Government/Policy

January 30, 2018

CAR on NAFTA: 'We Build Things Together'

Written by Sandy Williams

“We don’t just sell to each other–this is a kind of unique relationship in the world…we make things together,” said Canada International Trade Minister François-Philippe Champagne in a recent speech. Center for Automotive Research analyst Bernard Swiecki referred to the quote as a summary of what NAFTA means to the North American automotive industry. “We build things together, we are each other’s inputs,” he said in his presentation at the Jan. 25 Association of Steel Distributors meeting in Detroit.

The NAFTA negotiations are stalling and the U.S. may end up withdrawing from the trade agreement that has worked to the benefit of the automotive industry and its supply chain for more than two decades. A central argument for U.S. negotiators is that Mexico has taken jobs from U.S. workers, but as Swiecki pointed out, the issue is not that simple.

The NAFTA negotiations are stalling and the U.S. may end up withdrawing from the trade agreement that has worked to the benefit of the automotive industry and its supply chain for more than two decades. A central argument for U.S. negotiators is that Mexico has taken jobs from U.S. workers, but as Swiecki pointed out, the issue is not that simple.

Mexico is known as an outsourcing destination “to make cheaper cars,” said Swiecki. It doesn’t have its own domestic automaker and neither does Canada. About 81 percent of the vehicles produced in Mexico and 88 percent of those produced in Canada are exported. In the U.S., 78 percent of the vehicles built here, stay here.

Swiecki stressed that, despite the headlines, at no time has the industry closed a plant in the U.S. to move to Mexico. Whenever production “moved,” it was actually replaced by a superior product. One example is the move of the Ford Focus to Mexico and China, which was then replaced with the higher profit Ford Ranger and Bronco in the U.S.

