Prices

January 11, 2018

Commerce Data Shows Imports on the Decline

Written by Peter Wright

Imports of rolled steel into the United States have been on the decline since peaking in July, based on a three-month moving average of government import data through the end of 2017. In three months through December compared to three months through September, total rolled steel imports declined by 16.8 percent, while sheet products dropped by 18.2 percent.

The weekly accumulative licensed import tonnages were complete for December and reported by of the U.S. Department of Commerce on Jan. 9. The data is reported within the Steel Import Monitoring and Analysis system (SIMA). An explanation of the methodology that Steel Market Update uses to analyze the trade data is given at the end of this piece together with notes describing SIMA. All volumes in this analysis are reported in short tons. We prefer not to dwell on single-month results because of the extreme variability that can occur in individual products. In the comments below, we use three-month moving averages to give what we believe is the most accurate picture.

![]() The three-month moving average (3MMA) of rolled product import volume in July 2017 was 2,722,567 short tons, the highest since May 2015. Imports declined in each of the next four months to reach 2,077,778 tons in December.

The three-month moving average (3MMA) of rolled product import volume in July 2017 was 2,722,567 short tons, the highest since May 2015. Imports declined in each of the next four months to reach 2,077,778 tons in December.

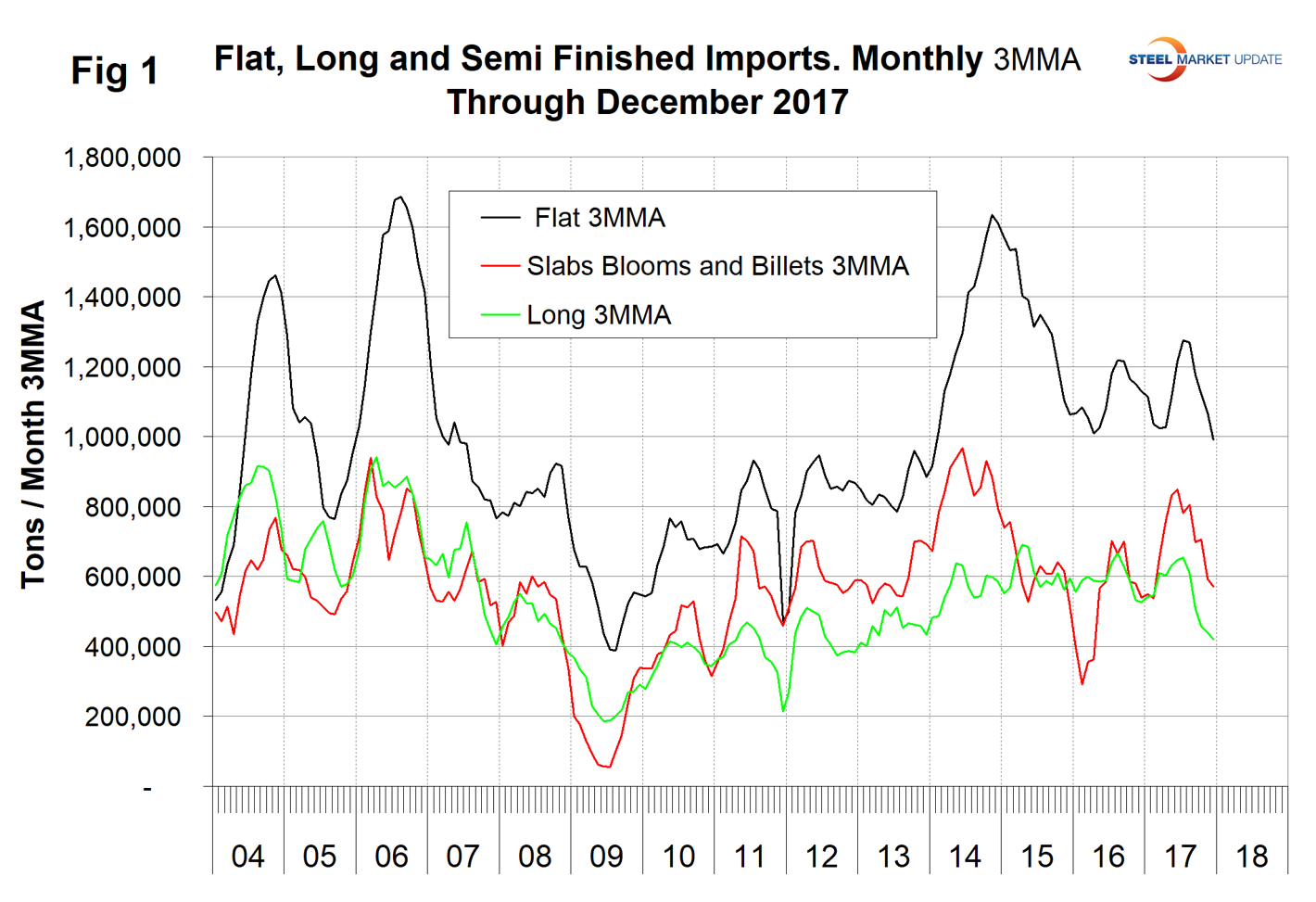

Figure 1 shows the 3MMA through December licensed tons of semi-finished, flat and long products since January 2004. Imports of semi-finished in December had a 3MMA of 571,285 tons, which was up by 5.8 percent year over year, but down by 18.2 percent compared to the three months through September. “Flat” includes all hot and cold rolled sheet and strip, plus all coated sheet products, plus both discrete and coiled plate. The 3MMA of flat rolled imports was 990,700 tons in December, which was down by 12.3 percent year over year and by 15.8 percent compared to three months through September. Long product imports were rangebound between 519,000 tons and 772,000 tons for 34 months between December 2014 and August 2017 with no particular trend evident. In September 2017, long product imports broke out of the range to the downside and stayed down through December when the volume was 419,730 tons. Year over year, longs declined by 20.3 percent.

