Market Segment

April 24, 2018

NLMK Cautious on Slab Supply to U.S. Operation

Written by Sandy Williams

NLMK Group reported a 1 percent increase in first-quarter revenue, to $2.79 billion, as a 5.0 percent seasonal drop in sales was offset by stronger pricing. Net income grew by 17 percent from Q4 to $502 million, driven by higher operating profit.

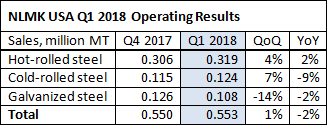

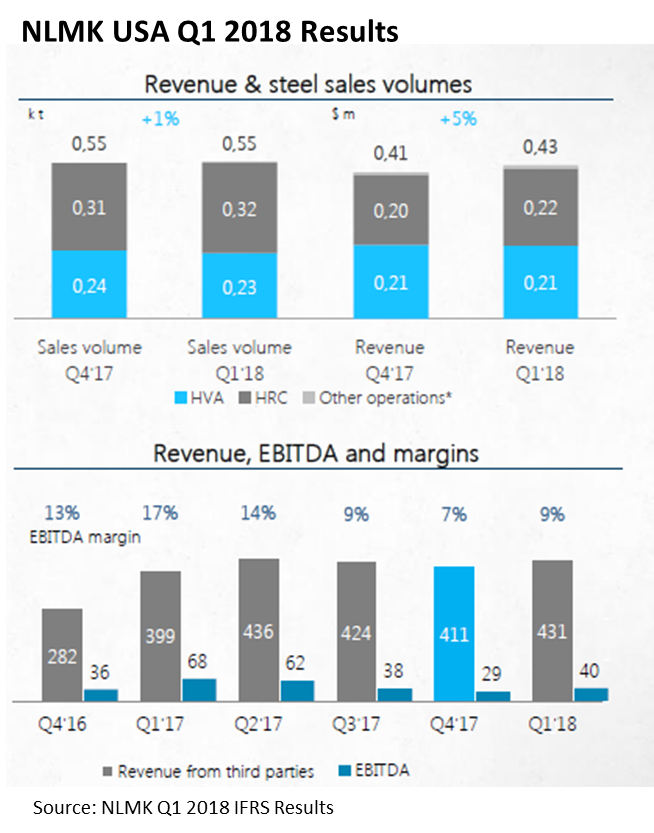

NLMK USA sales increased 1.0 percent from the fourth quarter on higher demand for hot- and cold-rolled steel and concern over supply disruption. Revenue jumped 5 percent quarter-over-quarter to $43 million due to higher pricing. Average selling prices increased 4.0 percent in the first quarter to $160 per metric ton following the Section 232 announcement.

NLMK expects continued underlying demand growth in the U.S. with pricing dependent on Section 232 news. CEO Grigory Fedorishin said NLMK is paying the 25 percent tariff on slabs imported to its U.S. mill, but is still making $50-$70 per ton at the current pricing level. As exclusions to the tariff are approved, pricing may decline, said Fedorishin, so NLMK will review the situation every few weeks to see if it will maintain its supply chain to the U.S.

NLMK USA has requested an exemption for Russian slabs from its parent company, which is expected to be decided in mid-June. The U.S. operation imports more than two million tons of slabs per year, 90 percent of which are purchased from NLMK Group.