Market Data

February 22, 2018

SMU Steel Buyers Sentiment Index: Signs of Uncertainty

Written by Tim Triplett

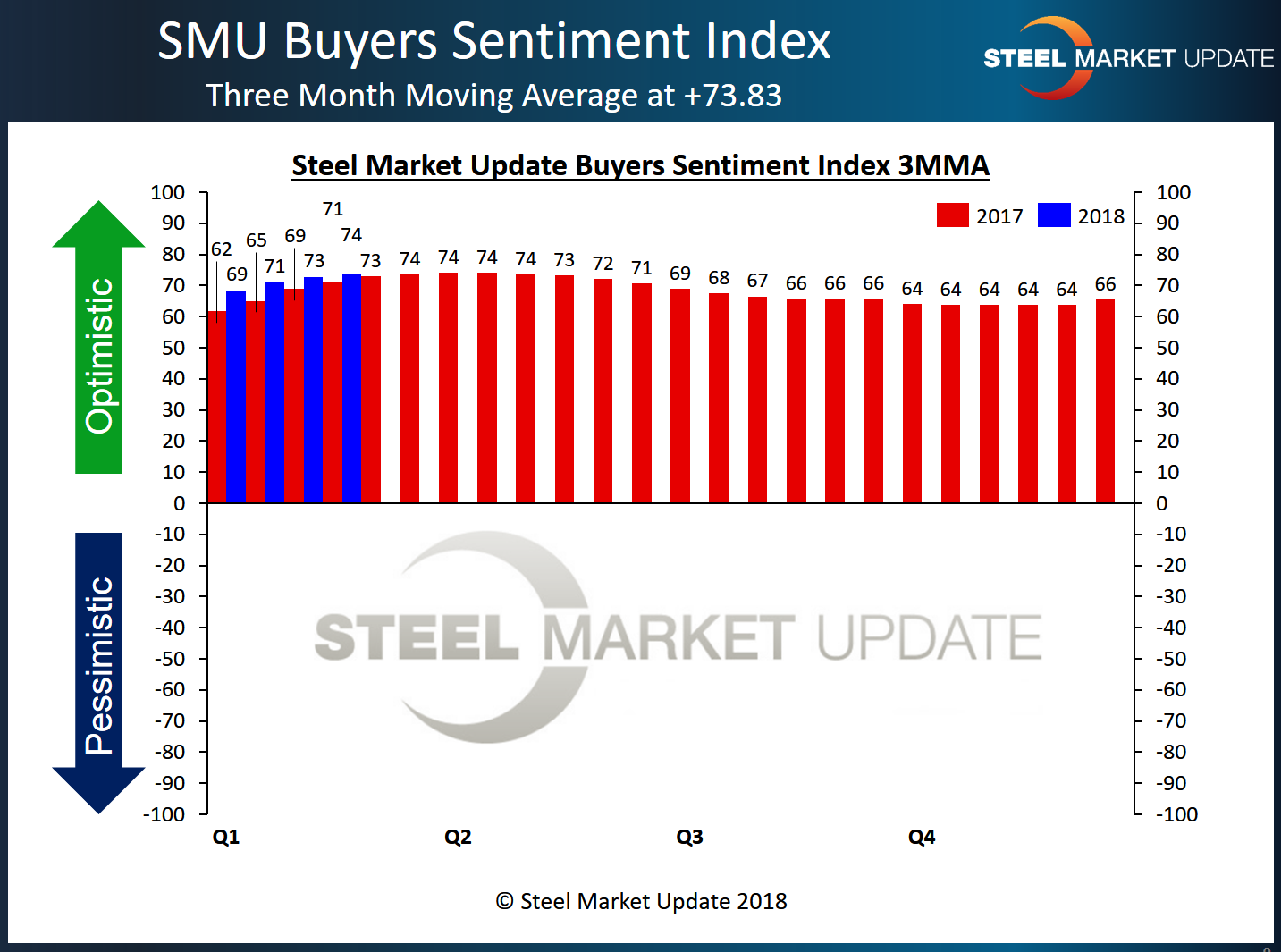

Current and future sentiment among flat rolled steel buyers showed a slight dip this month, due in part to the uncertainty over possible government trade action against imports. Viewed as a three-month moving average, however, industry optimism remains near record highs, according to the latest Steel Market Update Steel Buyers Sentiment Index.

The index measures changes in buyers’ optimism levels, which offers insight into their likely decision-making. Nearly three out of four respondents to SMU’s flat rolled market trends questionnaire this week said their company’s chances for success in the current market environment are good (50 percent), if not excellent (24 percent). About 23 percent feel their prospects are fair, while only 3 percent consider them poor.

Asked about their company’s ability to be successful three to six months in the future, respondents were slightly less bullish, as 71 percent characterized their chances as good or excellent, 21 percent as fair and 8 percent as poor.

Current sentiment, measured as a single data point, averaged +71 this week, down from +78 a month ago, which was an all-time high for the index.

Looking at the data based on a three-month moving average (3MMA), which smooths out the ups and downs and provides a truer picture of the trend, the Current Sentiment 3MMA is at +73.83, about the highest it has been since peaking at 74.17 in April 2017.

