Market Data

March 1, 2018

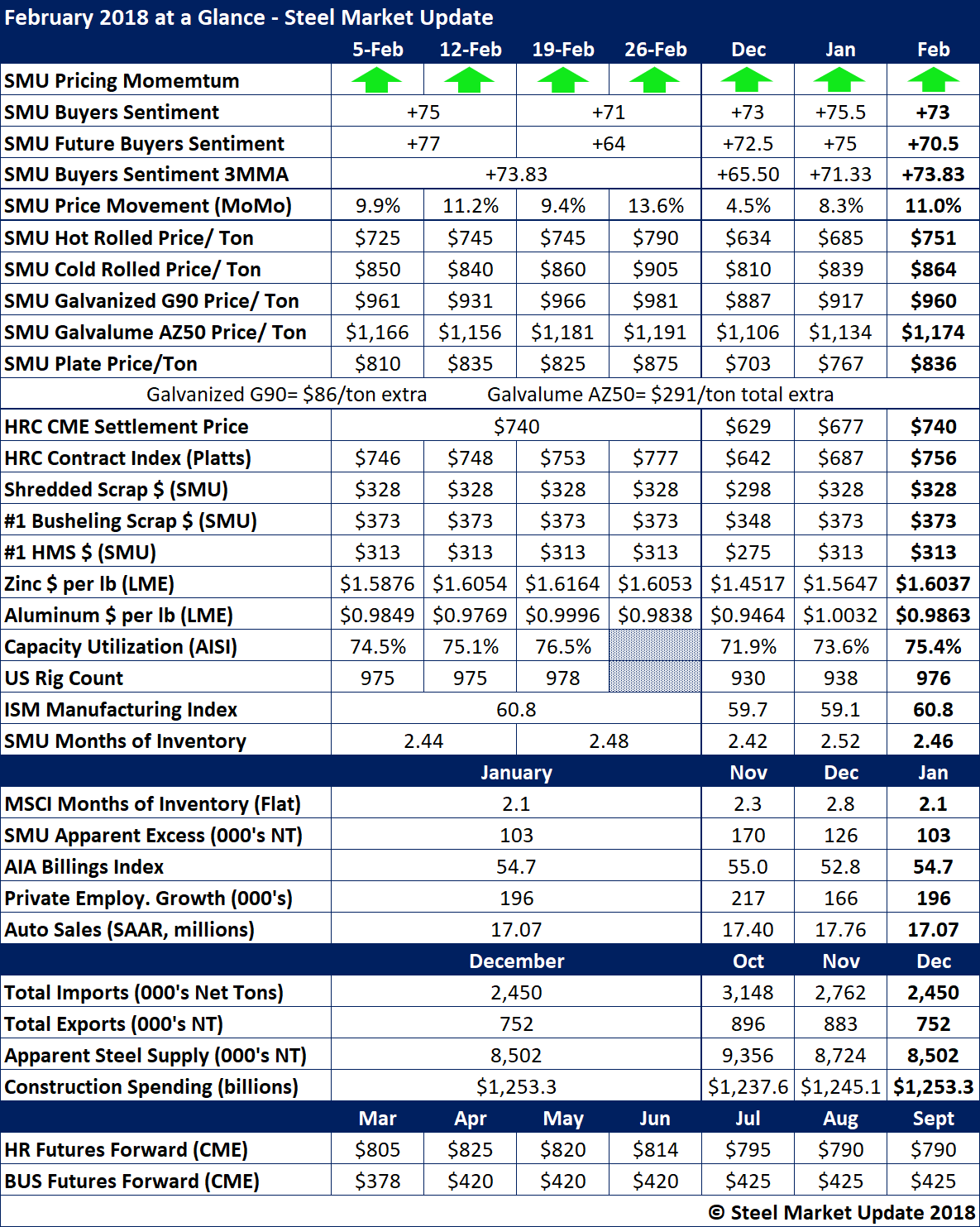

February 2018 at a Glance

Written by Brett Linton

There were no surprises in this month’s data as our SMU Price Momentum continued to reflect higher steel prices, and that expectation continues over the next 30 to 60 days. Our SMU Steel Buyers Sentiment Index is at, or very near, all-time highs for our index. Buyers and sellers of flat rolled steel are optimistic about their company’s ability to be successful in the current market situation, as well as three to six months into the future.

Prices rose over the past 28 days with benchmark hot rolled ending the month at $790 per ton. This is the highest average HRC price seen since May 2011 (which at the time was crashing from the all-time high of $1,070 per ton). Our index average at $751 per ton was $11 per ton higher than that of the CME HRC settlement price for the month, but $5 per ton lower than Platts.

MSCI service center inventories ended the month of January at 2.1 months of supply (flat rolled), while SMU’s new service center index of inventories (not shown below as only available to Premium members) had inventories at 2.8 months of supply.

Those are some of the highlights for the month of February. There is much more information provided in the table below.

To see a history of our monthly review tables, visit our website.