Prices

December 5, 2017

U.S. Slab Imports at a Three-Year High

Written by Laura Remington

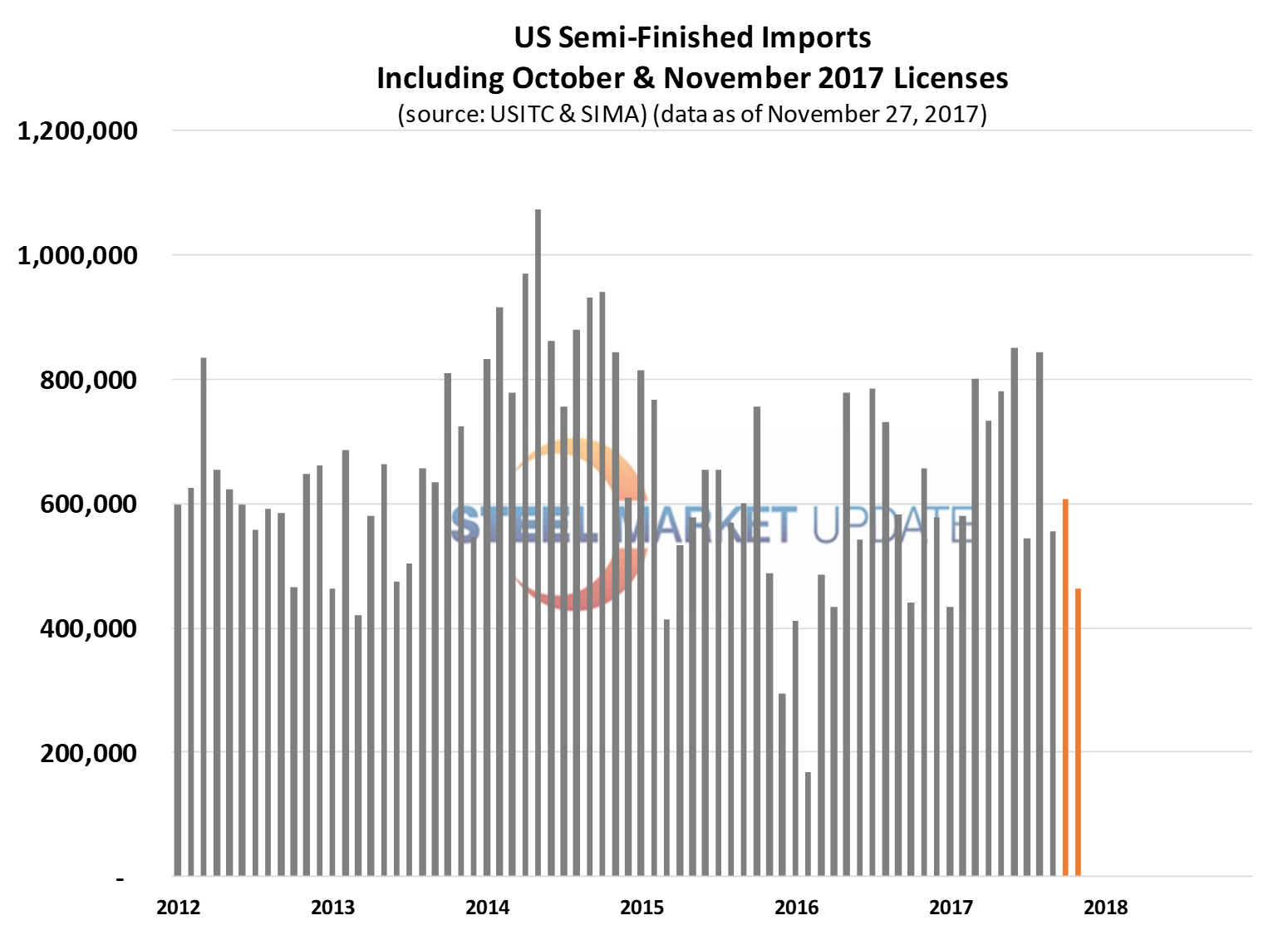

U.S. steelmakers have imported 7.19 million short tons of semi-finished steel so far this year, an increase of 9.1 percent over 2016, according to government data on October preliminary imports and November licenses as of Nov. 27 (Figure 1).

