Market Data

March 6, 2018

SMU Service Center Apparent Excess/Deficit Inventories Forecast

Written by Brett Linton

Steel Market Update forecast that flat rolled steel shipments from U.S. service centers would rise from 87,805 tons per day in December to 109,083 tons per day in January. The Metals Service Center Institute (MSCI) reported last week that sheet distributors shipped 105,109 tons per day. Our shipment forecast accuracy continues to be high, off by just 3.6 percent in January.

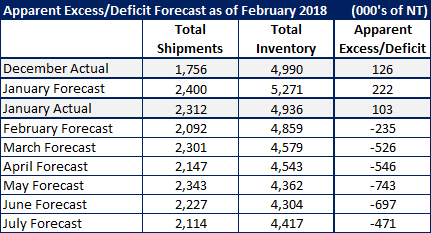

![]() On a monthly basis, our forecast called for total shipments to rise from 1,756,000 tons in December to 2,400,000 tons in January. The final figure was 2,312,000 tons.

On a monthly basis, our forecast called for total shipments to rise from 1,756,000 tons in December to 2,400,000 tons in January. The final figure was 2,312,000 tons.

Receipts coming into the service centers has been harder to predict. SMU forecast daily receipts to rise from 96,895 in December to 121,849 tons in January. They rose at a much lesser rate to 102,650 tons. Total receipts were forecast to rise from 1,938,000 tons in December to 2,681,000 tons in January, and MSCI reported them to be 2,258,000 tons.

SMU forecast total inventories would rise from 4,990,000 tons in December to 5,271,000 tons in January. MSCI reported total inventories at 4,936,000 tons in January. Our forecast was off due to our overestimation in steel receipts.

At the end of December, our proprietary model calculated that the domestic flat rolled service centers had 126,000 tons of excess inventories on their floors. We predicted the excess would grow to 222,000 tons by the end of December. However, with the lower receipts, we found the excess remained relatively stable at 103,000 tons.

February Forecast Calls for a Deficit in Inventories

Our adjusted forecast calls for a decrease in total U.S. service center shipments to 2,092,000 tons of flat rolled steel during the month.

Based on our new formula for receipts, we are calling for total inventories to fall to 4,859,000 tons in February.

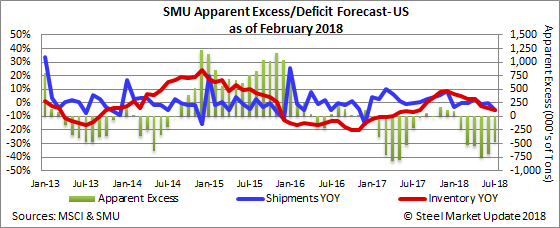

With the change in the model, our new forecast is for U.S. service centers to be holding a deficit of -235,000 tons through the end of February and for that deficit to grow throughout the summer months.

Here is what the full forecast looks like through July 2018: