Market Data

March 8, 2018

SMU Steel Buyers Sentiment Index: Market's Unsettled

Written by Tim Triplett

President Trump’s controversial decision to impose a steep tariff on steel imports has clearly unsettled the market and taken a toll on the attitude of many steel buyers. Both current and future sentiment among flat rolled steel buyers declined significantly in the last two weeks, according to the latest Steel Market Update Steel Buyers Sentiment Index. The index measures changes in buyers’ optimism levels, which offers insight into their likely decision-making.

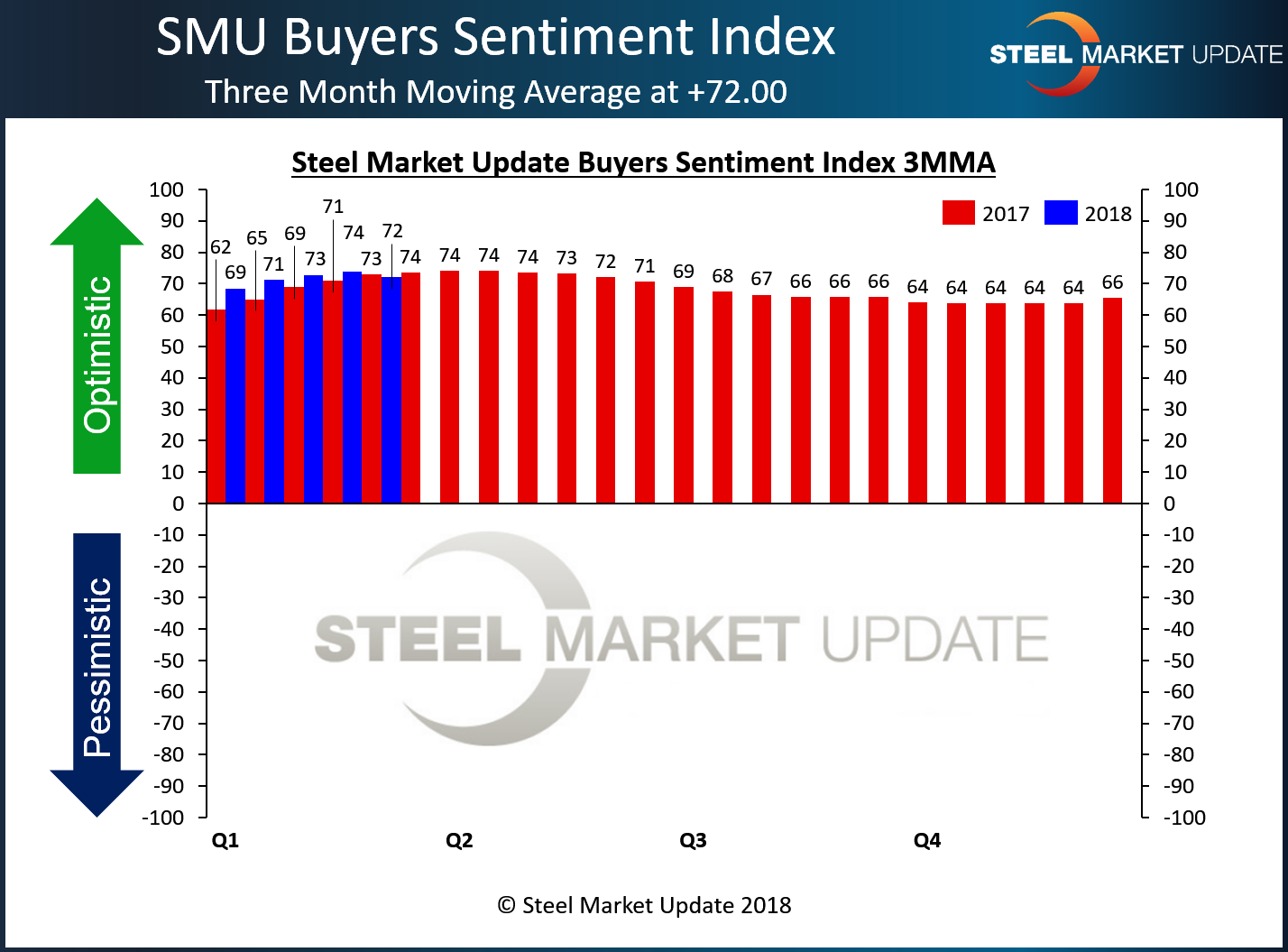

Current sentiment, measured as a single data point, fell 12 points in the past two weeks to +59. Based on a three-month moving average, which smooths out the ups and downs, the Current Sentiment 3MMA dropped to +72.00 from +73.83 in mid-February. While still at optimistic levels, not far off the peak for the index of 74.17 in April 2017, the double-digit decline is significant for an index that usually moves within a very narrow range.

