Market Data

February 25, 2018

SMU Market Trends: What Will Trump Do on 232?

Written by Tim Triplett

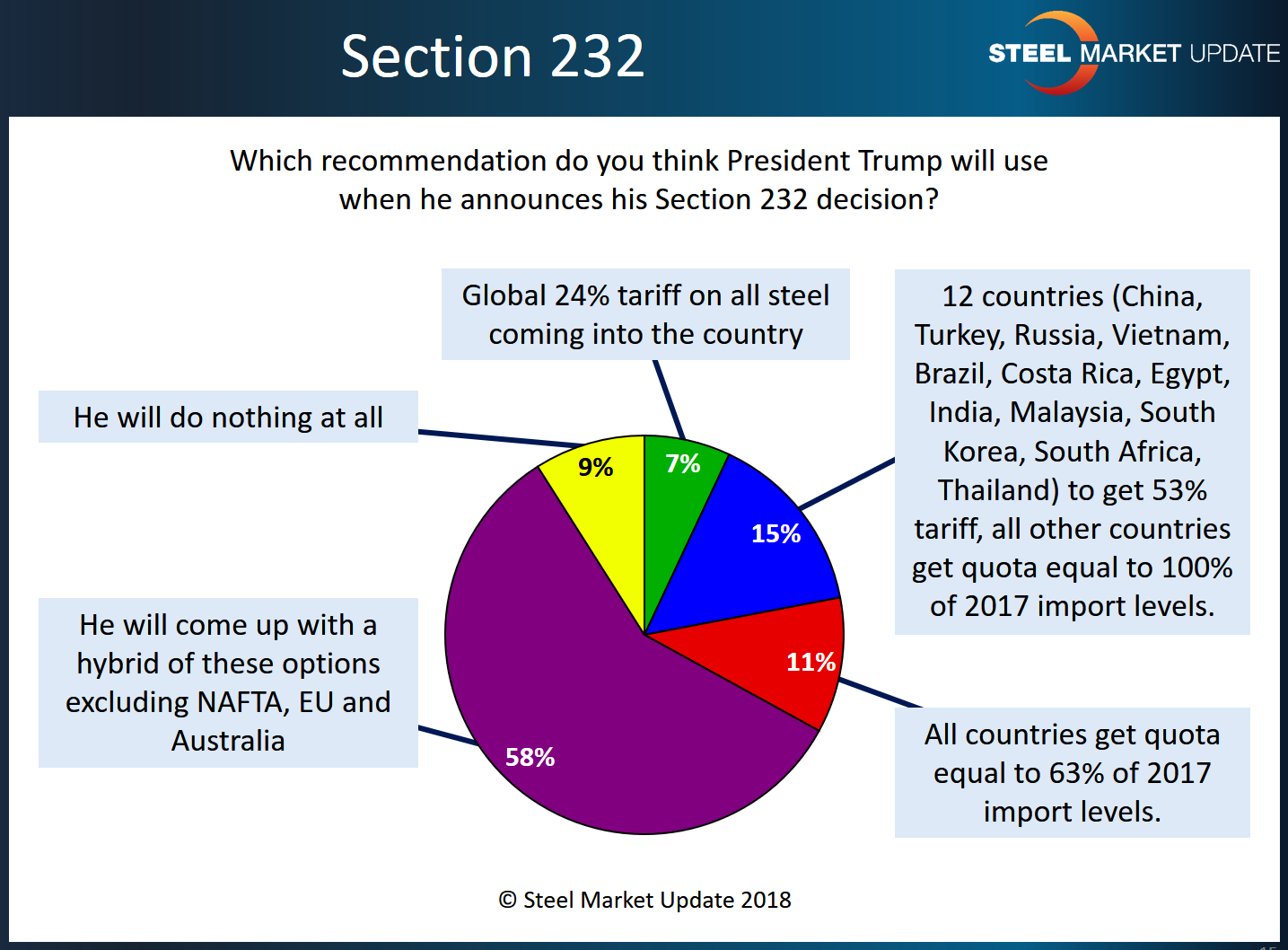

President Trump has made no official announcement about his plans for Section 232, leaving the steel market to speculate on last week’s Commerce Department recommendations. The majority of respondents to this week’s Steel Market Update market trends questionnaire are guessing he will come up with his own solution to combat unfair imports.

The Commerce recommendations include three options designed to raise domestic steel production above 80 percent of capacity: a global tariff of at least 24 percent on all steel imports; a targeted tariff of 53 percent on all steel imports from 12 high-export countries, along with a quota that limits all countries to their 2017 export levels; or a quota on all steel products from all countries equal to 63 percent of their 2017 exports to the U.S. The president has until April 11 to choose one of these options, offer a modified plan or take no action at all.

About 57 percent of SMU’s respondents expect the president to come up with a hybrid solution, most likely one that excludes U.S. trading partners in NAFTA, the EU and Australia.

Another 15 percent say he will favor a tariff targeted at the 12 countries that export to most steel to the U.S., including China, Brazil, Costa Rica, Egypt, India, Malaysia, Republic of Korea, Russia, South Africa, Thailand, Turkey and Vietnam.

Another 12 percent speculate that he will treat all countries the same by favoring the quota on all steel imports, limiting them to no more than 63 percent of each country’s exports to the U.S. in 2017.

Another 6 percent agree he will attempt to treat all nations the same but will do so by applying a 24 percent tariff on all steel imports rather than using quotas to limit them. Over the weekend reports began to surface that Trump is favoring this option.

Finally, 10 percent of respondents believe he will treat all equally by taking no action at all. Trump is facing strong political pressure from the many steel-consuming industries that argue steel tariffs and quotas will raise the price of consumers goods and could drive some manufacturing offshore.

Following are some of the more insightful comments from SMU readers:

• “I expect a combination of the first three may apply. Have you been watching President Trump?” Service Center/Wholesaler

• “In true form of the ‘art of the deal,’ gain an advantage over your opponent and negotiate a better deal from there. The threat of doing or being able to do something gives Trump the ability to thread the needle.” Service Center/Wholesaler

• “Individual country quotas will be negotiated with key trading partners.” Service Center/Wholesaler

• “He’s only going to impose a tariff on certain products, i.e. OCTG and pipe.” Service Center/Wholesaler

• “The solar panels and appliances were a token to show some action, or willingness to take action, which threw domestics a bone. However, outside the steel bubble, there are far too many manufactured products that will be affected. This will create unintended backlash.” Service Center/Wholesaler

• “I believe the president is using this as a bargaining tool in his war on trade. The whole process has played out with much drama, as our president enjoys. He has a plan we just are not privy to, but I don’t think much of anything will happen as it will penalize the manufacturing base and lead to more manufacturing job losses via offshoring over the next several years.” Manufacturer/OEM

• “I really have no idea, but he will do something, and it will be bad for trade and for the majority of our economy. Short-term support for the few steel mill producers.” Trading Company

• “As stubborn as the administration seems to be regarding the effect on the entire metalworking, metal-consuming industry, I think they will develop a hybrid. Otherwise, the retaliation would be very strong.” Steel Mill

• “Could he decide that imported steel is an issue, but 232 is the wrong tool and start over again with appropriate measures? He’s already getting all the heat of passing something with none of the fire.” Service Center/Wholesaler

• “I refuse to try to predict what the president might do.” Service Center/Wholesaler