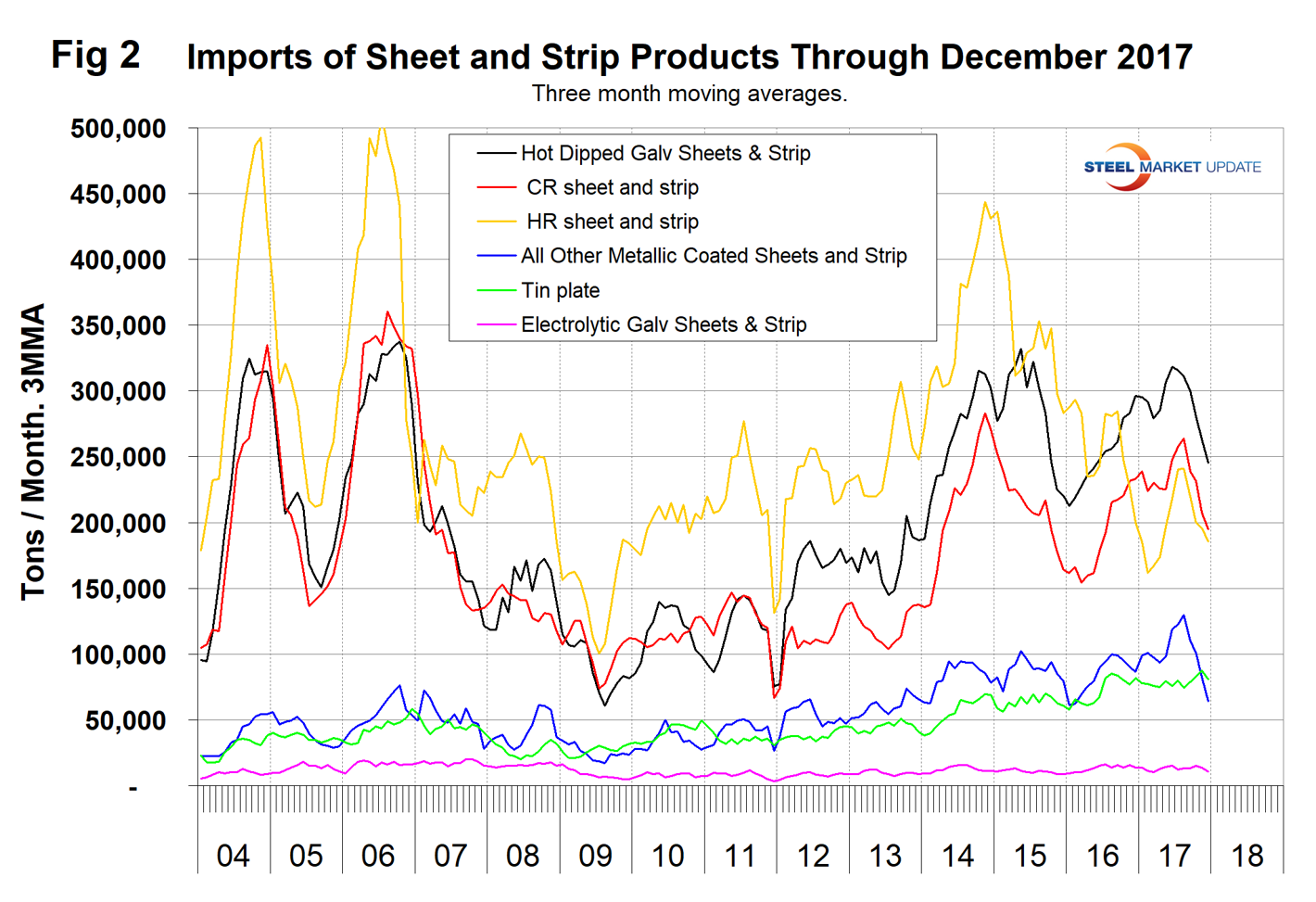

Figure 2 shows the trend of sheet and strip product imports since January 2004. The total of these products was down by 18.2 percent in three months through December compared to three months through September and down by 13.4 percent year over year. All six of the sheet categories that SMU examines were down year over year led by other metallic coated, (mainly Galvalume) down 26.4 percent. Hot rolled, cold rolled and HDG were down by 7.4 percent, 16.3 percent and 17.1 percent, respectively.