Future Steel Buyers Sentiment Index

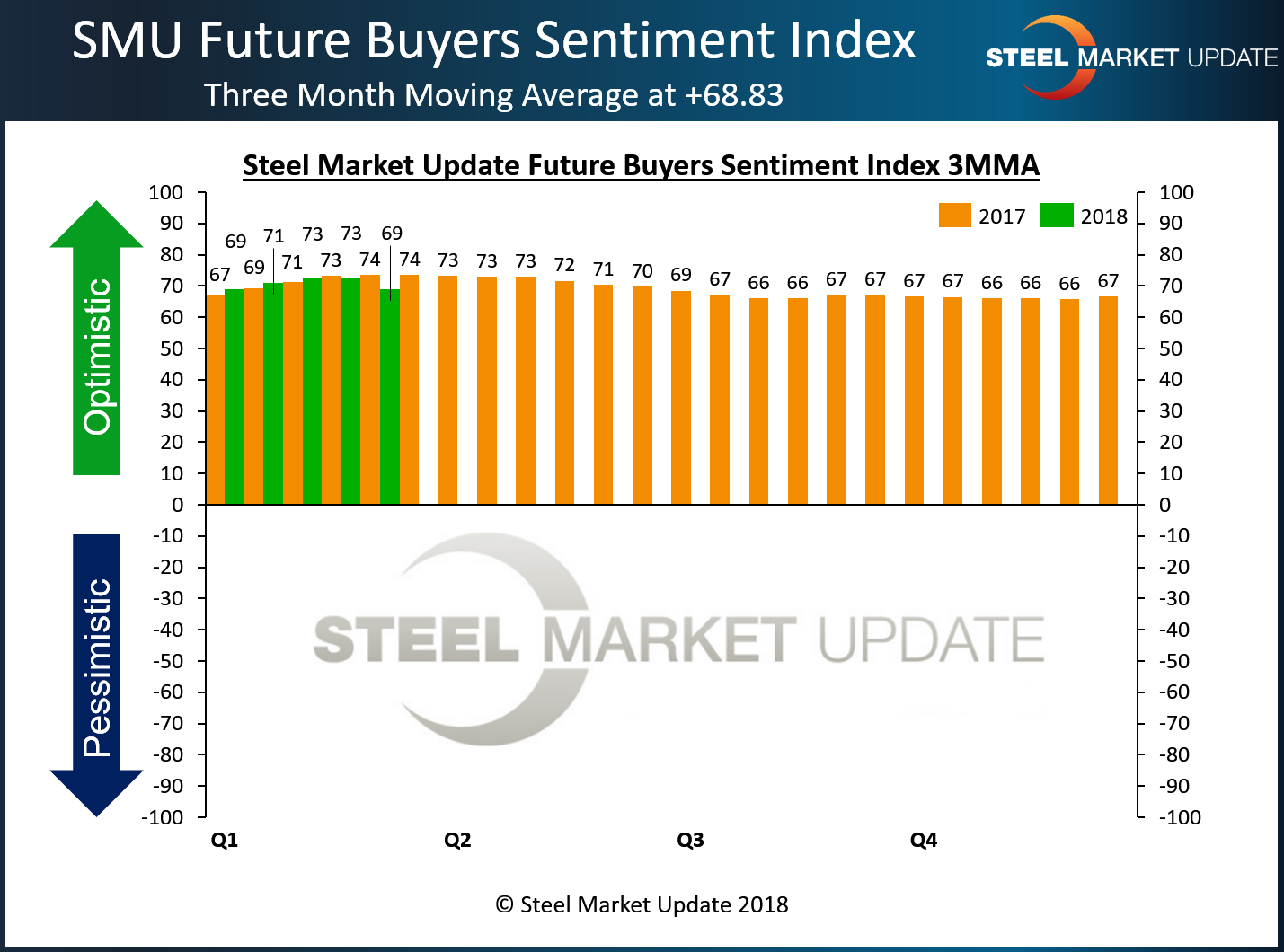

Steel buyers were also asked to assess their chances for success three to six months down the road. The Future Sentiment indexed as a single data point declined by an even greater 16 points to +48. Measured as a three-month moving average, Future Sentiment dipped to +68.83, down from +72.67 in mid-February. For comparison, the high mark for Future Sentiment was +73.67 set in mid-March 2017.

What Respondents are Saying

- “A 25 percent tariff is too high.” Manufacturer/OEM

- “It’s a very unsettled steel market, which will make it hard to plan for future purchases/sales.” Service Center/Wholesaler

- “The current Section 232 situation is going to create havoc on my trading business.” Trader

- “The mills are hell bent on creating an environment that will be super high risk with these ridiculously inflated prices. Also, financing costs are increasing as interest rates and steel prices escalate.” Service Center/Wholesaler

- “Section 232 provides a fair bit uncertainty. With uncertainty grows caution.” Trader

- “Our prospects are awful if Section 232’s 25 percent tariffs go through as Trump wants. We will lose market share to Asian producers until we move offshore.” Manufacturer/OEM

- “In the steel business, what goes up must come down. The down is always far more painful than the up is enjoyable due to competitors selling on actual cost on the way up and having no choice but to sell on replacement cost on the way down.” Service Center/Wholesaler

- “The trade wars will cause the U.S. economy to slow and lessen demand for steel products.” Trader

- “I’m concerned with the strategy and greed factor of domestic mills once tariffs or quotas are enacted against several of the larger importing coated steel countries!” Service Center/Wholesaler

- “With the specter of Section 232, it’s the period outside of six months that gives me concern. I’m worried about manufacturing and/or production of finished parts moving offshore in the longer term.” Service Center/Wholesaler

- “So much depends on how many of our import orders get delivered in time to avoid the 232 tariff.” Service Center/Wholesaler

- “These tariffs are going to make it very difficult for the small to mid-size service centers to be competitive on sourcing.” Service Center/Wholesaler

- “The market could take a quick slowdown if steel prices jump too much too fast.” Service Center/Wholesaler

- “This cycle will last as long as the trade issues ‘allow.’ If Trump softens somewhat, the market will adjust and start to descend in late summer. If he stays with the program as announced on March 1, it could stay strong until late 2018.” Steel Mill

- “The future’s good, provided there are no tariffs on Canadian steel shipping to the U.S.” Service Center/Wholesaler

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 37 percent were manufacturers and 48 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.