Government/Policy

December 7, 2017

Vietnam Circumvention Ruling Sets New Precedent

Written by Tim Triplett

The Commerce Department’s Vietnam circumvention ruling on Tuesday represents a departure in the U.S. government’s interpretation of what constitutes adding “minor or insignificant” value to a product. This is a key issue in determining whether importation of a product from a country not directly subject to a trade remedy amounts to a “circumvention” of existing trade orders.

Washington trade attorney Lewis Leibowitz was not surprised by the circumvention determination. “It has been widely expected that Commerce would reach out to penalize imports of steel products from Vietnam. However, it remains to be decided whether the ruling is consistent with U.S. law or trade agreements. Until this decision, it seemed clear that if a product is transformed “substantially” such that it is a new and different product, it cannot also be a “minor or insignificant” change. Commerce ignored their previous jurisprudence on “substantial transformation” to reach a result that looks out of phase with international trade norms. This could have widespread implications for other cases and other countries that process steel from China and elsewhere.”

Leibowitz takes issue with the ruling, which is based on the premise that the value added to the steel in cold rolling and coating steel in Vietnam is “minor and insignificant.” In fact, in the case of CORE steel made from Chinese hot-rolled substrate, the product has undergone not one but two significant changes, cold rolling and covering with a corrosion-resistant coating. “The Chinese product has been ‘substantially transformed’ in Vietnam, either once or twice, making the finished product undeniably a product of Vietnam, not China,” he argues.

Shares of publicly traded steel companies rallied on Wednesday in response to the preliminary ruling by Commerce, which found that corrosion-resistant steel (CORE) and certain cold rolled flat products imported from Vietnam, which were produced from substrate originating in China, are circumventing existing antidumping and countervailing duty (AD/CVD) orders on Chinese steel. As a result, Customs and Border Protection will begin collecting cash deposits on imports of CORE produced in Vietnam using Chinese-origin substrate at antidumping rates of 199.43 percent and countervailing duty rates of 39.05 percent. CBP will also collect AD and CVD cash deposits on imports of cold-rolled steel produced in Vietnam using Chinese-origin substrate at rates of 265.79 percent and 256.44 percent, respectively. Duties will apply to shipments entering the United States on or after Nov. 4, 2016, unless the Customs entries have been closed out by Customs, a practice known as “liquidation” of the entry.

The decision was a victory for U.S. steelmakers, who won AD/CVD duties against Chinese steel in 2015 and 2016 only to see shipments from other countries rise. The domestic industry accused the Chinese of diverting their products through third countries to circumvent the duties. Domestic steel producers, including Steel Dynamics, Inc., California Steel Industries, AK Steel Corp., ArcelorMittal USA, Nucor Corp. and United States Steel Corp., filed a complaint when shipments of CORE from Vietnam to the United States increased from $2 million to $80 million shortly after the preliminary duties were imposed on Chinese products in 2015. Likewise, shipments of cold-rolled steel from Vietnam jumped to $215 million from just $9 million after Chinese products were hit with duties about the same time.

Domestic steelmakers applauded the Commerce ruling that imports of Chinese steel, even though they are finished in Vietnam, are still covered by U.S. AD/CVD orders on imports from China. U.S. Steel said in a statement: “The Commerce Department’s finding of circumvention represents a critical step to shutting down one of the many paths used to flood the U.S. with dumped and subsidized steel. This decision presents an encouraging sign for the steel industry and should put other countries and companies on notice that their cheating will no longer be tolerated. We urge Secretary Ross and President Trump to continue to aggressively crack down on unfairly traded steel imports, including immediate and broad action in the Section 232 investigation on steel imports and national security.”

Likewise, AK Steel said it strongly supports the preliminary rulings. “We are pleased with this decisive action by the Commerce Department against foreign producers and importers who have been and continue to attempt to circumvent our trade laws,” said Roger K. Newport, CEO of AK Steel. “We commend the Commerce Department for holding these parties accountable and for sending a signal to foreign producers and countries around the world that the U.S. will vigorously enforce its laws without exception. We encourage the Commerce Department and the administration to continue these positive efforts with swift and broad action on the Section 232 investigation on steel imports.”

The American Iron and Steel Institute echoed a similar sentiment: “We are very pleased with the Department of Commerce’s announcement of its preliminary affirmative rulings that certain types of steel products from Vietnam, which originated in China, circumvent existing antidumping and countervailing duty orders. Subsidies and other interventionist foreign government policies have led to record high levels of dumped and subsidized imports in the U.S. market, causing severe economic harm and significant job losses. We look forward to the final determination in this case early next year. Continued aggressive enforcement of the full range of U.S. trade laws, including Section 232 and our antidumping and countervailing duty laws, is critical to ensure that the U.S. industry is not further damaged by unfair trade in steel.”

“There are a number of unresolved issues surrounding this preliminary determination,” Leibowitz said. “For importers of cold rolled and CORE steel from Vietnam, the uncertainty continues at least until mid-February when Commerce is scheduled to issue a final circumvention determination.”

“More to the point,” Leibowitz continued, “no finding of ‘cheating’ was made on Tuesday. Circumvention is a complex issue. It was inappropriate to label anyone based on this ruling as trying to violate accepted rules. The rules themselves are not at all clear. Vietnamese producers of cold-rolled and CORE steel are selling competitively, and they are probably not selling steel made with Chinese substrate. Commerce recognized this by establishing a certification process for importers and exporters, so that Vietnamese shipments to the United States will continue.”

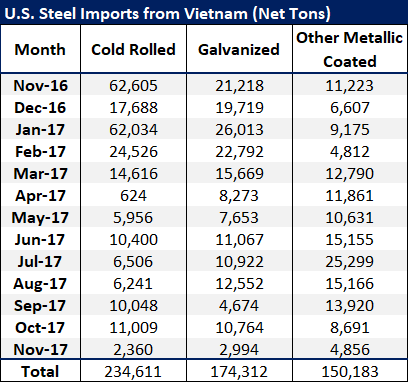

The number of tons that are potentially impacted by the DOC order is quite large (see table below). However, one trader who was surprised by the announcement believes his company protected itself against any penalties associated with required deposits. “Any of our purchases require full-scale traceable documentation that the [substrate] is of non-Chinese origin. Some traders might have an issue buying from mills that do not have an efficient system tying the HRC substrate and the CRC together and proving that the substrate is non-Chinese. We do not have the same concerns with mills like POSCO/Vietnam, which has a sophisticated internal system. During the past 6-9 months, very little Chinese HRC was actually used by the re-rollers. Mainly Korean, Japanese, Taiwanese and Indian. This will not help with North Korea at all,” he said.

The U.S. is on pace to import about 440,000 tons of cold-rolled and CORE steel from Vietnam this year, down from 810,000 tons in 2016. Based on import licensing data, analysts forecast about 130,000 tons of supply from Vietnam in 2018.