Prices

March 29, 2018

SMU Analysis: Quotas on South Korea May Have a Big Impact

Written by John Packard

In response to the Trump administration tariffs, South Korea was the first country to agree to a quota and to restrict the amount of steel they can export out of their country to the United States. Steel Market Update’s analysis below shows the potential for the quotas to have a big impact on specific market segments in the second half of the year.

Here is what trade attorney Lewis Leibowitz told SMU earlier this week about the Korean agreement based on the information currently available:

“As part of the renegotiation of the Korea-U.S. free trade agreement (KORUS), the Trump administration granted South Korea a permanent exemption from the steel tariffs that went into effect on March 23. The other exempt countries still have until May 1 to secure a longer-term exemption or their imports will be covered as of that date.

1. Korea agreed to a quota on steel imports into the United States equal to 70 percent of the three-year average from 2015-2017.

2.According to the Peterson Institute for International Economics, that figure for all steel products covered by the tariff proclamation is about 2.68 million short tons annually. This is a 21 percent decrease from 2017 import levels for Korea—so this quota will ‘bite.’

3. The White House announced that quotas would be on a product-by-product basis; each individual steel product will have a quota. It remains to be seen if a quota can be transferred between specific products.

4. It’s also unclear if a product exclusion provision will apply to the quota deal.”

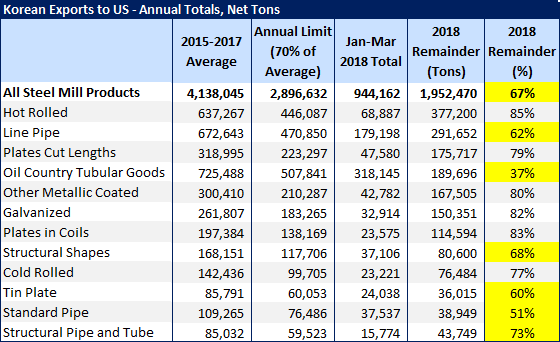

SMU did a quick calculation of the annual tonnage shipped by South Korea to the United States during 2015-2017 using Department of Commerce SIMA data (license data, which could be off slightly) and came up with an average of 4,138,045 net tons (not metric tons). At 70 percent, Korea’s quota per year would be 2,896,632 net tons.

There remains a question (as Leibowitz mentioned above) as to whether the tonnage is for all products combined or if the quota is by product. We believe, based on what the government has said so far, that the quota will be by product. So, we calculated how the quota may impact certain flat rolled, plate, and pipe and tube products.

The chart below uses Department of Commerce numbers. For the sake of this analysis, we used DOC license data to calculate where we think Korea will be as of the end of the first quarter. So, we have projected the month of March based on license data through March 27.

Based on these numbers, and assuming that our data will be close to where the final figures shake out, we believe that Korea has already used up one-third of their overall quota for the year (first three months = one quarter of the year). Korea will have to back off shipments in order to not break through their quota.

One of the products of concern to many in the industry is the large volume of oil country tubular goods (OCTG) Korea has been shipping to the U.S. Based on our quick analysis, if Korea is going to be held to a quota by product, the country has already shipped 63 percent of their annual quota on OCTG and only has 189,696 net tons left for the remainder of the year.

This is why the question as to whether Korea can move tonnage from one product to another is going to be a big deal.

If there is a true reduction of pipe and tube (OCTG, line pipe, structural pipe, etc.) imports, there will be significant pressure on the available supply of hot rolled coming out of the U.S. mills for domestic pipe production.

Following is SMU’s calculations for individual products based on the DOC data. Our numbers may be off slightly, but what we want to communicate is what tonnage will be affected first, and the most, out of the following products. The percentages shown reflect how much of their quota is potentially left this year.