Prices

March 29, 2018

Hot Rolled Steel and Scrap Futures: Opportunity to Retrace

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Announced steel tariffs provide less uncertainty and give the markets an opportunity to retrace.

Steel

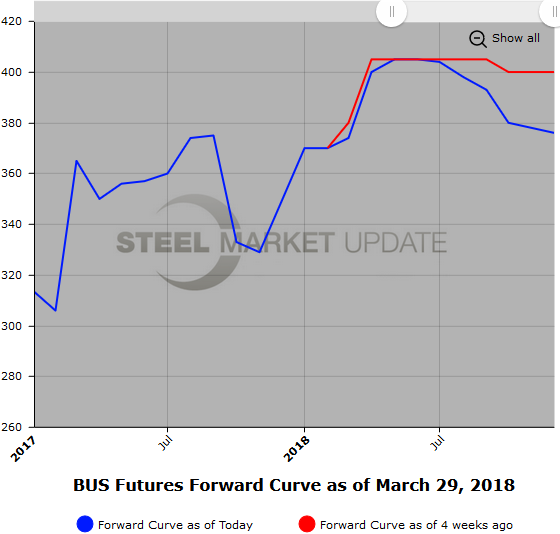

March has proven to be a volatile month for HR futures with all the uncertainty that revolved around potential tariffs linked to national security. However, the nearby (Apr’18) HR futures price remains basically unchanged at $860-865/ST, which is about $5-10/ST above where a number of the indexes have reported spot physical HR trading.

What has changed in HR futures prices is the slope of the backwardation. More certainty with regard to the tariffs has led to the middle to latter month HR futures being sold lower. On a CME settlement basis for the month of March, Q2’18 HR futures prices have declined from $857/ST to $837/ST or $20/ST; Q3’18 HR futures prices have declined from $842/ST to $793/ST or $49/ST; Q4’18 HR futures prices have declined from $817/ST to $776/ST or $41/ST. The steepest individual monthly decline occurred in Jul’18 HR futures, which dropped $49/ST during March. Currently, the steepest Calendar month-to-month spread can be found in the Apr’18 versus May’18 period at $28/ST basis March 1st to March 28th CME settles.

HR futures trading activity has been brisk this month with just shy of 200,000 ST trading. Most of the trading has been in the balance of Calendar 2018 with some activity in Calendar 2019 toward the latter part of the month. The Calendar 2019 has been trading around an average of $745/ST, a decent discount to the front month at $860/ST.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact Brett at 706-216-2140 or Brett@SteelMarketUpdate.com.

Scrap

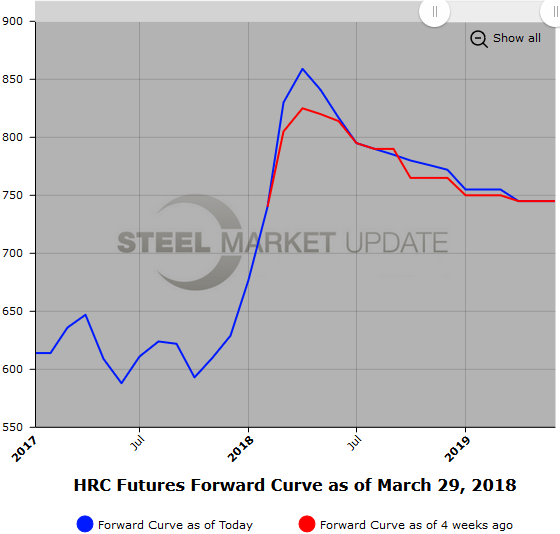

Steel scrap has also had a fairly volatile month for similar reasons to HR. Lots of wet weather and winter storms have also provided some challenges to making deliveries to the mills. However, with 232 issues becoming clearer, we have seen some retracement of recent upward price pressure. In BUS we have seen the market shed about $15/GT in Q2’18 and about $35/GT in the 2H’18. 2H’18 BUS is now offered below $400/GT.

While markets are still very thin in Midwest shred (USSQ), the recent selloff in other scrap markets has also been reflected in lower indicated levels dropping from $390/GT to $370/GT for the balance of calendar 2018. The indicated curve remains relatively flat.

In 80/20 scrap, we have seen futures prices decline as export shipments have dropped off in the last week or two. Q2’18 SC futures have retraced about $42/MT and the quarter currently sits around $345/MT. The Apr’18 versus Sep’18 spread is a modest $10 discount basis today’s settles ($352 vs $342).

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.