Market Segment

April 26, 2018

Mexico Production Boosts Ternium Results

Written by Sandy Williams

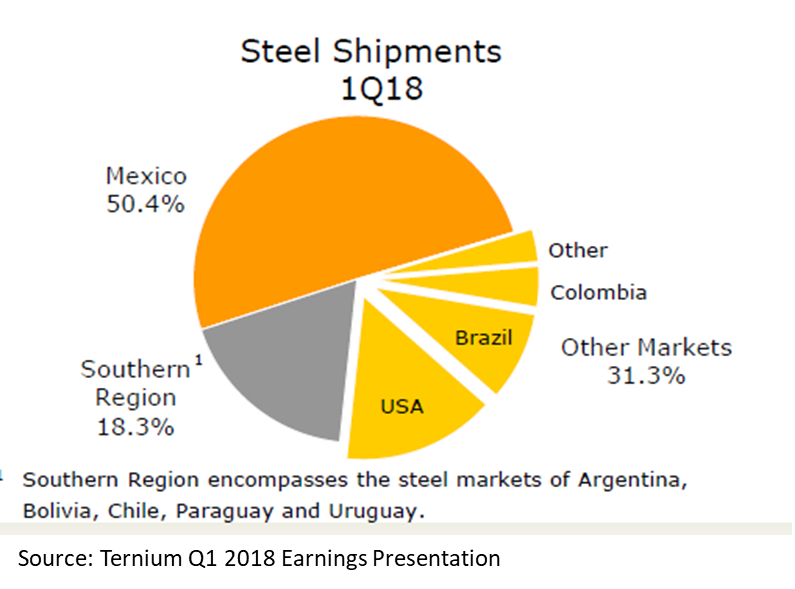

Steel producer Ternium reported shipments of 3.5 million tons in first-quarter 2018, a 3.0 percent increase from the fourth quarter and a 42 percent jump from Q1 2017. Higher steel prices pushed revenue up $45 per ton. Higher shipments were a result of a 160,000-ton increase in Mexico that was offset by a 48,000-ton decrease in other markets due to higher shipments of slabs to Ternium subsidies and the consequent decrease in shipments of slabs to third parties.

Ternium posted total sales of $2.96 billion and net income of $422.1 million, significantly higher than the previous quarter or year.

Ternium posted total sales of $2.96 billion and net income of $422.1 million, significantly higher than the previous quarter or year.

Steel shipments in the Mexican market are expected to remain healthy in the second quarter. Demand remains strong in the industry sector, but the commercial market, more closely associated with the construction industry, is expected to weaken.

Regarding the current trade environment, Ternium wrote in its earnings press release:

“Uncertainty in the markets regarding U.S. trade action against imports of steel under section 232 lingers on, as many countries that were initially exempted from the 25 percent general tariff are negotiating specific conditions under which to maintain such exemptions, in some cases by way of import quotas. In addition, the NAFTA renegotiation process continues, and the Mexican government is analyzing the renewal of a recently expired safeguard against steel imports. Steel prices in the North American region have significantly increased year-to-date, but the outcome of these trade-related issues will have a bearing on future steel price performance in this market.”

The company anticipates steel shipments in the Mexican market to remain at healthy levels after a record first quarter this year. Industrial customer demand remains strong in the second quarter 2018, while the commercial/construction market may show some weakness.

Mexican steel prices rose significantly in the first quarter and are expected to continue to increase with new industrial sales contracts. Ternium also expects its cost per ton to rise in the second quarter at its Mexican subsidiary as higher prices of third-party purchased slabs gradually flow through cost of sales.

The Argentina market is enjoying its second consecutive year of economic growth since 2011. Ternium expects steel shipments and revenue per ton to slightly increase in the Argentine market in the second quarter compared to the first quarter of the year.

Ternium is Latin America’s leading flat steel producer with operating facilities in Mexico, Brazil, Argentina, Colombia, the southern United States and Central America.