Market Data

December 14, 2017

SMU Service Center Flat Rolled and Plate Inventories

Written by John Packard

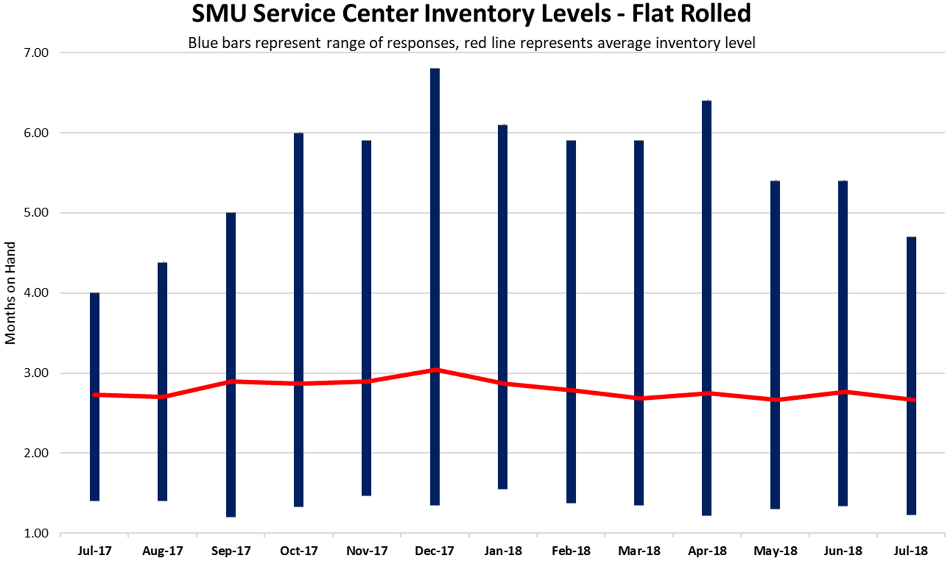

Both flat rolled and plate steel distributors saw only a very modest drop in inventories as of the end of July. Inventories continue to be “balanced” at 2.7 months of supply on flat rolled and 2.1 months of supply on plate, according to Steel Market Update’s proprietary inventory data.

Flat Rolled Spread Tightens

Although our number of months of supply average has dropped by only 0.10 months, what we are finding is the spread between those reporting inventories below two months of supply and the top end, which was almost 7 months of supply back in December, has dropped. For the first time since August 2017, the highest level of inventories is below 5 months of supply.

We found that 46 percent of those responding to our queries regarding July inventories reported lower inventories than the prior month. SMU saw 41 percent reporting inventories of flat rolled as being the same, and the balance (13 percent) reporting inventories as being higher.

Tight Plate Inventories Continue

Much like flat rolled, plate steel inventories ended the month down marginally compared to the previous month. Plate inventories now stand at 2.1 months of supply vs. 2.2 months. We are finding inventory levels remain within a very tight range of 1.0 to 2.5 months.

With 100 percent of the data providers participating, we found 70 percent reporting inventories as being the same, 20 percent higher and 10 percent lower.

What Inventory Respondents Said About Flat Rolled

• “We’re slightly overstocked, but not concerned based on lower cost inventory. The steep backwardated futures curve is causing concern/confusion vs. regular, consistent market commentary trumpeting strength and expected consistency.”

• “Decreasing stock levels. Demand is slowing. Our July was better than normal. August should be good. September forecast is down compared to last year.”

• “We have 1.68 months’ supply on the floor with 2.3 months in the system (if you include material on order). We are running inventories lean based on the elevated cost and our opinion that there is a greater chance for prices to decrease than increase.”

• “We’ve been in reduction mode since early Q2.”

• “Flat rolled is at 2.0 months to 2.7 months depending on product. Inventories balanced. Some service centers acting irresponsibly with pricing fluctuations.”

• “We finished July at 2.9 months of inventory. We expect a strong August and will stay the course [regarding inventories] for now.”

• “We had 2.75 months of flat rolled inventory on-hand at the end of July. We are moving to decrease our inventory as we head into the fall due to the high cost of steel and inventory carrying costs. Trucking continues to become a big problem, inbound and outbound, and now rail is becoming the same type of issue (late deliveries and not enough railcars as more companies try to move away some from trucking). We had to announce our fourth price increase for farm and ranch equipment in the past 12 months. Never in the 54 years of our company have we announced more than one price increase in a year, much less four. The White House is oblivious to how Section 232 is affecting manufacturers and our economy. They say GDP is great and so everything is fine. News stories are rampant on how this is adversely affecting manufacturers. Demand is starting to slow due to the high prices of steel; we had our slowest July in the past three years. The number of customers with stretched credit lines who can’t pay their bills on time is at an all-time high. I continue to hear more consumers aren’t accepting the huge increases in product costs due to steel prices rising rapidly.”

• “We have reasonably balanced inventory, yet we typically try to reduce inventory to bare bones to be in a position to take advantage of any year-end deals we come across, as well as to reduce some end-of-year taxes. We are seeing some slight softening on the street for finished good transaction pricing, but I think it’s due to unfounded fears. I see nothing that should cause any precipitous drops in mill pricing.”

• “Our flat roll is at 2.25 months and plate is at 2.49 months. Inventories are actually very low vs. normal July trends. Considering there are 23 shipping days in August, we will be extremely lean heading into September by design. Everything concerns us about the market, especially the seemingly unsustainable USA price premium. However, demand in July surprised on the high side, imports are trending down, and mills have significant outages planned in Q3 and Q4. Plate mills look to be sold out through year-end. Of course, many are trying to talk the market down because, as an industry, we are conditioned to believe if prices are not rising then they must fall. The reality is Section 232 is forcing us to navigate uncharted waters where prices may very well remain stable at elevated levels for an extended period of time, whether we like it or not.”

• “[Inventory balance] will depend on demand. If orders remain intact, our inventory is aligned. As has been the case, Section 232 variables keep people guessing. I think there is going to be a ‘psychology’ factor for the coming months. Many are trying to talk the market down, some think we will remain flat and others foresee shortages. Rarely have I seen this much divergent thinking in the market. July was below average volume for us. August is starting a bit tepid. I think with scrap expected to fall, buyers will be wanting price reductions, so we see pricing pressure in the near term. We will see if the mills have the strength to withstand the test.”

What Inventory Respondents Said About Plate

• “We have a few holes, much like most people judging by the increased levels of service center inquiries we are seeing. We probably will not materially change our inventory level in the next couple months. We see demand pretty steady, and no real advantageous buys are out there. Domestic mills are full, 10-12 week lead times, and still have good order-entry rates. They don’t have to make deals. This year is essentially booked for plate. The biggest challenge is for service centers to realize that the mills have moved and have at least 50 percent base load in non-service-center project/OEM business. Given that, it is less likely the mills will offer service centers ‘specials,’ as they don’t need the service center base like they used to. Service centers are not going to be able to ‘buy their margin’ like they used to, so they are going to have to learn how to sell on something other than always the low price. Biggest concern is margin compression on resale.”

• “We have 2.31 months on hand. We are working to increase stock levels. The current USA price vs. the rest of the world is a concern. Raw material cost increases makes up about 20-25 percent of the total price move from November 2018 to current. Tariffs going away, while good, will hurt as our prices drop back down to a lower sustainable level. There’s potential for a recession in 2019.”