Government/Policy

April 9, 2018

Commerce Affirms Dumping of Cold-Drawn Mechanical Tubing

Written by Sandy Williams

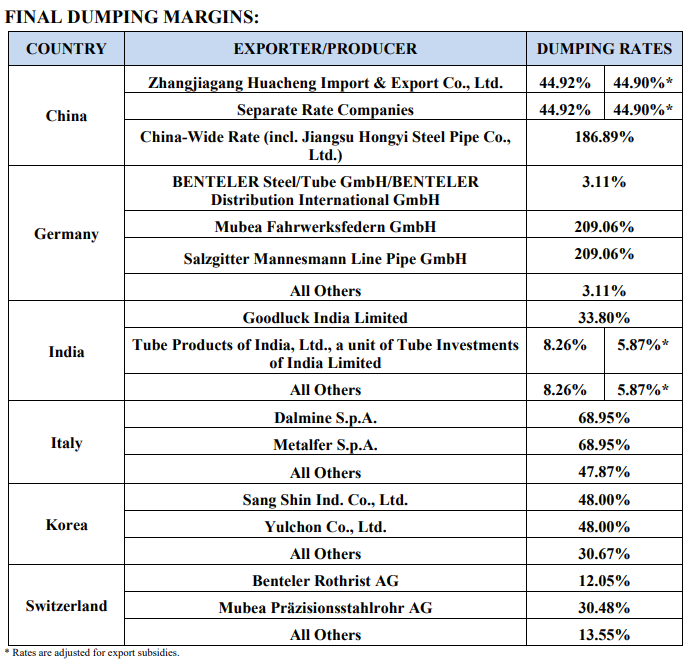

Commerce announced an affirmative final decision in the antidumping investigation concerning imports of cold-drawn mechanical tubing from China, Germany, India, Italy, Korea, and Switzerland.

In addition, Commerce found that “critical circumstances” exist with respect to Dalmine S.p.A. and Metalfer S.p.A., but not with respect to all other producers/exporters in Italy; Sang Shin Ind. Co., Ltd., Yulchon Co., Ltd. and for all other producers/exporters in Korea; and with respect to the China-wide entity, including Jiangsu Hongyi Steel Pipe Co., Ltd., and the producers/exporters receiving a separate rate, but not with respect to Zhangjiagang Huacheng Import & Export Co., Ltd.

The petitioners in the investigation are ArcelorMittal Tubular Products, Michigan Seamless Tube, LLC, PTC Alliance Corp., Webco Industries, Inc., and Zekelman Industries, Inc.

The scope of these investigations covers cold-drawn mechanical tubing of carbon and alloy steel of circular cross-section, 304.8 mm or more in length, in actual outside diameters less than 331mm, and regardless of wall thickness, surface finish, end finish or industry specification.

The U.S. International Trade Commission is scheduled to make its final determination regarding injury to the domestic industry by May 24, 2018.

Dumping margins are listed in the chart below.