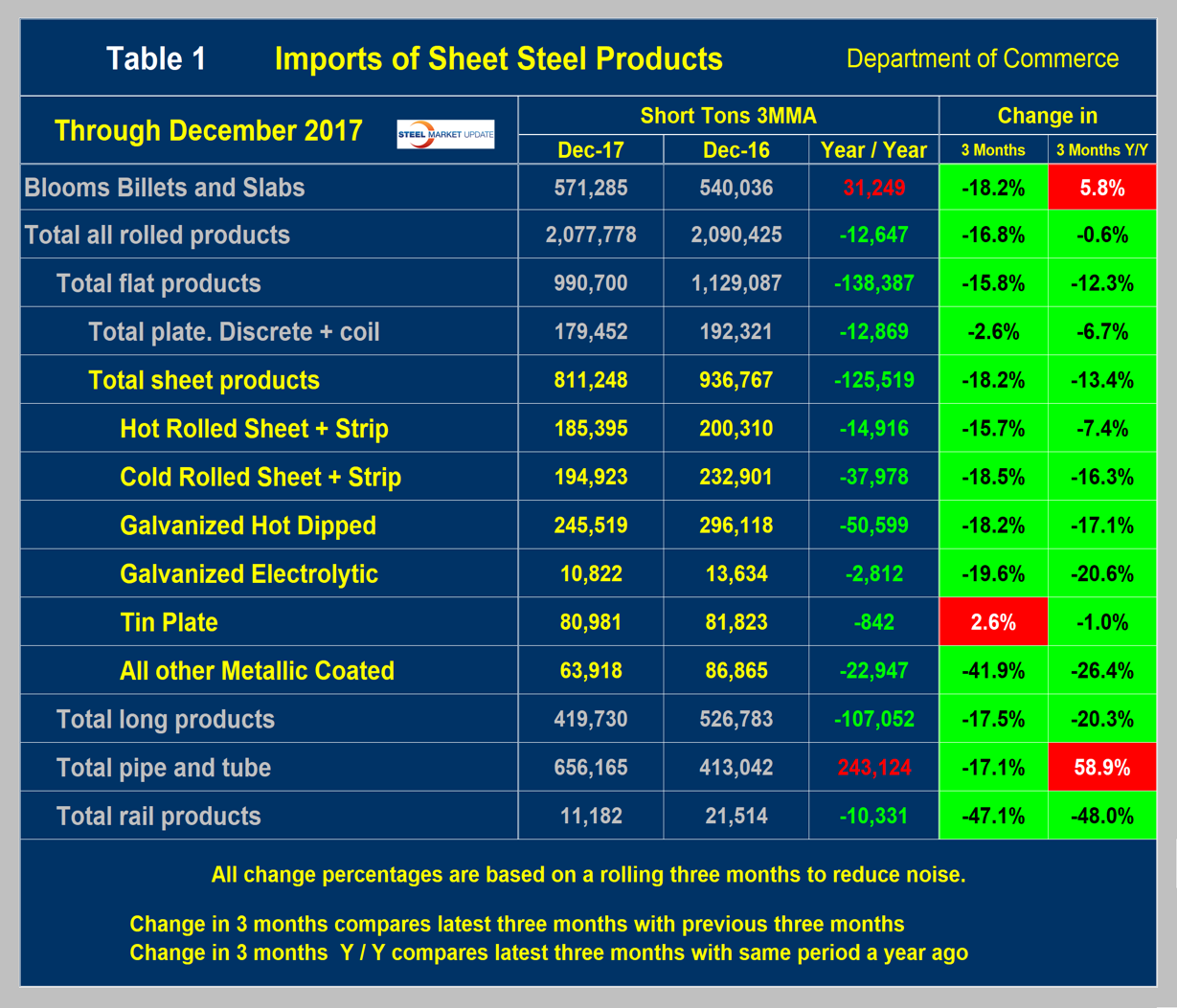

Table 1 provides an analysis of major product groups and of sheet products in detail. It compares the average monthly tonnage in the three months through December 2017 with both three months through September (3M/3M) and three months through December 2016 (Y/Y).

