Prices

January 11, 2018

Long Product Imports Increase by 9.5 Percent in Q1

Written by Peter Wright

In Q1 2018, long product imports increased by 9.5 percent compared to Q4 2017.

Total long product imports were down by 150,000 tons per month year over year on a three-month moving average (3MMA) basis, but there was a turn for the worse in the first quarter, according to Steel Market Update’s analysis of federal Steel Import Monitoring and Analysis (SIMA) data.

This is the third edition of our new and expanded import reports that now include all major steel sectors: sheet, plate, longs and tubulars, with a total of 18 subsectors. This month we have separate reports for flat rolled, long and tubular products. In addition, we now publish import market share analysis for the same 18 steel product groups. Together, these import reports plus the import share reports should give an accurate view of the effect of the Section 232 trade legislation. See the end of this piece for an explanation of the methodology. All volumes in this analysis are reported in short tons. We use three-month moving averages rather than single-month results to smooth out the variability.

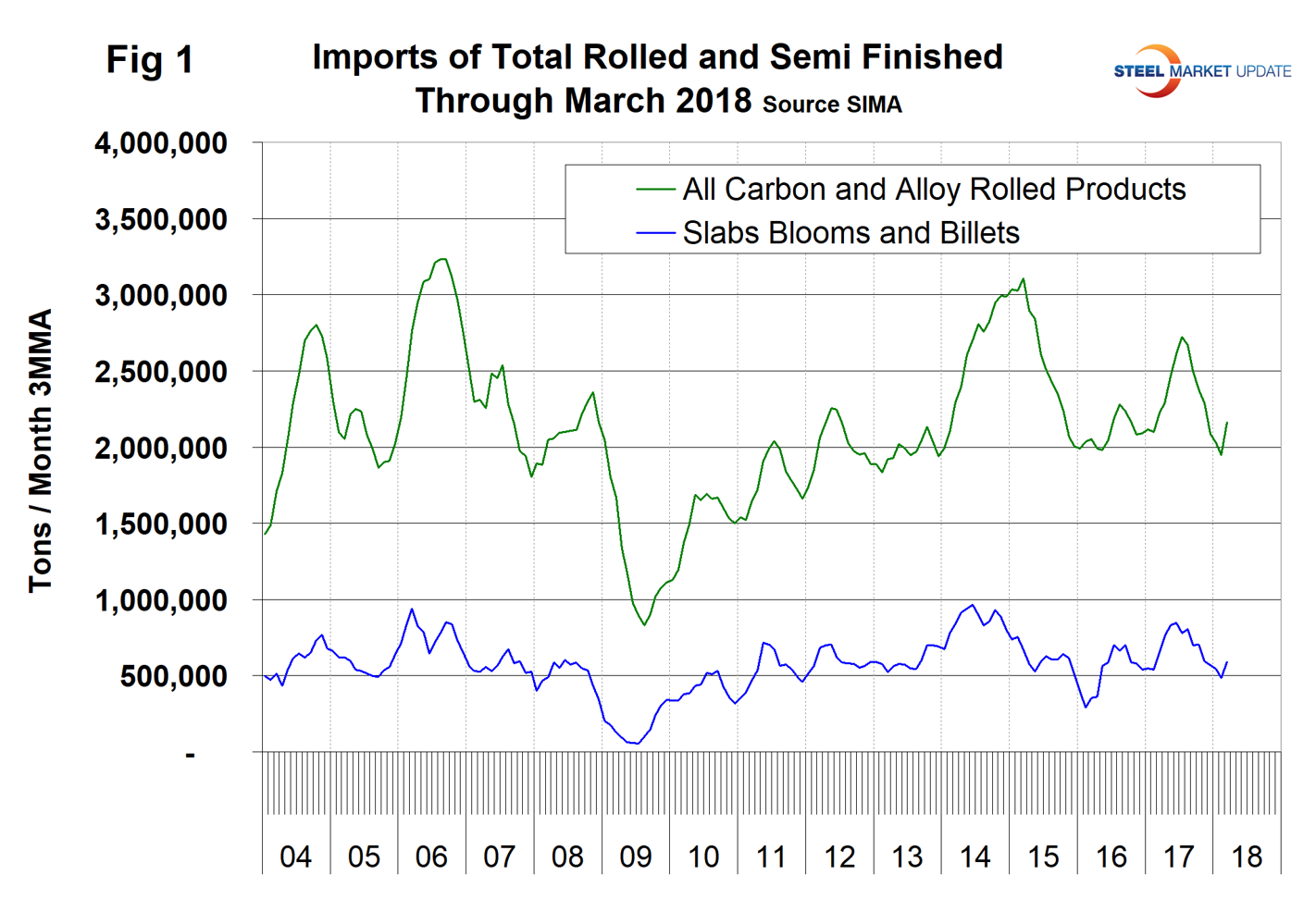

Figure 1 shows the tonnage of total rolled steel and semi-finished imports through March. The three-month moving average (3MMA) of total rolled product import volume in March was 2.2 million tons, up from 1.9 million in February, but down from 2.7 million in July last year. The 3MMA of semi-finished imports in March was 590,000 tons, the highest since last November and up from 484,000 in February.

In Table 1, we show the 3MMA of the tonnage in March 2018 and 2017 with the year-over-year change. We then calculate the percentage change in volume in the most recent three months with the previous three months. This month we are comparing January/February/ March with October/November/December (3M/3M). The next column to the right shows the year-over-year change as a percentage. Declines are color coded green and increases are coded red. Finally, in the far-right column, we subtract the 12-month change from the three-month change. This is a way of describing the magnitude of the recent trend as a percentage. In some cases, even though imports are declining in both time frames, the trend is red meaning the decline is slowing.