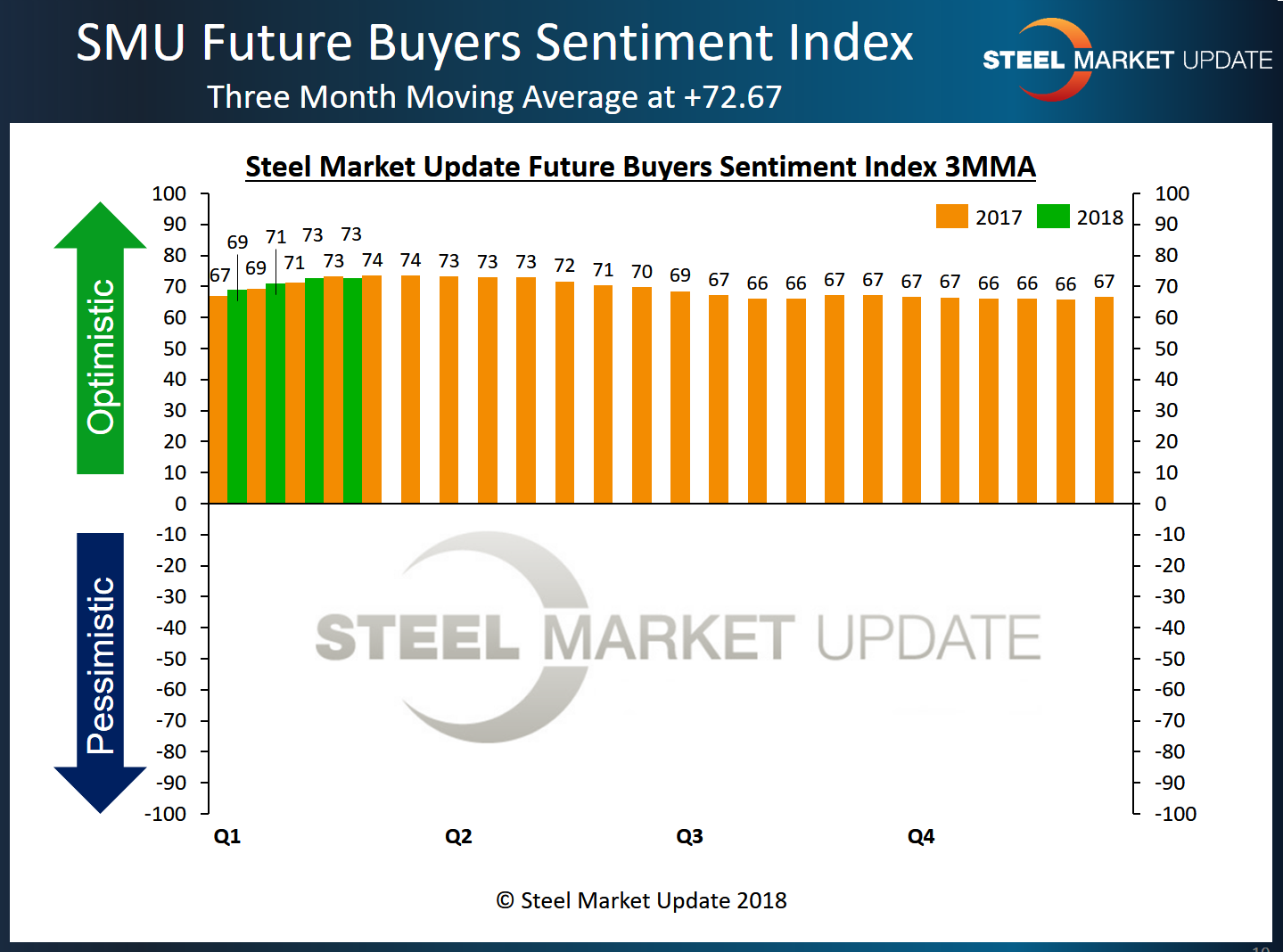

Future Steel Buyers Sentiment Index

Looking three to six months down the road, Future Sentiment indexed as a single data point declined to +64 from +77 at this time last month, which was the all-time high for future sentiment. Measured as a three-month moving average, however, Future Sentiment has seen no significant decline, registering +72.67 in mid-February. The current level is not far off the high mark of +73.67 set in mid-March 2017.

What Respondents are Saying

- “The prices increases are moving into a territory that is quite frightening. Economic fundamentals are still good, but government intervention in the market is not healthy.” Trading Company

- “I have had several manufacturing customers hurt by offshoring or actually offshoring the steel consumption portion of their manufacturing. Costs are going up but selling price increases are lagging behind substantially.” Service Center/Wholesaler

- “Downstream manufacturers are uncompetitive when steel prices in the U.S. are significantly higher than our foreign competition.” Manufacturer/OEM

- “Trade restrictions will certainly create a bubble on prices and profits in the short term, but as higher prices affect consumer costs and final customers’ prices, the long-term effect will be negative and put downward pressure on the economy. Inflation will cause the Fed to keep raising borrowing rates as the longer-term impacts are mostly negative.” Trading Company

- “I am very concerned about restrictions on supply, which will only favor the bigger service centers. I am also very concerned about the down cycle, which always accompanies a big move up like we have been experiencing.” Service Center/Wholesaler

- “Customers are starting to be concerned about the rapid rise in pricing. I have heard from two companies that are cancelling expansion plans for 2018 due to rising raw material costs to make their product. Another customer was concerned about their line of credit as the cost to buy steel continues to rise.” Manufacturer/OEM

- “Sadly, our success doesn’t depend on Trump ruling on 232, but more on the stupidity of our competitors selling into the spot market.” Service Center/Wholesaler

- “It all depends on the resolution of 232.” Trading Company

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 39 percent were manufacturers and 45 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.