Market Data

March 22, 2018

SMU Service Center Apparent Excess/Deficit Inventories Forecast

Written by Brett Linton

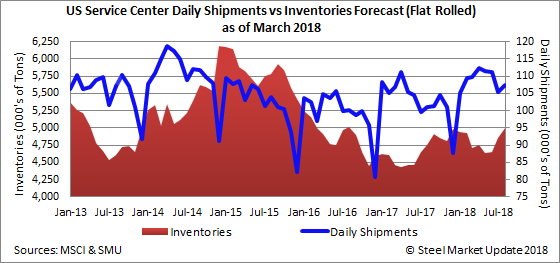

Steel Market Update forecast that flat rolled steel shipments from U.S. service centers would slightly decline from 105,109 tons per day in January to 104,577 tons per day in February. The Metals Service Center Institute (MSCI) reported last week that sheet distributors shipped 109,565 tons per day, an increase over January. Our shipment forecast accuracy continues to be relatively high, off just 4.6 percent in February.

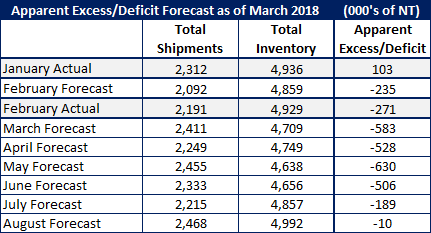

![]() On a monthly basis, our forecast called for total shipments to fall from 2,312,400 tons in January to 2,091,500 tons in February. The final figure was 2,191,500 tons; our forecast was off by exactly 100,000 tons.

On a monthly basis, our forecast called for total shipments to fall from 2,312,400 tons in January to 2,091,500 tons in February. The final figure was 2,191,500 tons; our forecast was off by exactly 100,000 tons.

Receipts coming into the service centers continues to be harder to predict. SMU forecast daily receipts to fall from 102,650 in January to 100,726 tons in February. The actual receipt rate rose to 109,210 tons. Total receipts were forecast to fall from 2,258,300 tons in January to 2,014,500 tons in February, and MSCI reported them to be 2,184,200 tons.

SMU forecast total inventories would fall from 4,935,600 tons in January to 4,858,600 tons in February. MSCI reported total inventories at 4,928,500 tons in February, just slightly down over the previous month. Our forecast was off primarily due to our underestimation in steel receipts.

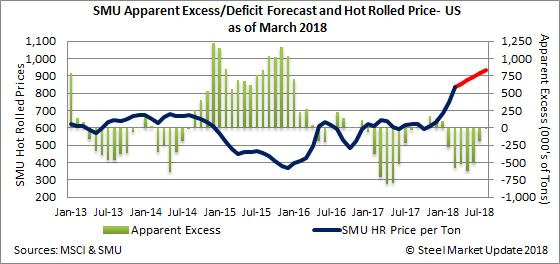

At the end of January, our proprietary model calculated that the domestic flat rolled service centers had 102,700 tons of excess inventories on their floors. We predicted the excess in inventory levels would turn into a 234,600 ton inventory deficit by the end of February. Our underestimation in the daily shipments and receipts balanced out, and we found the excess inventories turned into a 271,300 ton inventory deficit in February. We were off by 36,700 tons.

March Forecast Calls for Inventory Deficit to Grow

Our adjusted forecast calls for an increase in total U.S. service center shipments to 2,411,000 tons of flat rolled steel during the month of March. We are calling for total inventories to fall to 4,709,000 tons in March.

With the change in the model, our new forecast is for U.S. service centers to be holding a deficit of -583,000 tons through the end of March and for that deficit to remain at that level throughout June, then shrinking.

Here is what the full forecast looks like through August 2018: