Government/Policy

April 24, 2018

AIIS Responds to Commerce Criticism of Report

Written by Sandy Williams

A new study by Martin Associates questioning the relationship between steel tariffs and mill capacity utilization was largely dismissed by the Commerce Department as industry propaganda, prompting a stern response from the American Institute for International Steel. AIIS released the analysis by Dr. John Martin on April 18 and stands behind his findings.

The Secretary of Commerce asserts in the Section 232 report that “the only effective means of removing the impairment is to reduce import levels that should, in combination with good management, enable U.S. steel mills to operate at 80% or more of their rated production capacity.”

Martin countered the Secretary’s argument in his analysis, offering data which he believes shows there is no direct relationship between steel imports and capacity utilization. During the March 2002-December 2003 period when Section 201 import tariffs were imposed, capacity utilization actually declined rather than grew, Martin said.

Following release of the report by AIIS, an anonymous Commerce Department official issued what the Institute termed a “cursory critique, alleging, among other things, that the AIIS study focuses on ‘short-term’ analysis, and ignores other factors like the recession.”

The Commerce criticism and Martin’s responses are reprinted below:

The Commerce Department dismissed the April 18 report as “just a series of charts” with significant flaws, including the “failure to include 2017 data,” and argued that “correlation does not equal causation.”

Martin’s Response: The reason 2017 steel industry data was not included on all charts is that the American Iron and Steel Institute annual report that included the steel industry data for 2017 has not yet been released. The 2016 AISI annual report, which has the most recent AISI data (2016), was published in July 2017. Therefore, the 2017 AISI annual report, which would include the 2017 data, should be available in July 2018. It is to be emphasized that the data utilized in the analysis did include 2017 data for waterborne steel imports as published by the U.S. Census, USA Trade Online. That data shows an increase in steel imports from 2016 to 2017, but the 2017 level of waterborne imports was less than the level in 2015.

“The Martin report was paid for by a consortium of foreign steel companies and importers, and so it is not surprising that it supports their interests,” a Commerce Department official said in an email to Inside U.S. Trade. “But, it uses carefully selected data and incorrectly assumes causality between the selected items.”

Martin’s Response: AIIS, which represents the entire steel supply chain, including importers, and is not a consortium of foreign steel companies, paid for the Martin Associates’ report published in September 2017 regarding “THE 2016 NATIONAL ECONOMIC IMPACT OF IMPORTED IRON AND STEEL PRODUCTS ON THE U.S. MARINE TRANSPORTATION SYSTEM AND THE U.S. ECONOMY.” Martin Associates received no compensation for this current analysis of the relationships between steel industry capacity utilization and import levels and the Section 201 tariffs.

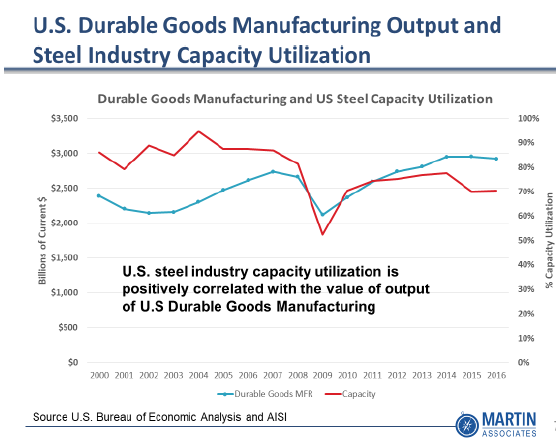

Martin Associates does not assert causality, just the fact that the levels of capacity utilization and imports are positively related to the level of durable goods manufacturing output, and further that the steel industry capacity utilization fell constantly during the 22 months in which the Section 201 tariffs were in effect. This raises the question of why capacity utilization would be expected to increase with the Section 232 actions. The reason capacity utilization is the focus of the analysis is that the 80% capacity utilization target is the stated reason by Commerce justifying the enactment of Section 232. Please see the chart below where correlation, not causation, is emphasized in the presentation.

The April 18 study, the Commerce official continued, also “ignores the International Trade Commission’s 2005 evaluation of the Section 201 tariffs,” which reported that while capacity utilization “declined from 2002 to 2003, this was because both capacity and production increased during that time and capacity utilization still remained above 80 percent.”

Martin’s Response: The intent of the Section 232 tariffs is to increase capacity utilization to 80% in order to ensure national defense readiness. It is clear from the AISI industry capacity utilization data that in fact the steel industry capacity utilization fell during the months Section 201 tariffs were in place. Therefore, if capacity utilization is the target, as stated in the initial Commerce report, then history does not support the fact that steel industry capacity utilization increases under tariffs.

The Martin Associates study focuses only on “short-term variations in capacity utilization rather than longer-term data,” while the Section 232 tariffs, the official continued, “are designed to address a long-term issue.” Accordingly, the official said the report was “flawed because it ignores other factors that would influence capacity utilization, imports, or production levels” and “doesn’t take into account other reasons why capacity utilization was low in 2002, most notably the recession.”

Martin’s Response: The use of quarterly data from 2001 through 2016 is not short-term data analysis. In fact, 60 data points between 2001 and 2016 is a significant set of data and includes the impact of the 2009 recession. Actually, during the 2002 recession, according to AISI data, industry utilization was higher (averaging 88.8%) than in 2003 (averaging 84.9%).

Note: Martin’s presentation, Relationship Between Steel Imports and Steel Industry Capacity Utilization, may be accessed here or from www.AIIS.org.