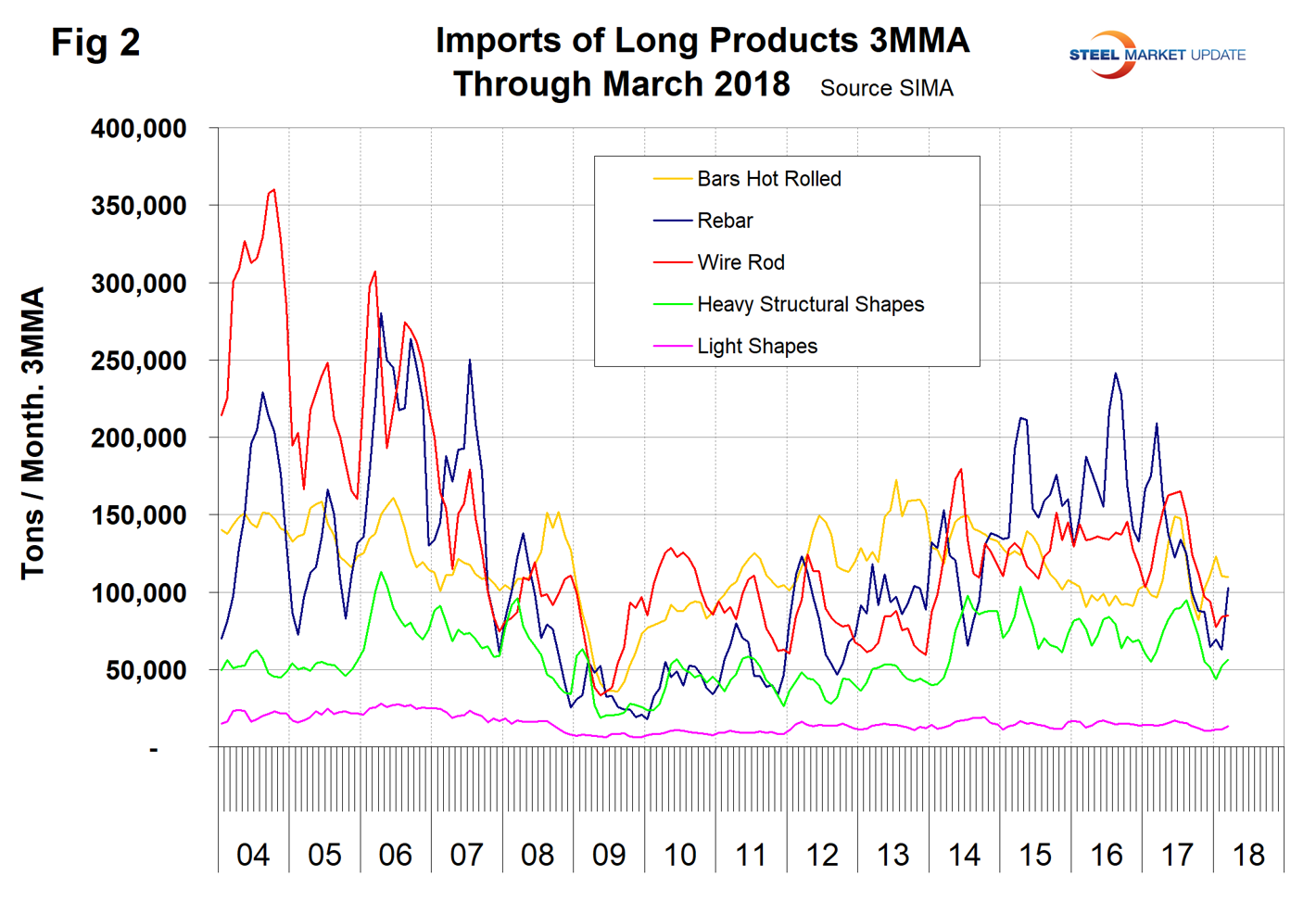

Table 1 describes the imports of all major sectors of the long products market. Year-over-year total long product imports declined by 150,000 tons per month on a 3MMA basis. Comparing the short-term 3M/3M basis with the long-term year-over-year basis, rebar had a dramatic turn around to a 59.6 percent increase from a 50.9 percent decrease. Light shapes also changed dramatically 3M/3M with a 28.7 percent increase. Hot rolled bars and wire rod were both down in the short-term analysis. Figure 2 shows the history of long product imports on a 3MMA basis since January 2004.

Explanation: SMU publishes several import reports ranging from this very early look using license data to the very detailed analysis of final volumes by product, by district of entry and by source nation, which is available in the premium member section of our website. The early look is based on three-month moving averages using the latest license data, either the preliminary or final data for the previous month and final data for earlier months. We recognize that the license data is subject to revisions but believe that by combining it with earlier months in this way gives a reasonably accurate assessment of volume trends by product as early as possible. The main issue with the license data is that the month in which the tonnage arrives is not always the same month in which the license was recorded. In 2014, we conducted a 12-month analysis to evaluate the accuracy of the license data compared to final receipts. This analysis showed that the licensed tonnage of all carbon and low alloy products was 2.3 percent less than actual receipts, close enough to confidently include license data in this current update. The discrepancy declined continuously during the 12-month evaluation as a longer period was considered.

Statement from the Department of Commerce: The Steel Import Monitoring and Analysis (SIMA) system of the Department of Commerce collects and publishes data of steel mill product imports. By design, this information gives stakeholders valuable information on steel trade with the United States. This is achieved through two tools: the steel licensing program and the steel import monitor. All steel mill imports into the United States require a license issued by the SIMA office. The SIMA Licensing System is an online system for importers to register, apply for and receive licenses in a timely manner. In addition to managing the licensing system, SIMA publishes near-real-time aggregate data on steel mill imports into the United States. These data incorporate information collected from steel license applications and publicly released Census data. The data are displayed in tables and graphs for users to analyze. Additionally, SIMA provides data on U.S. steel mill exports, as well as imports and exports of select downstream steel products.