Government/Policy

January 23, 2018

Trump Imposes Safeguards on Washers, Solar Cells; Is Steel Next?

Written by Sandy Williams

President Trump’s decision today to impose tariffs on imports of solar panels and large washing machines in a bid to help U.S. manufacturers has heated speculation the administration may take a similar tack on the pending Section 232 rulings on steel and aluminum imports.

President Trump has approved recommendations by the U.S. International trade Commission to place safeguard tariffs on imports of residential washing machines, which the ITC determined were causing serious injury to the U.S. domestic market. The ITC initiated an investigation under Section 201 at the request of Whirlpool. The safeguards will impact imports from major South Korean competitors Samsung and LG.

Canada will be excluded from the safeguard remedy, but Mexico will not. “Under NAFTA, U.S. law requires the exclusion of Canada or Mexico from a Section 201 action if the president determines that imports from that country do not account for a substantial share of imports and do not contribute importantly to serious injury to domestic producers,” said an official from the Office of the U.S. Trade Representative. “Based on the information and findings of the ITC, the president determined that for washers, Canada met these criteria, and Mexico did not.”

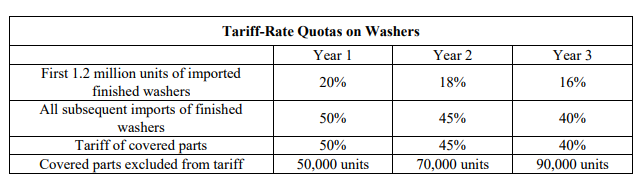

The tariffs are based on quotas over a three-year period that will be reduced each year (see chart).

“These cases were filed by American businesses and thoroughly litigated at the International Trade Commission over a period of several months,” said U.S. Trade Representative Robert Lighthizer. “The ITC found that U.S. producers had been seriously injured by imports and made several recommendations to the president. Upon receiving these recommendations, my staff and I conducted an exhaustive process, which included opportunities to brief in person and through public comments, public hearings, and meetings with senior representatives. Based on this information, the Trade Policy Committee developed recommendations, which the president has accepted.

Added Lighthizer: “The president’s action makes clear again that the Trump administration will always defend American workers, farmers, ranchers and businesses in this regard.”

Whirlpool Chairman Jeff Fettig said the decision was a win for U.S. manufacturing. “This is a victory for American workers and consumers alike. By enforcing our existing trade laws, President Trump has ensured American workers will compete on a level playing field with their foreign counterparts, enabled new manufacturing jobs here in America and will usher in a new era of innovation for consumers everywhere.”

Whirlpool said it added 200 full-time positions at its manufacturing plant in Clyde, Ohio, in anticipation of increased demand from the safeguard remedy.

Samsung and LG both plan to expand manufacturing in the United States. Samsung’s new facility in Newberry, S.C., began production last week and LG’s Clarksville, Tenn., facility is scheduled to be operational sometime in 2019.

LG said in a statement following the announcement, “Soon, competition in the washer market will not be about domestic vs. foreign production. It will be about competition among washers made in the United States, in Ohio, Kentucky, Tennessee and South Carolina.”

Safeguards for Solar Imports

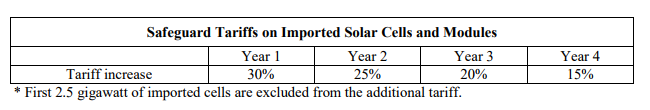

The president also approved recommendations for safeguard tariffs on imports of solar cells and modules. The Section 201 investigation was initiated following a petition by Suniva and SolarWorld. The tariffs, beginning with 30 percent in year one, are less than the 50 percent requested by the petitioners.

The Solar Energy Industries Association did not support the petition against imports of solar cells and modules and said the decision will cause the loss of roughly 23,000 jobs in the industry this year.

“While tariffs in this case will not create adequate cell or module manufacturing to meet U.S. demand, or keep foreign-owned Suniva and SolarWorld afloat, they will create a crisis in a part of our economy that has been thriving, which will ultimately cost tens of thousands of hard-working, blue-collar Americans their jobs,” said Abigail Ross Hopper, SEIA’s president and CEO.

“It boggles my mind that this president – any president, really – would voluntarily choose to damage one of the fastest-growing segments of our economy,” said Tony Clifford, chief development officer, Standard Solar. “This decision is misguided and denies the reality that bankrupt foreign companies will be the beneficiaries of an American taxpayer bailout.”

What is Section 201?

Section 201 of the Trade Act of 1974 authorizes the president to take action in the form of tariffs, tariff rate quotas, quantitative restrictions or other actions in response to a positive determination by the ITC that increased imports of a product are seriously injuring domestic producers. According to the statute “any action taken must facilitate a positive adjustment to import competition and provide greater economic and social benefits than costs.”

What is Section 232?

Section 232 of the Trade Expansion Act of 1962 allows the Secretary of Commerce to investigate the effects of imports on the national security of the United States. Commerce Secretary Wilbur Ross has delivered reports on both steel and aluminum imports to President Trump, who now has less than 90 days to decide whether to impose additional tariffs or quotas. Critics of the president’s America-first approach to trade policy fear any action on steel and aluminum that mirrors washing machines and solar panels could ignite a trade war with China and other foreign countries.