Market Data

April 22, 2018

SMU Survey: Does Section 232 Put Your Company at Risk?

Written by Tim Triplett

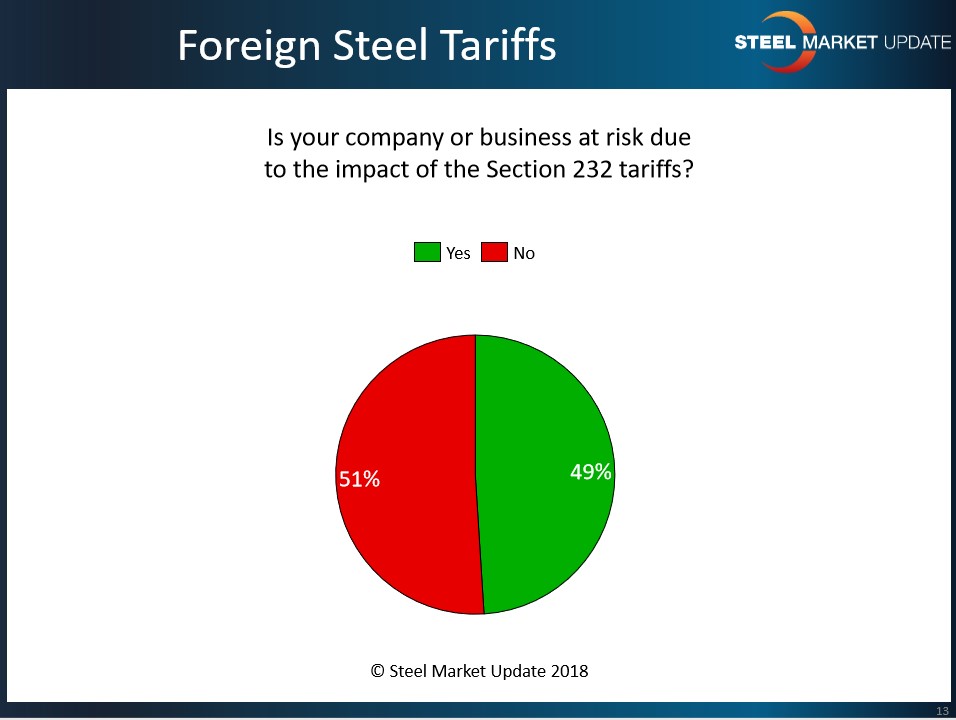

Is your company at risk due to the impact of the Section 232 tariffs?

Industry executives responding to Steel Market Update’s April 16 flat rolled market trends questionnaire are almost evenly split on whether the Trump administration tariffs will help or hurt their businesses. Fifty-two percent say their business is not at risk, while 48 percent feel it is.

Service center executives are concerned about the effects of the tariffs on demand and profit margins:

• “Long term, we are concerned that the manufacturing demand could be hurt if the tariffs stay in place too long.” Service Center/Wholesaler

• “Our business volume is slowing due to people putting things on hold.” Service Center/Wholesaler

• “It’s a global economy. Our domestic prices spiked, when they were already above the global market. How does 232 make us more competitive? This is a band-aid on a rusty fender.” Service Center/Wholesaler

• “Are we at risk? No, but we are impacted as the cost to carry steel has increased as the mills pushed prices up 50 percent from the bottom in October.” Service Center/Wholesaler

• “We have contracts with suppliers who depend on Russian slab.” Service Center/Wholesaler

• “If Trump negates 232 after we have received and PAID the tariff, we will have extremely overpriced inventory.” Service Center/Wholesaler

• “A large part of my supply comes from offshore due to limited availability domestically.” Service Center/Wholesaler

• “We had to pay most of the tariff for inbound tons from Turkey that we can’t pass along to our customers.” Service Center/Wholesaler

• “We have substantial risk on unsold inventory positions. When prices go back down, which they always do, we will take some losses. With the futures backwardation currently in the market, it is very difficult to hedge against that exposure.” Service Center/Wholesaler

• “Inventory control is the name of the game. It is important to take care of loyal customers. As long as we stay to this format, things are good.” Service Center/Wholesaler

Manufacturers are fearful that rising steel prices will make them less competitive:

• “Our customers are already looking at offshore sourcing on the products we make for them. We can’t compete with cheaper foreign steel, and if there are no tariffs on finished goods, our business is at risk.” Manufacturer/OEM

• “Price increases will affect demand if they get out of control.” Manufacturer/OEM

• “Our products require lots of steel, so we have already been impacted by the increases in the steel market. We also purchase several items that originate in China, and therefore we are waiting to see how the new proposed tariffs might affect us, as well.” Manufacturer/OEM

• “We are unsure if the construction industry will suffer a decline in demand due to increasing prices.” Manufacturer/OEM

• “My industry sector will lose steel sales to non-corrosive polymer systems. Also, with uncertainty on my ability to pass through my steel costs, I cannot consider raises, capital investments, etc. The ultimate customers for the product I make just want low price.” Manufacturer/OEM

• “It’s a constant battle to explain to a customer why we need to increase prices. In the short order, our margins are compressing to very uncomfortable levels.” Manufacturer/OEM

• “Some product is shipped across our border and these will definitely have repercussions.” Manufacturer/OEM

• “We have seen an escalation of imports of manufactured steel products from Italy and Sweden at very low prices. These competitors have access to much lower steel prices versus those in North America.” Manufacturer/OEM

• “Our company does not buy foreign metal. The only impact the tariffs have on our business is the extreme increases in the cost of domestic steel. This may force us to look at purchasing foreign metal.” Manufacturer/OEM

Even one steel mill executive acknowledged the downstream impact of the tariffs: “There will be short-term and long-term effects of the Section 232, some good and some bad. But, objectively, an aggressively administered Section 232 will damage the metalworking industry,” he said. Added a toll processor: “The supply chain disruption is not in our favor.”