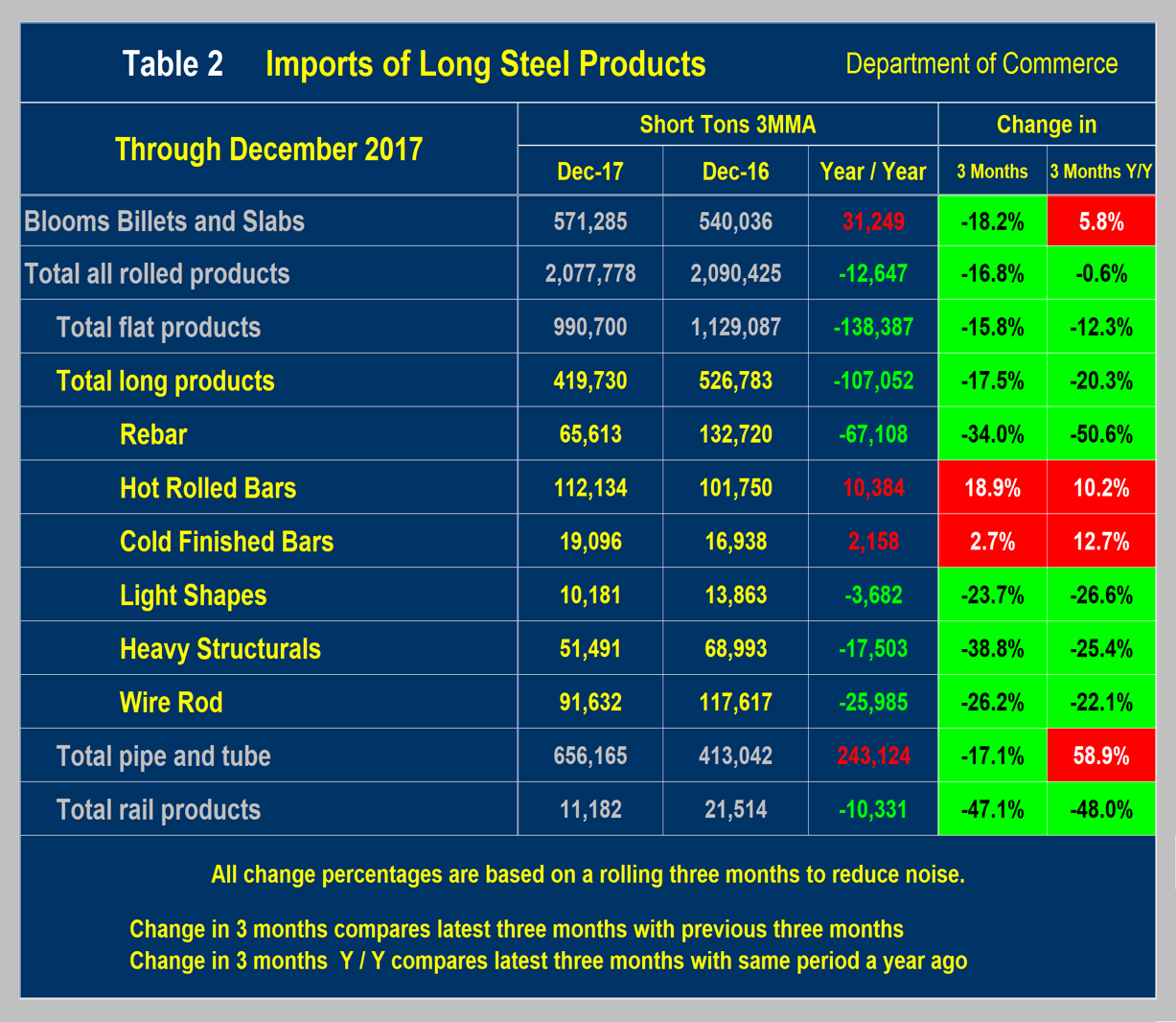

Table 2 shows the same analysis for long products. The total tonnage of long products declined by 107,052 tons per month Y/Y, mainly driven by a decline in rebar and wire rod volumes. On a 3M/3M basis, the total volume of long products declined by 17.5 percent.

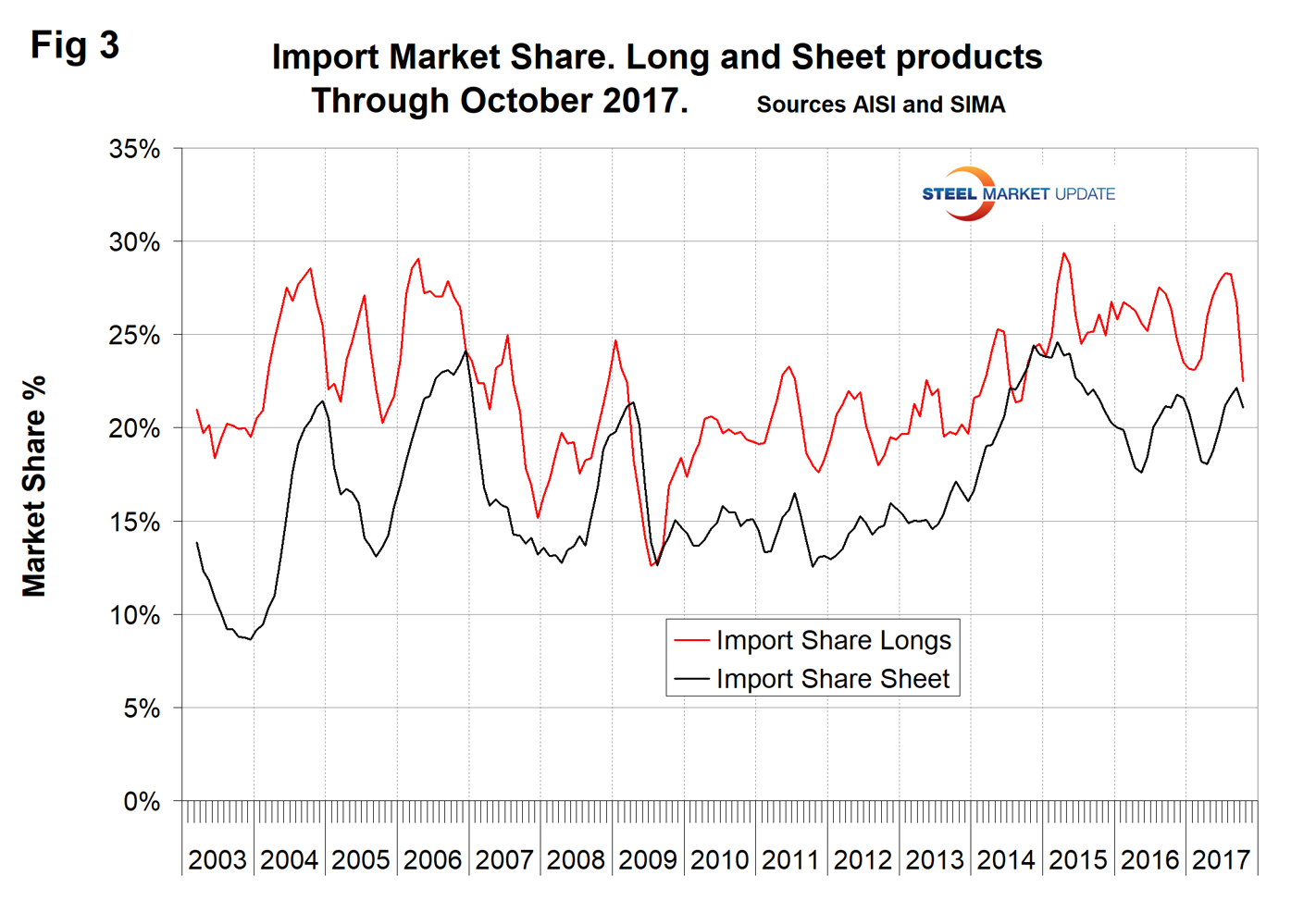

Figure 3 shows the import market share of sheet and long products through October, which is the latest data available. The import market share of sheet products peaked at 24.3 percent in March 2015. The October 2017 level was 21.1 percent. Long product import market share has been considerably higher than for sheet products since early 2015, but since July has dropped dramatically to 22.5 percent in October.

