Prices

January 25, 2018

Hot Rolled Futures: Sellers Cautious

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

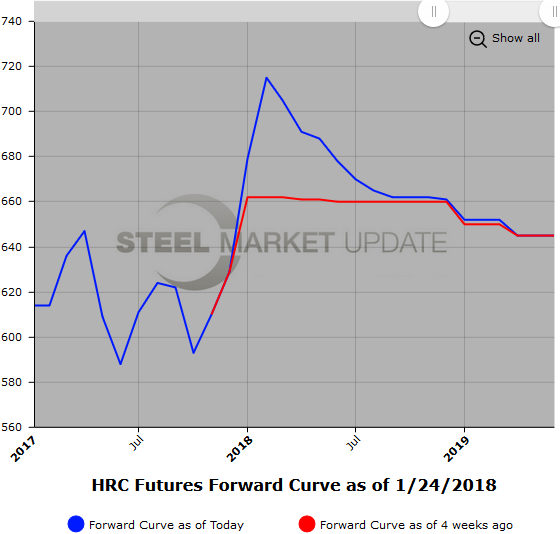

A couple of interesting observations this week in the ferrous futures. Basically, steel is up, and scrap is softer. HR nearby quarter forward prices pushed higher in the last week and a half on larger volume, but have softened slightly in the last day or two on declining volumes. Last week, HR futures volume came in just shy of 73,000 ST as compared to just 33,000 ST this past week. The increase in spot physical prices to just shy of the $700/ST level this week has not translated into higher futures prices yet.

Concern of another round of mill price increases has also made sellers of the 1H’18 futures more cautious, which is reflected in higher offers and declining trade volumes.

This week, the average weighted price in Feb’18 futures has dropped by $6 from a peak of $719/ST to $713/ST, and in Mar’18 it has dropped $12 from a peak of $713/ST to $701/ST. So, we’re seeing a bit more backward steepening between Feb and Mar’18.

Feb’18 futures are trading at a $22 premium to the latest HR spot ($695). 2H’18 HR is trading at a $30 discount to spot HR. 2H’18 HR is trading at a $52 discount to the Feb’18 average weighted futures price for this past week.

2H’18 HR futures have remained relatively anchored between $660-$665/ST. We have seen a slight increase in buying interest in smaller volumes for Q3’18 and Q4’18. We could see more interest on the back of today’s $60/ST HR mill price increase announcement by USS/POSCO.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

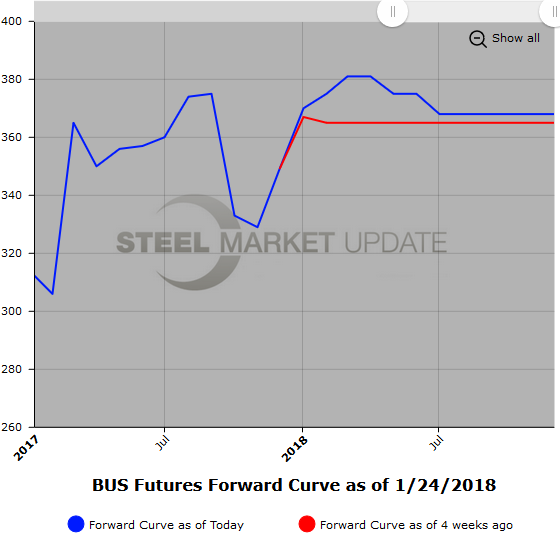

Scrap

The new year has brought better liquidity to the BUS futures, which has led to a nice pickup in BUS futures inquiries and volume traded. With a bit of a lull in 80/20 scrap futures and declining SC futures prices, we have had additional selling interest in the BUS futures, which has pushed futures prices lower. The latest 80/20 export cargo was reported to have traded at $363/MT, which explains the lower SC futures prices.

This week, Feb’18 BUS prices eased from last week’s mid $380/GT level to trade 16,000 GT at $377/$378/GT. Also, 2H’18 BUS traded at $370/GT and $368/GT in 500 GT/mo each.

We expect a bit more price volatility in the next quarter should the latest set of price increases gain any traction as metal margin spreads are already very healthy.

With the NFX U.S. Midwest Shred Steel Scrap futures market just getting started, we have seen some indications for nearby months, which have prices coming in at roughly $355-$360/GT or about a $20 discount to BUS for the same dates.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.