Market Data

January 23, 2018

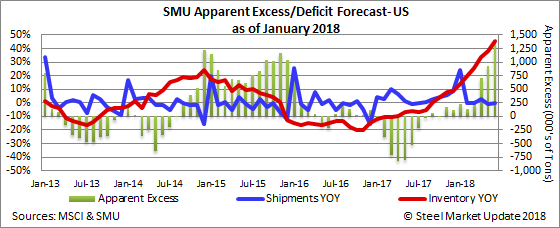

SMU Service Center Apparent Excess/Deficit Inventories Forecast

Written by John Packard

Steel Market Update forecast December 2017 flat rolled steel shipments from U.S. service centers would be 87,850 tons per day. The Metals Service Center Institute (MSCI) reported last week that sheet distributors shipped 87,805 tons per day. We missed being perfect by 45 tons per day.

Receipts coming into the service centers has been harder to predict. We have been using a four-year average month-to-month change and we have found it to be less than perfect. Our forecast for December called for receipts to rise to 99,219 tons per day. Instead, according to the MSCI numbers, receipts fell to 96,895 tons per day. We had forecast total receipts to be 2,099,600 tons and the MSCI reported 2,411,500 tons as having been received during the month.

SMU forecast total inventories to be 5,151,000 tons at the end of December. The actual number, according to the MSCI, came in at 4,990,000 tons.

At the end of November, our proprietary model calculated that the domestic flat rolled service centers had 170,000 tons of excess inventories on their floors. Based on the four-year model mentioned above, we predicted the excess would grow to 412,000 tons by the end of December. However, with the lower receipts, we found the excess remained relatively stable at 126,000 tons.

January Forecast Calls for Slight Build in Excess Inventories

Our forecast for January shipments calls for U.S. service centers to ship a total of 2,400,000 tons of flat rolled steel during the month.

We are adjusting our formula for receipts and are now using a model based on a two-year average of the month-to-month change. Based on the new model, we are calling for the total inventories to be 5,271,000 tons at the end of this month.

With the change in the model, our new forecast is for U.S. service centers to be holding an excess of +222,000 tons.

The issue we are having difficulty resolving is what foreign steel flat rolled imports will look like over the next few months. We could see a significant drop-off in imports, which would lower our receipts and shrink the Apparent Excess inventory situation very quickly.

Here is what the full forecast looks like through June 2018: