Market Data

March 22, 2018

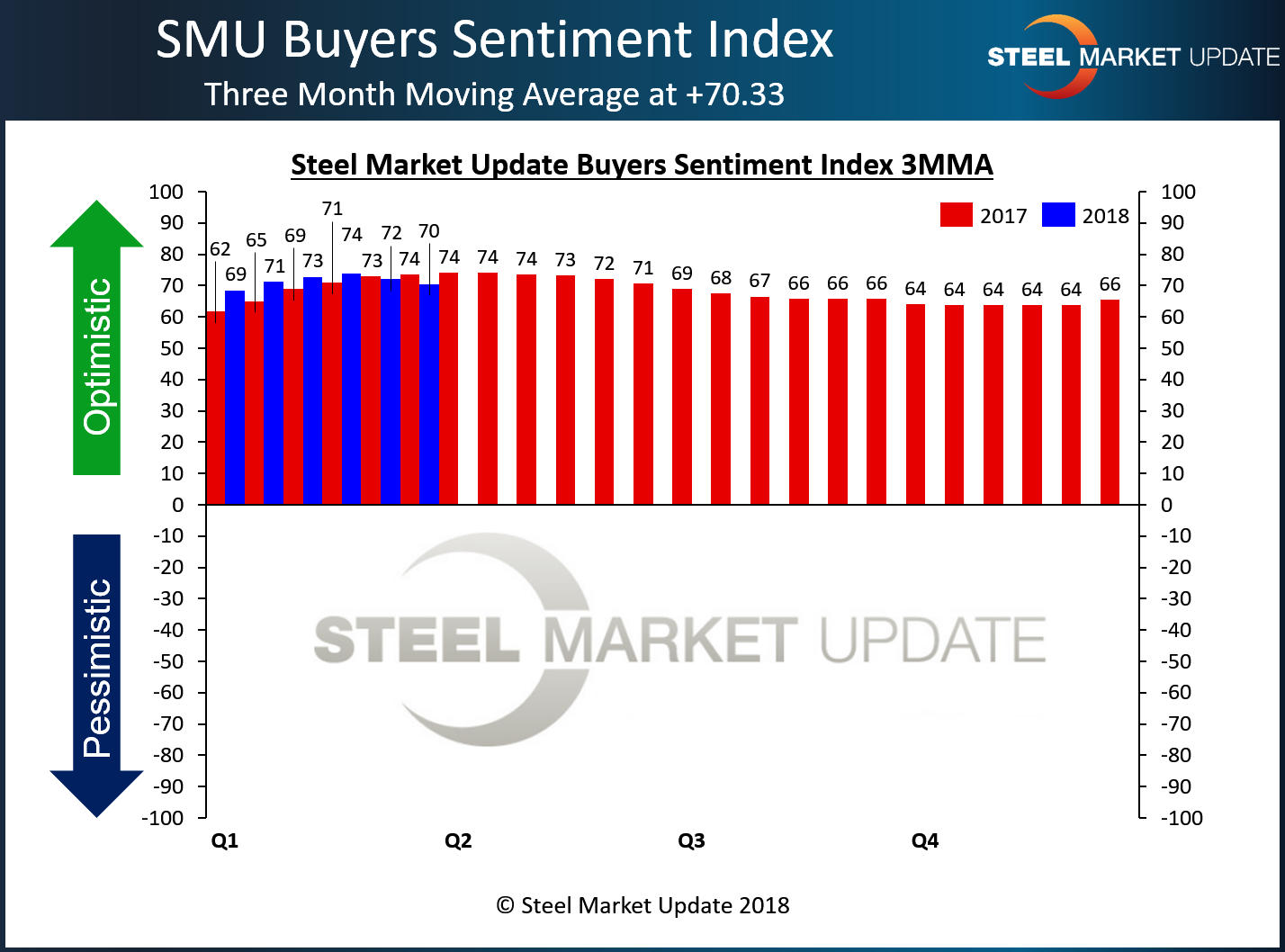

SMU Steel Buyers Sentiment Index: Troubling Signs

Written by Tim Triplett

Both current and future sentiment among flat rolled steel buyers saw a small but positive bump in the past two weeks, perhaps reflecting the announcements and uncertainty from the Trump administration on the steel tariffs that are set to take effect tomorrow, March 23. In general, buyers’ attitudes have bounced up and down within a small range over the past few months, but remain at highly optimistic levels from a historical perspective. Steel Market Update’s Steel Buyers Sentiment Index is designed to measure changes in buyers’ optimism levels, which offers insight into their likely decision-making.

Current sentiment, measured as a single data point, jumped by seven points in the past two weeks to +66. Measured as a three-month moving average, however, the Current Sentiment 3MMA dropped to +70.33 from +72.00 in early March. The three-month moving average helps to even out the highs and lows. The peak for the index was 74.17 in April 2017. Steel Market Update is concerned about the early slip in our 3-month moving average which tends to be seasonal slipping in late 2nd Quarter through the 3rd Quarter before rising at the end of the year. However, the +70 level is securely in optimistic category for our index as buyers and sellers of steel feel there company can be successful in the existing market conditions.

Future Steel Buyers Sentiment Index

SMU’s questionnaire also asked steel buyers to assess their chances for success three to six months down the road. Future Sentiment indexed as a single data point jumped by nine points since the beginning of March to +57. The three-month moving average for Future Sentiment registered another decline, however, to +66.00 from +68.83 earlier in the month. For comparison, the high mark for Future Sentiment was +73.67 set in mid-March 2017. As with Current Sentiment we are concerned with the early swing lower and the size of the movement over a short period of time. This is a troubling sign for the steel industry and we will need to watch it very carefully in the coming weeks.

What Respondents are Saying

Buyers’ comments reflect concerns about steel availability getting too low and steel prices getting too high and possibly reversing direction too quickly:

- “Demand is outweighing supply, which is very good in the short run.”

- “If we can’t get steel, we can’t sell steel.”

- “We will continue to sell off replacement costs, so we have cash to buy more steel.”

- Short term is good as we are holding large inventories, while the future with tariffs looks muddled.”

- “I’m concerned with the greed of the steel mills hiking prices too much too quickly!”

- “It is extremely difficult to pass on these absurd steel prices to our customer base, so it is difficult to be optimistic about the short-term outlook.”

- “With the market prices increasing rapidly and limited supply, imports will still be competitive even with tariffs. We’re working with more domestic supply options so those are successful when available.”

- “We’re optimistic, as long as pricing doesn’t fall too precipitously.”

- “Very concerned about pricing reversing.”

- “There are too many unanswered questions, too much uncertainty and lack of clarity to effectively prepare a business strategy.”

- “Admittedly, there are a lot of balls up in the air at this time. This includes the Section 232 action and all that surrounds it. We’re projecting it will take at least one quarter to shake out. Will Section 232 survive the continued pushback and, if so, in what form?”

- “Will our customers move their business to foreign competition? Not sure.”

- “We’re unable to estimate the negative effect of tariffs on current business. It could be substantial!”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 40 percent were manufacturers and 47 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.