36 indicators. This was an increase from 16.7 percent from December, January and February a year ago, but an improvement from 33.3 percent in November.

Our observations about trends in the December data are as follows: In the general economy, both the CFNAI and consumer confidence reversed direction and trended negative. Five of nine indicators of the general economy are now trending negative, eight of the nine are leading indicators.

In the raw materials section, all indicators are coincident and there were no negative trends in December prices. Iron ore and zinc prices both reversed direction and trended positive and scrap and pig iron were unchanged.

In the long products section, the price of rebar reversed direction and increased. There were no other trend reversals.

In the sheet and strip section, three indicators trended positive in the December data and three negative. This was the same as November, but there were two changes in the detail. Supply, which is a proxy for market demand, declined in October (reported in December) on a year-over-year basis and import market share declined in October, also reported in December.

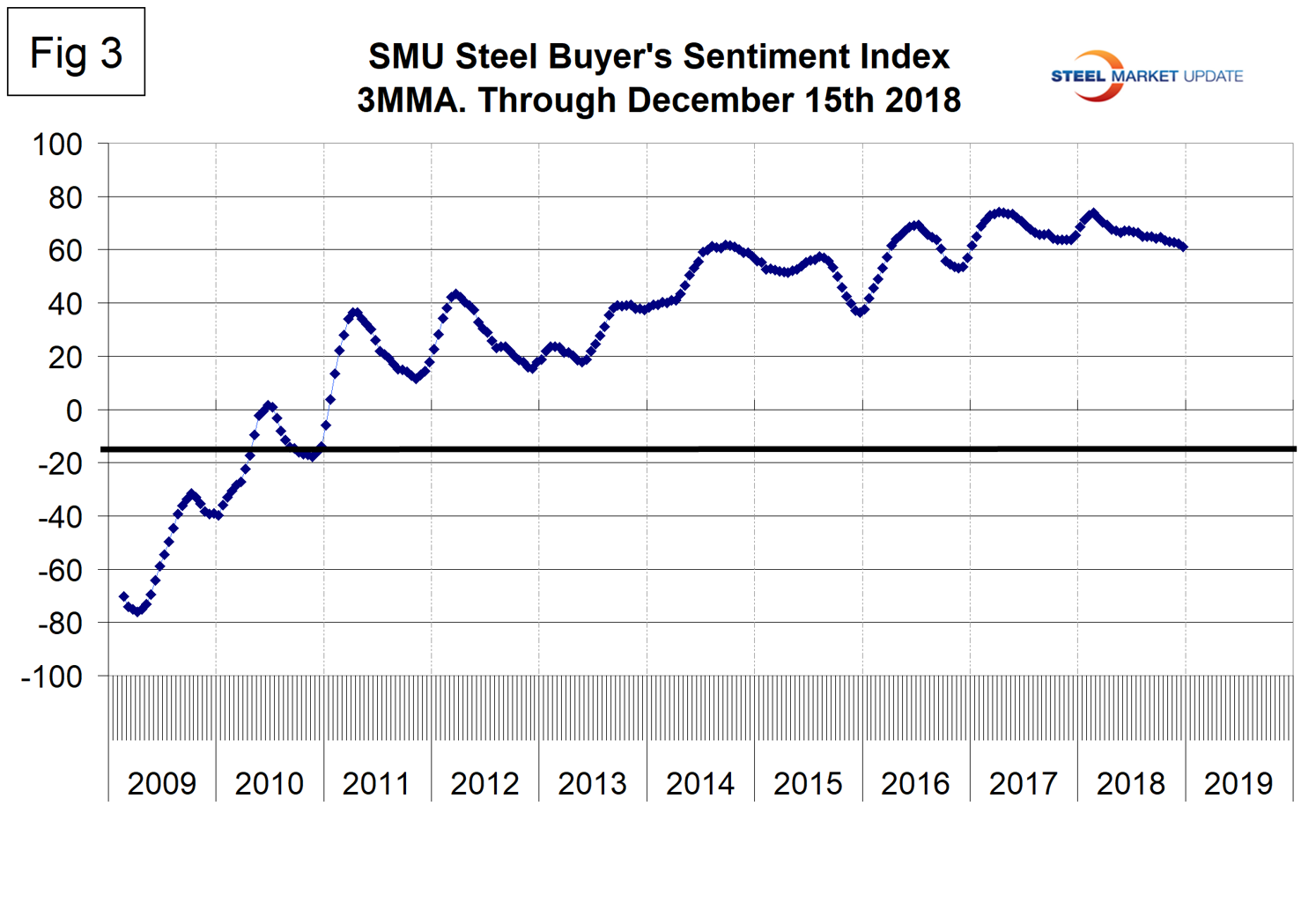

The SMU Steel Buyers Sentiment Index is a measure of the current attitude of buyers and sellers of flat rolled steel products in North America. It reports on how they feel about their company’s opportunity for success in today’s market. This index is still strong, but declined in both November and December, continuing a steady decline since the peak in mid-February (Figure 3).

Trends in construction are good, the only negative being a slight decline in housing starts. The producer price index of commodities was unchanged. This sector of the PPI analysis is a leading indicator of industrial construction, particularly energy and power projects.

In the manufacturing section, there were no trend reversals. The ISM index took a step back in each of the last three months of data. U.S. automotive sales were unchanged in the October data, but declined in November and again in December. Industrial production, manufacturing capacity utilization and manufacturing employment have each trended up every month since March 2017.

We believe a continued examination of both the present situation and direction is a valuable tool for corporate business planning. Figures 1 and 2 both show the pre-recession situation in August 2008. The trends analysis shows that the steel market was going over a cliff, but the actual values of the indicators at that time were still good with only 23 percent registering as historically negative.

Explanation: The point of this analysis is to give both a quick visual appreciation of the market situation and a detailed description for those who want to dig deeper. It describes where we are now and the direction the market is headed, and is designed to describe the situation on a specific date. The chart is stacked vertically to separate the primary indicators of the general economy, of raw material prices, of both sheet and long product market indicators, and of construction and manufacturing indicators. The indicators are classified as leading, coincident or lagging as shown in the third column.

Columns in the chart are designed to differentiate between where the market is today and the direction it is pointing. Our evaluation of the present situation is subjectively based on our opinion of the historical value of each indicator. There is nothing subjective about the trends section, which provides the latest facts available on the date of publication. It is quite possible for the present situation to be predominantly red and trends to be predominantly green or vice versa depending on the overall situation and direction of the market. The present situation is subdivided into: below the historical norm (-), (OK), and above the historical norm (+). The “Values” section of the chart is a quantitative definition of the market’s direction. In most cases, values are three-month moving averages to eliminate noise. In cases where seasonality is an issue, the evaluation of market direction is made on a year-over-year comparison to eliminate this effect. Where seasonality is not an issue, concurrent periods are compared. The date of the latest data is identified in the third values column. Values will always be current as of the date of publication. Finally, the far-right column quantifies the trend as a percentage or numerical change with color code classification to indicate positive or negative direction.