Prices

January 30, 2018

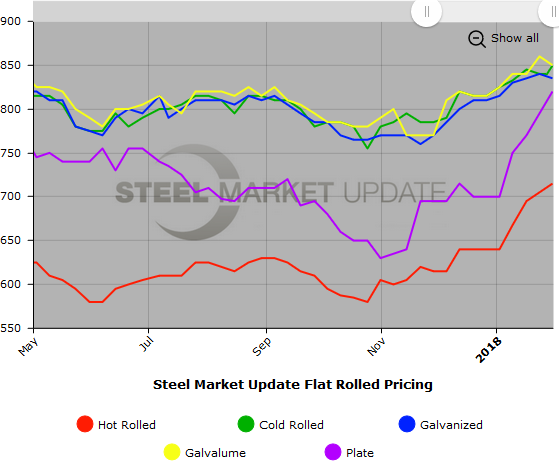

SMU Price Ranges & Indices: More Increases, Higher Prices

Written by John Packard

The flat rolled and plate steel mills were busy this week announcing new rounds of price increases. Steel buyers who spoke with Steel Market Update today reported offer prices as being much higher than their most recent transaction pricing. For that reason, we have included a note about what was being reported as the latest “offer” price being made by the domestic steel mills.

Steel buyers reacted to questions posed by SMU about the chance of the latest price increases “sticking” by telling us: “I think this one will take some time to collect. If scrap is flat, the HRC vs. Scrap spread will be over $300. We will start to see pushback that will test demand.”

“I think they could get the HR numbers, but not CR. The CR order book seems weaker based upon mill conversations. There’s room to negotiate there that doesn’t exist with HR.”

“Yes, I feel price increases will be fully collected, primarily because there are no alternatives for import.”

“Regarding HRC, the mills seems to be on board quoting $750 for spot tons. For plates, we are seeing around $44 to $45/cwt delivered. Our sales reps are telling us that the availability of spot tons is shrinking due to contract customers taking full allotment. Some mills are not quoting spot tons until they are caught up. A couple of months ago, I was skeptical that an HRC base of $800 was not in the card this year. Now I think it is possible if imports are restricted and/or prices are unattractive due to Section 232 or other trade cases.”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $700-$730 per ton ($35.00/cwt-$36.50/cwt) with an average of $715 per ton ($35.75/cwt) FOB mill, east of the Rockies. The lower end of our range rose $20 compared to one week ago, while the upper end remained the same. Our overall average is up $10 compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days. We are hearing of offers as high as $750 per ton.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $820-$880 per ton ($41.00/cwt-$44.00/cwt) with an average of $850 per ton ($42.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end remained the same. Our overall average is up $10 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days. We are hearing of offers on cold rolled as high as $890 per ton.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU base price range is $40.00/cwt-$43.50/cwt ($800-$870 per ton) with an average of $41.75/cwt ($835 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days. We are hearing of galvanized offers as high as $46.50/cwt ($930 per ton).

Galvanized .060” G90 Benchmark: SMU price range is $886-$956 per net ton with an average of $921 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-12 weeks

Galvalume Coil: SMU base price range is $41.00/cwt-$44.00/cwt ($820-$880 per ton) with an average of $42.50/cwt ($850 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to last week, while the upper end remained the same. Our overall average is down $10 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days. We are hearing of offers as high as $46.50/cwt ($930 per ton).

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,111-$1,171 per net ton with an average of $1,141 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $780-$860 per ton ($39.00/cwt-$43.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB delivered. The lower end of our range remained the same compared to one week ago, while the upper end rose $50 per ton. Our overall average is up $25 per ton compared to last week. Our price momentum on plate steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days. We were advised by most of our sources that prices provided today were prior to the new $50 per ton price announcements. We are hearing of offers at $880 to $900 per ton.

Plate Lead Times: 5-7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.