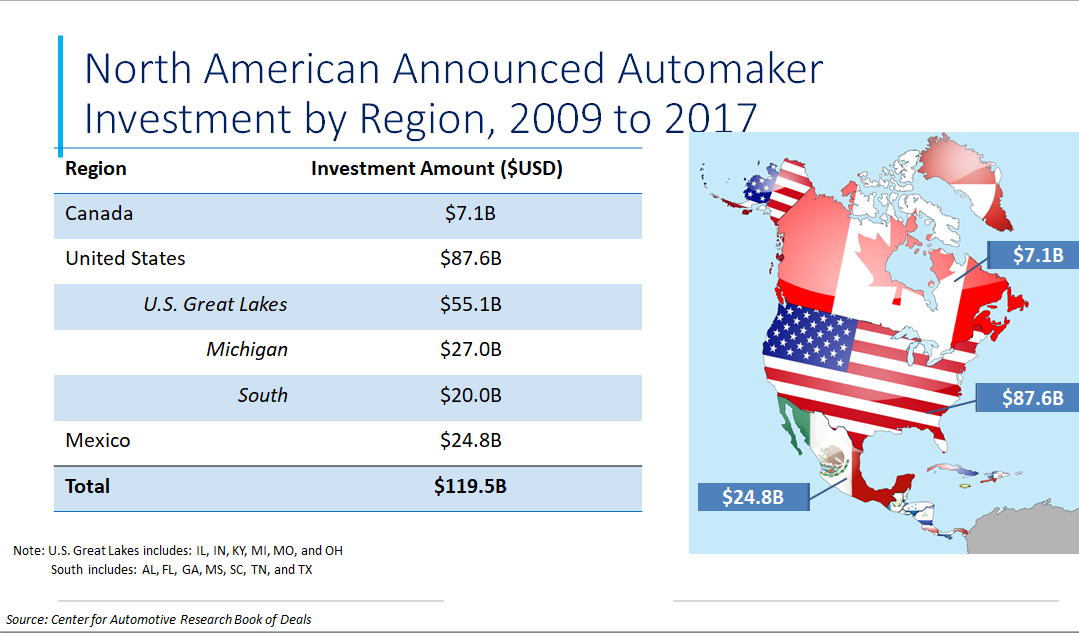

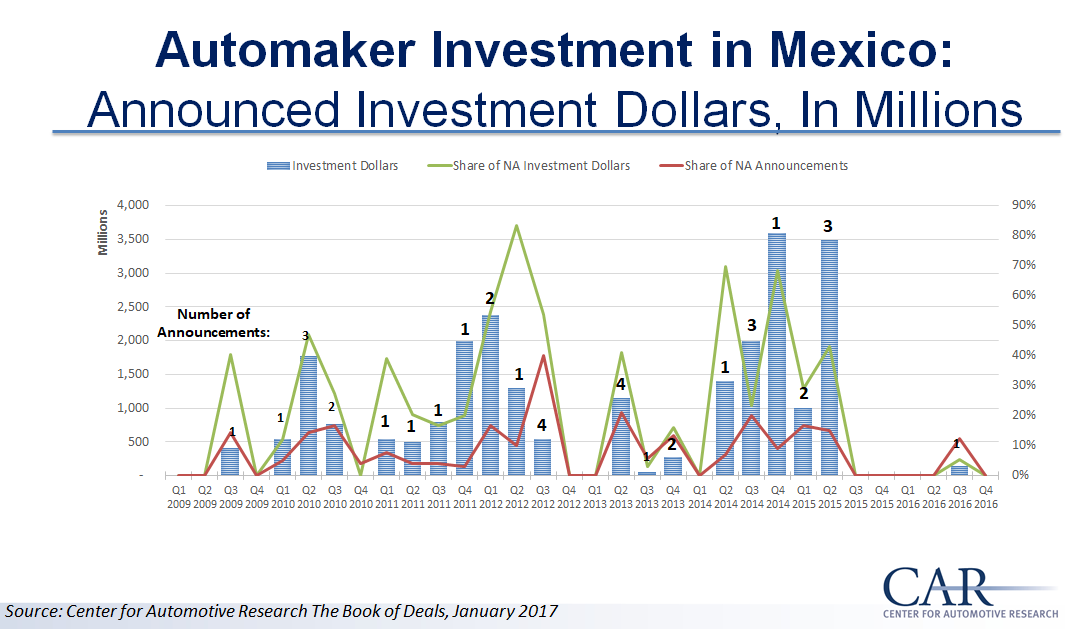

During the period 2009 through 2017, nine of 11 new assembly plants in North America were built in Mexico. Overall, automotive investment during the period totaled $120 billion, a majority of which was in the form of reinvestment and expansion. An interesting fact, said Swiecki, is that Michigan received more investment dollars than all of Mexico during the period–“something to consider when reading the headlines about auto investment in Mexico.”

Mexican suppliers are proceeding with automotive investment, he said, just without the usual groundbreaking fanfare to avoid becoming a target in social media or the news.

“We need Mexico as a source of cheap imports so that we can have the better paying, high-tech automotive jobs here,” said Swiecki. Countries where manufacturing is costly need an inexpensive source of inputs. “If you are Germany or France, you are an expensive place to make things, but you can source inputs from Eastern Europe, Morocco or Turkey and that makes the product you make cost competitive. The point being, everyone has their Mexico,” added Swiecki. “Ours just happens to be the actual Mexico.”

If all vehicle inputs made in Mexico were made in the U.S., vehicles would be so expensive no one could afford them, he noted. While the U.S. benefits from a healthy Mexican supply chain, U.S production does suffer from vehicle assembly in Mexico. It is important to consider what hurts more and how much we can stand to lose, said Swiecki, because some of the shift to Mexico is positive and creates more high-paying jobs in the U.S.

Shutting out Mexico would not ensure that the vehicles Americans purchase at their local dealer were made in the U.S. Auto manufacturers are global companies with 44 assembly plants around the world. “You can buy a Chinese Buick, Jeeps from Italy and a Mini from the Netherlands,” said Swiecki. “The point is distribution channels already exist to bring in vehicles from elsewhere in the world. The potential for unintended consequences is huge.”

An average vehicle built in Mexico and sold in the U.S. has 40 percent U.S. content, but a vehicle from China, for example, would have nearly zero U.S. content value. “There is a hierarchy of where we want things to come from,” said Swiecki, and NAFTA is the first choice.

Mexico is the most trade friendly country on the planet with 13 free trade agreements with 44 countries, said Swiecki. In addition, Mexico has the unique benefit of being a desirable manufacturing location with easy access to both the Pacific and Atlantic coasts. CAR reports that nearly 90 percent of new Mexican light vehicle assembly plant investments announced since 2009 were for Japanese and European automakers. Audi and BMW are building plants there and can export to Europe or China without tariff. A $50,000 Audi exported from a U.S. plant would pay a 10 percent tariff to Europe—a loss of $5,000 on every vehicle.

Round six of NAFTA negotiations in Montreal were held last week. The U.S. proposes to increase the NAFTA content of a vehicle from 62.5 percent to 85 percent and require 50 percent U.S. content. Increasing the U.S. content is a non-starter for Canada and Mexico, said Swiecki. The U.S. proposal to renew or renegotiate and ratify the agreement at the end of every five years complicates new investment. Risk averse automotive manufacturers would be reluctant to a make a capital investment with a decades-long return when the rules could change every five years, he added.

Republicans are traditionally pro-trade, but the current situation pits a Republican House and Senate against a Republican White House with different priorities. Adding to the tension, the states that would be hurt most by a withdrawal from NAFTA voted for Trump in the election.

Several outcomes are possible from the NAFTA negotiations, said Swiecki.

- Canada and Mexico give in – “not going to happen”

- U.S. gives up on controversial demands and focuses on modernizing the agreement – “not likely”

- Termination of NAFTA – “a possibility”

- Muddle through with concessions from all parties, controversial items diluted and partial wins and losses for everyone – “most likely scenario.”

Another possibility is “Zombie NAFTA” said Swiecki. To implement NAFTA originally, Congress had to pass enabling laws to make the agreement work. In the Zombie scenario, Congress does not kill all of the enabling laws, making NAFTA officially dead, but with its mechanisms continuing to function.