Market Data

February 1, 2018

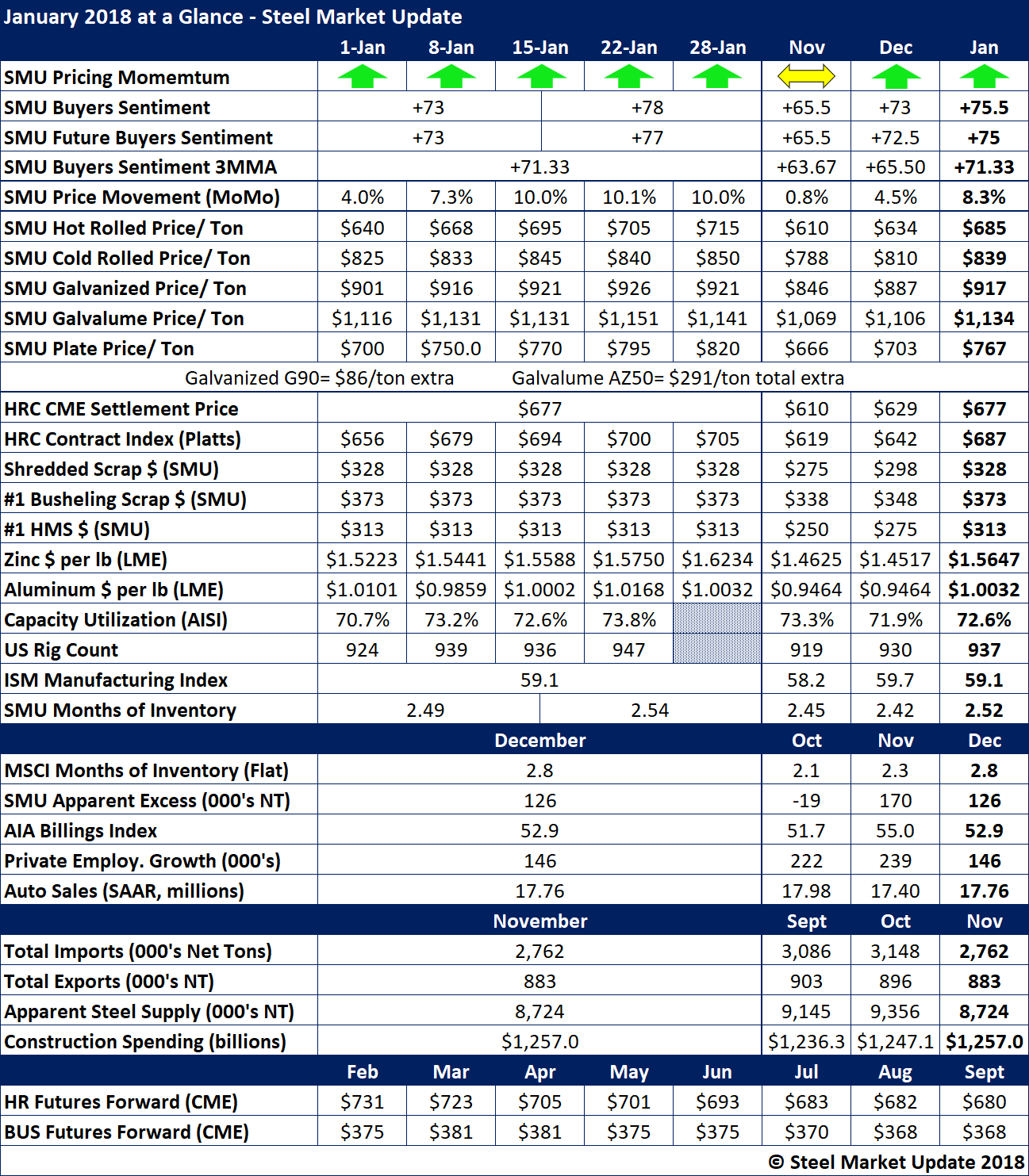

January 2018 at a Glance

Written by Brett Linton

Industry data through the end January, including drivers of steel prices, supply and demand, are all pointing up as the year got off to a strong start. As the month ended, the Steel Market Update (SMU) Price Momentum indicator was pointing to higher flat rolled steel prices over the next 30 to 60 days as the domestic steel mills continue to raise prices.

Our SMU Steel Buyers Sentiment Index jumped during the month of January and reached an all-time high at +78. Future Sentiment also rose to an all-time high of +77. Based on a three-month moving average, our Buyers Sentiment Index ended the month at +71.33.

Benchmark hot rolled ended the month at $715 per ton and for the entire month averaged $685 per ton. Our average was slightly higher than the CME HRC Futures settlement price, which was $677 per ton. We were slightly lower than Platts, which averaged $687 for the month of December.

Zinc and aluminum spot prices on the LME continue to trade at historically high levels (over the past five years).

Many of the data items shown below are optimistic and represent a good start to 2018.