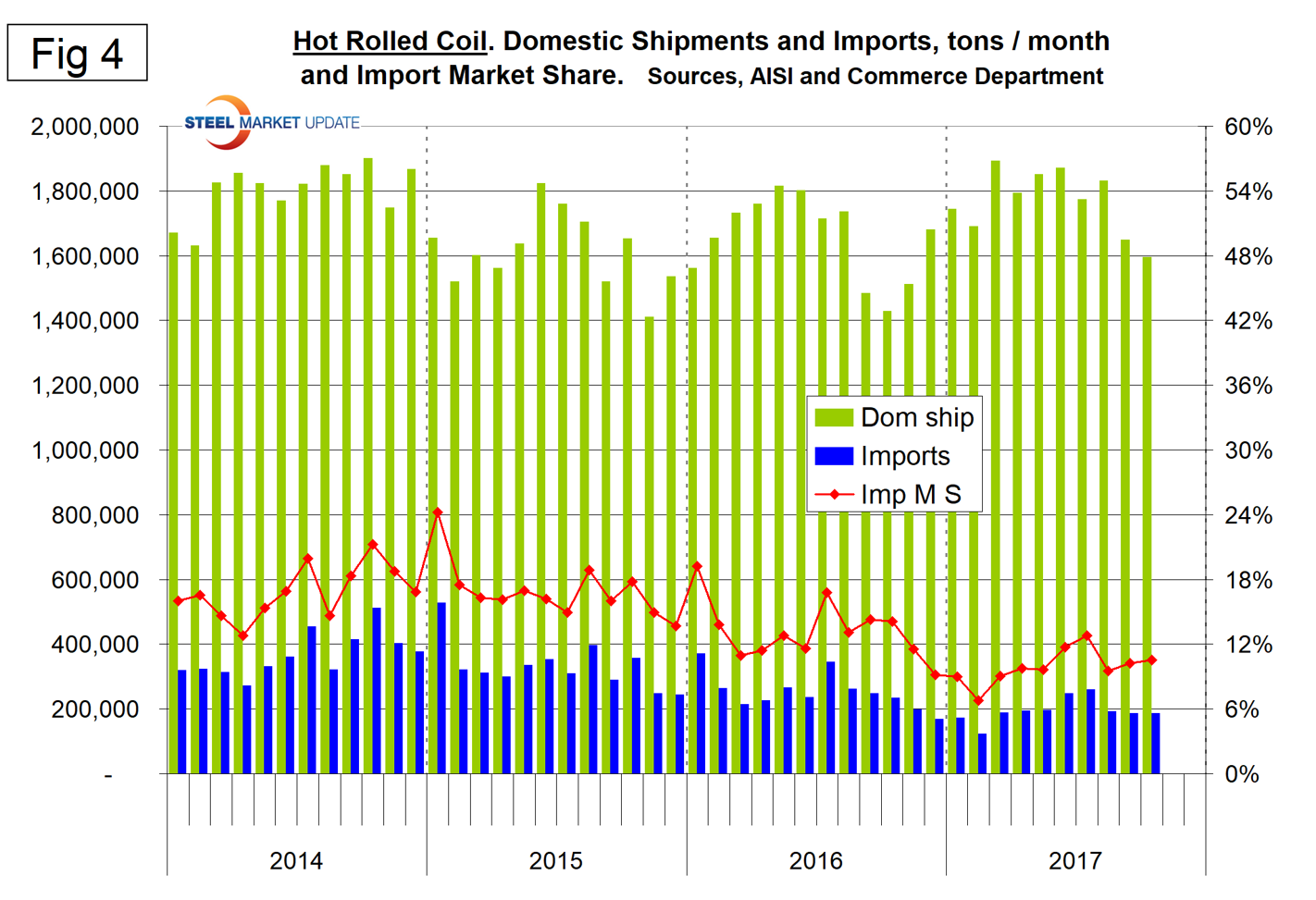

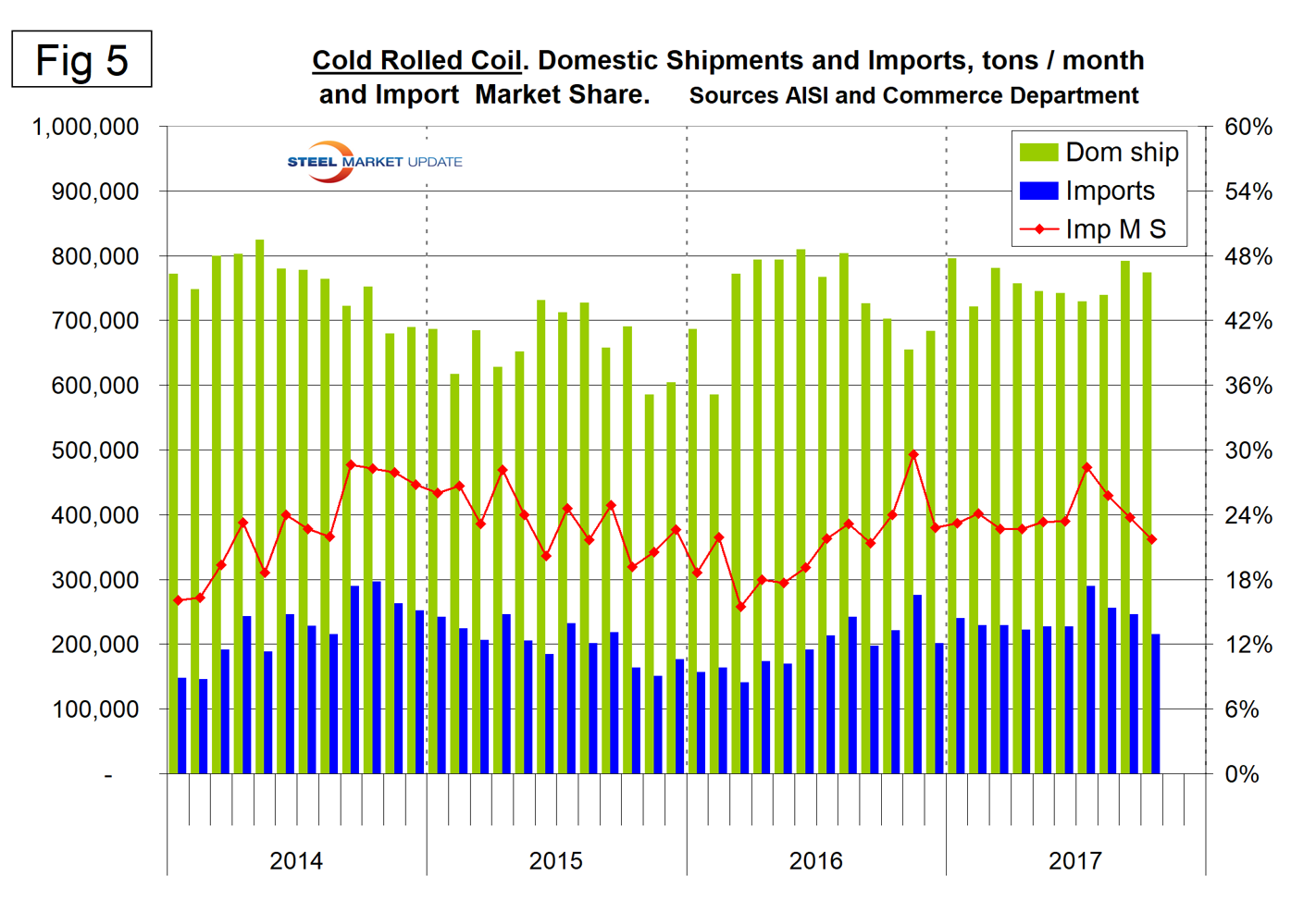

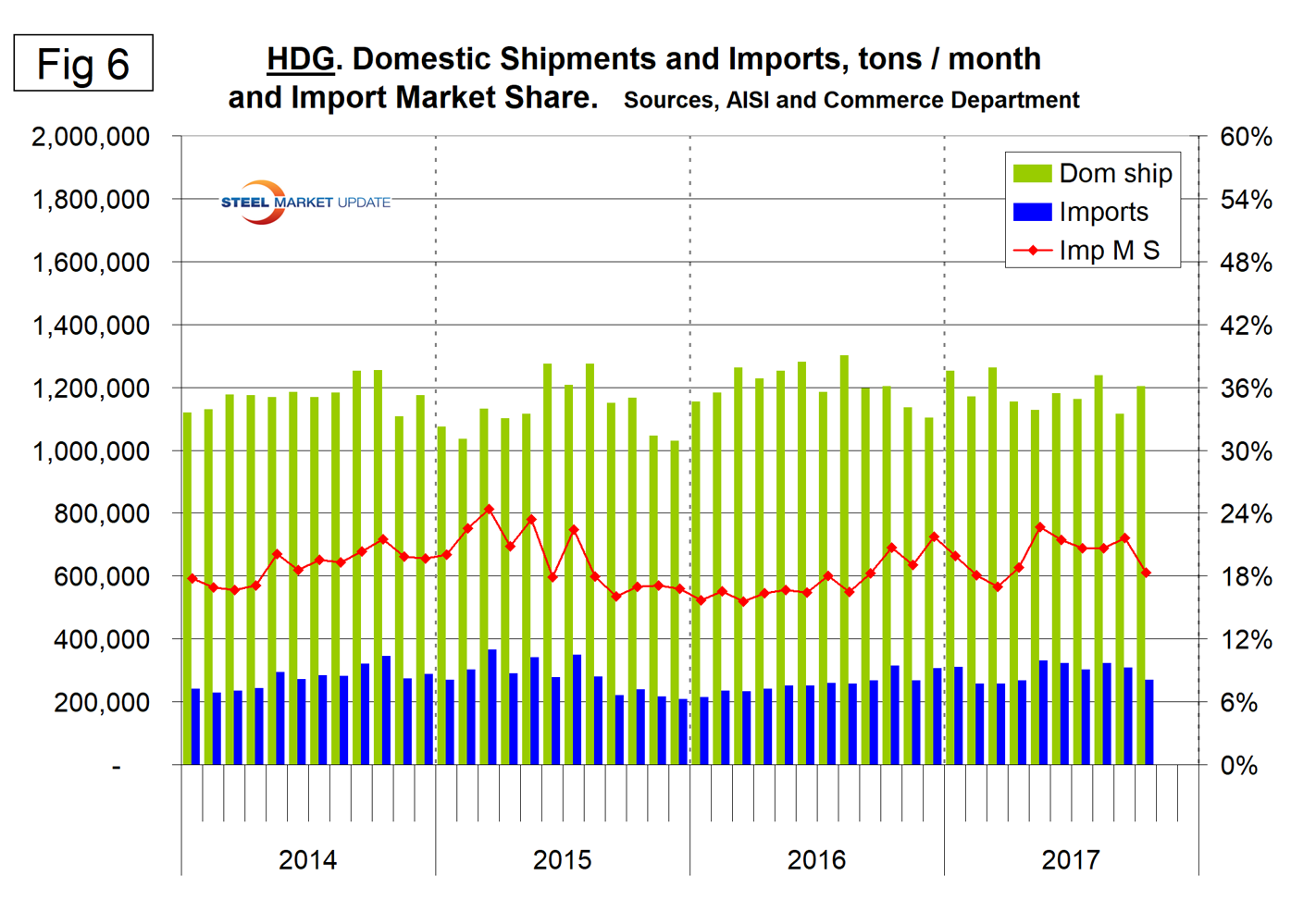

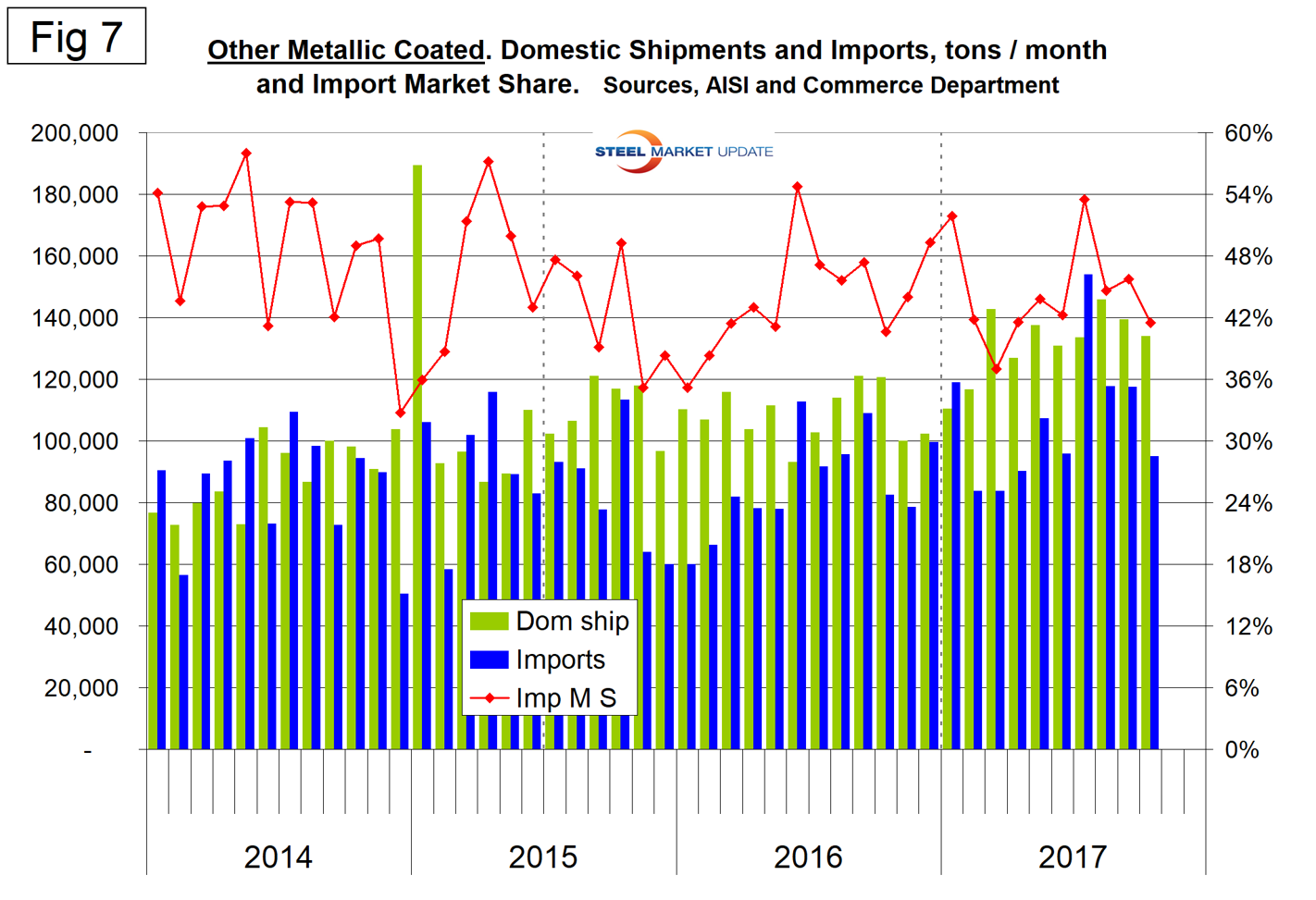

Figures 4-7 show U.S. mill shipments to domestic locations, imports and import market share of the four major sheet products. Note that the righthand import share axes are the same to give true comparability. HRC has the lowest import share followed by HDG, CRC and OMC, which is by far the highest. The import share of OMC dropped dramatically from June when it was 54.0 percent to 41.5 percent in October.

