Prices

April 28, 2018

Correction: April Foreign Steel Import Trend

Written by John Packard

Our apologies. On Thursday we used inaccurate import license data and the article we wrote was totally incorrect.

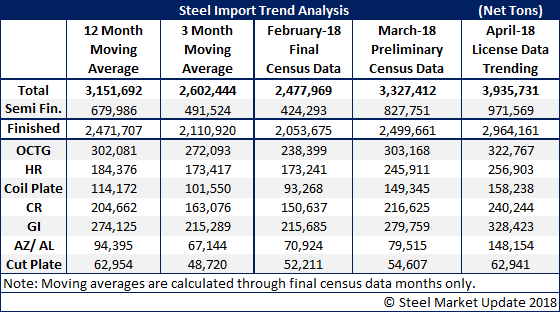

Here is the corrected version with license data as of Wednesday, April 25.

April 2018 licenses are suggesting the month will end with 3.9 million net tons of foreign steel imports. Of those, almost 1 million net tons will be semi-finished steels with 2.9 million tons of finished steels.

Every single product is above its 12-month moving average (cut plate is at the average) and is also above the 3-month moving average.

We will have an updated article later this week based on the license data that is expected to be released on May 1.