Logistics

January 15, 2018

Great Lakes Ore Shipments Up 11% in 2017

Written by Sandy Williams

Iron ore shipments on the Great Lakes jumped nearly 11 percent in 2017 to 60,321,712 tons and the highest total since 2012, according to the Lake Carriers’ Association.

Iron ore loadings at U.S. ports increased 13.4 percent to 55.75 million tons. Shipments from Canadian ports in the St. Lawrence Seaway fell 12.4 percent to 4.6 million tons.

December shipments dropped to 5.45 million tons from 5.67 million tons in November. As severe cold took hold of the lakes in late December, loadings slowed from Two Harbors, Duluth, and Marquette. U.S. and Canadian Coast Guard icebreakers struggled to keep up with demand to free icebound vessels, causing subsequent delays for other ships.

According to one carrier, not all mills in the U.S. and Canada received their full shipments of ore due to the cold weather and ice over the past few weeks. The source estimates some mills may be 100,000-200,000 tons short, the equivalent of two to four cargoes. Plans are being made to expedite shipments once the shipping season resumes in March.

Ore shipments rose in 2017 despite the closing of Cleveland Cliffs’ Empire Mine the previous year. All shipments of domestically mined iron ore now transit the Soo Locks to reach steel mills in states surrounding the lower Great Lakes. Iron ore loads through the Soo Locks increased 23.6 percent or 9.9 million tons in 2017.

The Soo Locks officially closed for the winter on Jan. 15 as the last vessels transited the locks on their way to shipyards for winter layup. The locks will remain closed through March 25.

During the layup, ships will undergo normal maintenance such as engine overhauls, cargo hold renewal and replacement of conveyor belts in its unloading systems. Lake Carriers Association says the sixth cargo vessel in the past few years will have an exhaust gas scrubber installed to reduce emissions. During the winter, the U.S. Coast Guard and American Bureau of Shipping will conduct hull inspections of 10 lakers placed in drydock.

Lake Carriers’ Association reports, “The industry’s annual payroll for its 2,700 employees approaches $125 million and it is estimated that a wintering vessel generates an additional $800,000 in economic activity in the community in which it is moored.”

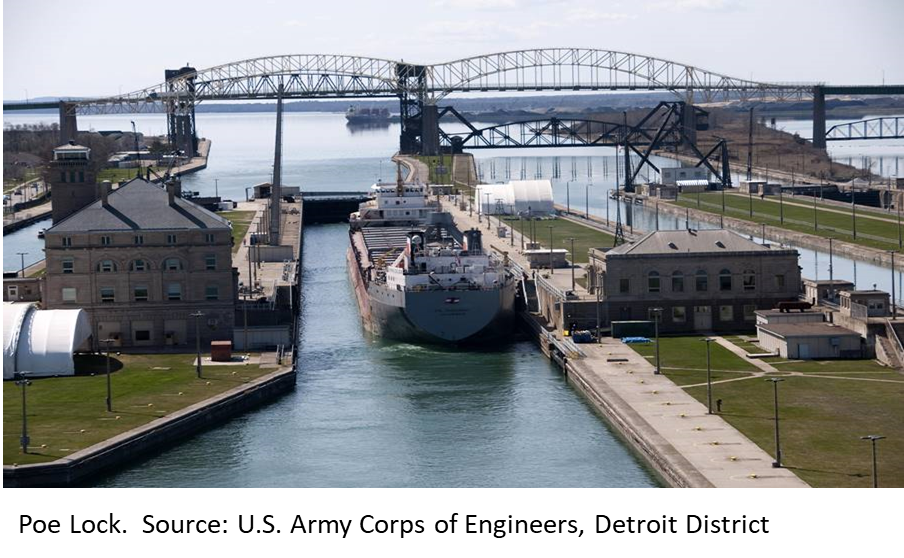

The U.S. Army Corps of Engineers, Detroit District, has a variety of maintenance projects scheduled for the Poe and MacArthur locks at the Soo Locks in Sault Ste. Marie.

“It is vitally important that we keep the infrastructure at the Soo Locks in good working order,” said Lt. Col. Dennis Sugrue, district engineer. “The district puts a high priority on keeping the locks functioning safely and reliably for the benefit of our nation.”

Planned winter maintenance includes $2.4 million to replace parts of the aging Poe Lock gates. The Poe Lock handles the 1,000-foot lake freighters that carry ore to the steel mills while the MacArthur accommodates smaller freighters and vessels. The Davis and Sabin locks, both over 100 years old, have not been used for decades.

Infrastructure funding is still being sought to repair the deteriorating Soo Locks, as well as build an additional Poe-sized lock to replace the Davis and Sabin Locks. A study by the Department of Homeland Security in 2015 estimated an unplanned closure of the Poe Lock in peak iron ore shipping season would cause 75 percent of U.S. integrated steel production to cease within 2-6 weeks. It would also cause the shutdown of 80 percent of domestic iron ore operations and nearly 100 percent of North American appliance, automobile, construction equipment, farm equipment, mining equipment, and railcar production.