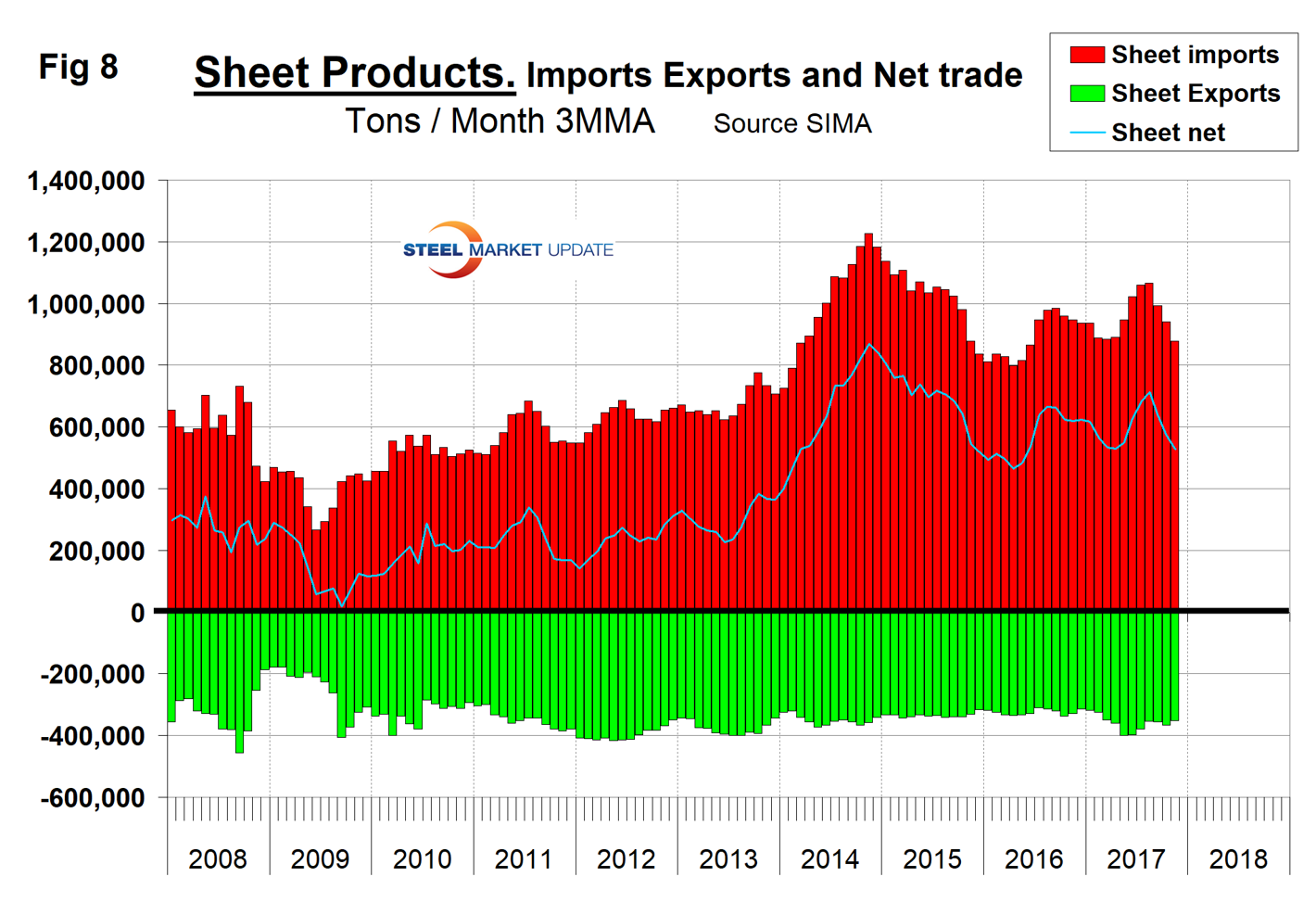

Our analysis is based on the final volumes through November. We regard this as an important look at the overall trade picture and its effect on demand at the mill level. Figure 8 shows net sheet product imports on a 3MMA basis to be 526,754 tons in November, which was the lowest since May 2016. Exports increased in the first half of 2017 driven by the depreciation of the U.S. dollar on the international foreign exchange markets. Net sheet steel imports shown by the blue line in Figure 8 are still high by historical standards. (Net imports equals imports minus exports.)

Explanation: SMU publishes several import reports ranging from this very early look using license data to the very detailed analysis of final volumes by product, by district of entry and by source nation, which is available on the premium member section of our website. The early look, the latest of which you are reading now, has been based on three-month moving averages using the latest license data, either the preliminary or final data for the previous month and final data for earlier months. We recognize that the license data is subject to revisions, but believe that by combining it with earlier months in this way gives a reasonably accurate assessment of volume trends by product as early as possible. We are more interested in direction than we are in absolute volumes at this stage. The main issue with the license data is that the month in which the tonnage arrives is not always the same month in which the license was recorded. In 2014, we conducted a 12-month analysis to evaluate the accuracy of the license data compared to final receipts. This analysis showed that the licensed tonnage of all carbon and low alloy products was 2.3 percent less than actual receipts, close enough we believe to confidently include license data in this current update. The discrepancy declined continuously during the 12-month evaluation as a longer time period was considered.

Statement from the Department of Commerce: The Steel Import Monitoring and Analysis (SIMA) system of the Department of Commerce collects and publishes data of steel mill product imports. By design, this information gives stakeholders valuable information on steel trade with the United States. This is achieved through two tools: the steel licensing program and the steel import monitor. All steel mill imports into the United States require a license issued by the SIMA office. The SIMA Licensing System is an online automatic system for users to register, apply for, and receive licenses in a quick and timely manner. This online system allows importers to process imports with minimal effort and added efficiency. In addition to managing the licensing system, SIMA publishes near real-time aggregate data on steel mill imports into the United States. These data incorporate information collected from steel license applications and publicly released Census data. The data are displayed in tables and graphs for users to analyze various levels and changes in steel trade involving the United States. Additionally, SIMA provides data on U.S. steel mill exports, as well as imports and exports of select downstream steel products.