Government/Policy

January 18, 2018

Pipe Producers File AD/CVD Petition on Welded Pipe

Written by Sandy Williams

The American Line Pipe Producers Association filed an antidumping and countervailing duty petition with the Department of Commerce and U.S. International Trade Commission on Wednesday. The group alleges that the dumping of large diameter welded pipe from Canada, Greece, India, China, Korea and Turkey is causing injury to domestic producers. The group also charges that China, India, South Korea and Turkey are benefiting from countervailing government subsidies.

Wiley Rein LLP filed the petition on behalf of association members American Cast Iron Pipe Co., Berg Spiral Pipe Corp./Berg Steel Pipe Corp., Dura-Bond Industries and Stupp Corp., as well as Skyline Steel.

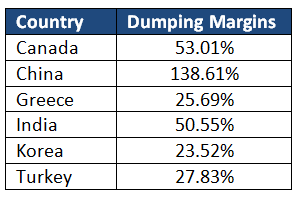

The following dumping margins are alleged:

The products covered by these petitions are welded carbon and alloy steel pipe, more than 406.4 mm (16 inches) in nominal diameter (large diameter welded pipe), regardless of wall thickness, length, surface finish, grade, end finish or stenciling. Large-diameter welded pipe may be used to transport oil, gas, steam, slurry or other liquids and for structural purposes, including piling.

“For years, our companies and workers have lost many large projects and massive amounts of sales to dumped and subsidized imports,” said John Stupp, President and CEO of Stupp Bros., Inc., and CEO of petitioner Stupp Corp. “It’s time to stand up for American manufacturing jobs, and to take on these unfairly traded products.”

KeyBanc Capital Markets estimates apparent consumption of large diameter welded line pipe in 2017 was 2.0 million to 2.5 million tons, approximately 55-60 percent of the 3.9 million ton U.S. line pipe market.

Although welded pipe could be covered under the Section 232 steel investigation, Key Banc suggests the action was taken by the producers to prevent foreign bidding for large line pipe projects during the interim. The president has 90 days to consider action on the recommendations provided in the Section 232 report.

“With bidding activity heating up in this market via a healthy backlog of crude and natural gas pipeline projects, we believe U.S. line pipe producers are attempting to prevent any new business from moving offshore,” wrote KeyBanc analysts Phil Gibbs and Tyler Kenyon in a report on Thursday. “Notably, Evraz North America (Canada) has been increasing its presence within the U.S. market following the commissioning of its Regina large diameter pipe mill in 2017.”

Commerce will determine whether to initiate the investigations within 20 days of the filing, and the USITC will reach a preliminary determination of material injury or threat of material injury within 45 days.