Prices

March 4, 2018

January Raw Steel Production at Highest Level Since August

Written by Brett Linton

Total raw steel production for the month of January was 7,595,623 net tons, with 5,129,878 tons produced by electric arc furnaces (EAFs) and 2,465,745 tons produced by blast furnaces. This is the highest monthly production figure seen since August 2017 when 7,824,820 tons were produced. January raw steel production was 174,474 tons or 2.4 percent higher than the previous month, but 93,102 tons or 1.2 percent lower than the same month last year, reports the American Iron and Steel Institute (AISI) in Washington. AISI’s monthly estimates are different than the weekly estimates we report; the monthly estimates are based on over 75 percent of the domestic mills reporting versus only 50 percent reporting for the weekly estimates.

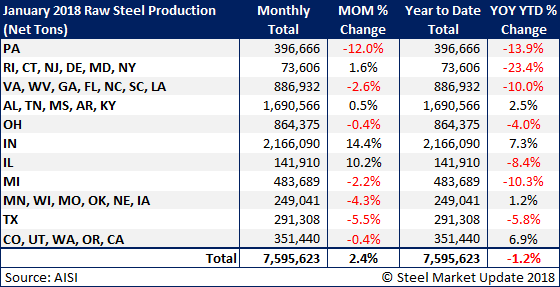

As seen in the table below, seven of the 11 state groups reported a decrease in month-over-month production, and a different seven of the 11 state groups reported a decrease in production compared to the same month last year.

The mill capacity utilization rate for January 2018 was 73.6 percent, up from 71.9 percent in December, and up from 73.3 percent one year ago.

SMU Note: An interactive graphic of our raw steel production history can be seen in the Analysis section of our website here. If you need help logging into or navigating the website, please contact us at info@SteelMarketUpdate.com or 800-432-3475.