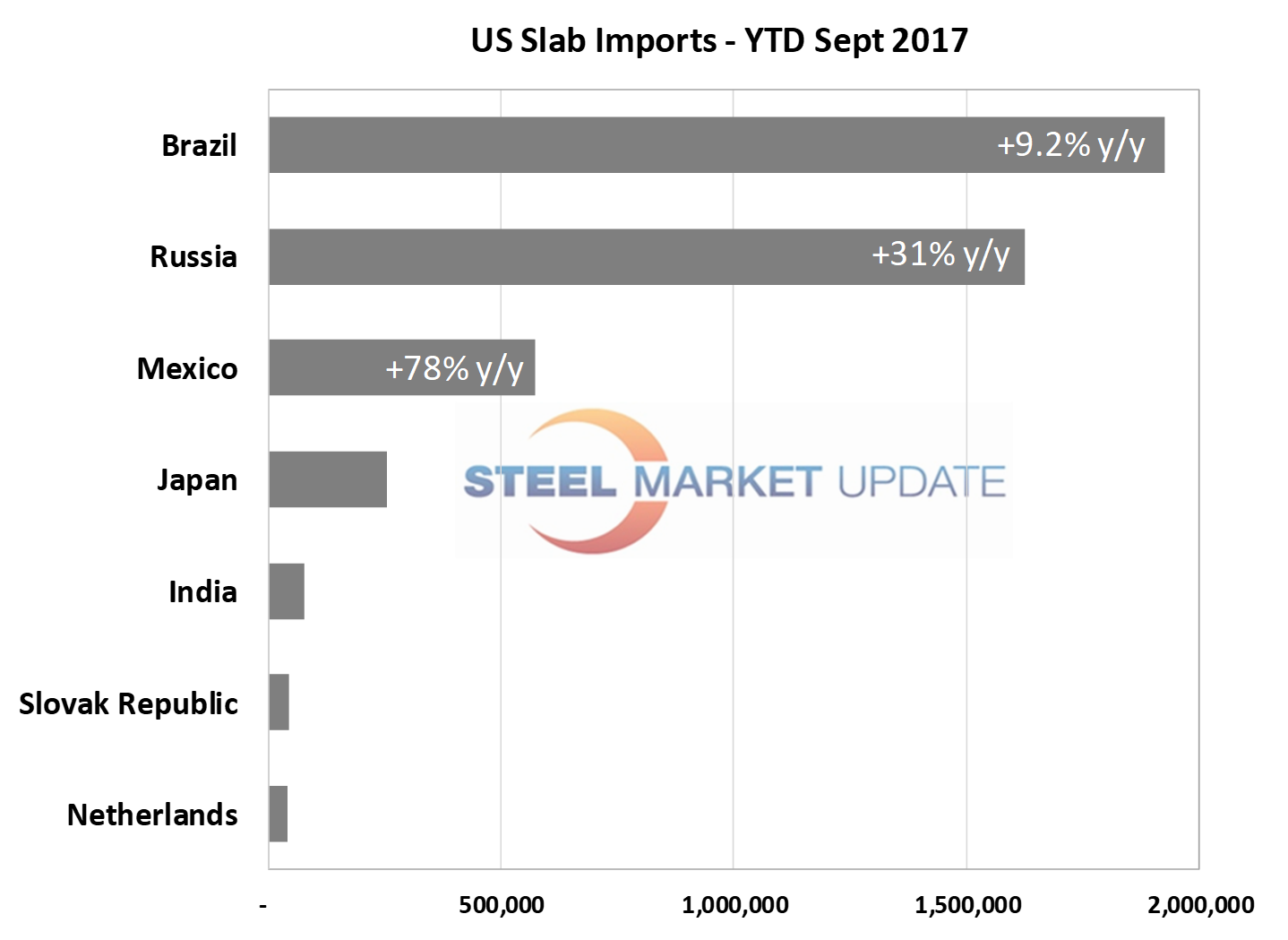

Semi-finished steel includes slabs, blooms and billets, which mills hot roll into coils and other products. Seventy-five percent or 5.4 million tons were classified as slabs, defined as “semi-finished products of iron or nonalloy steel containing by weight less than 0.25 percent of carbon, of rectangular (other than square) cross section having a width measuring at least four times the thickness.” Slab imports have increased by 24 percent year to date.

Looked at as a three-month moving average, imports of semi-finished products overall declined by 4.7 percent, compared to imports from September through November 2016. However, the slab component of this category increased by 4 percent over the same period, driving year-to-date imports of semi-finished products.

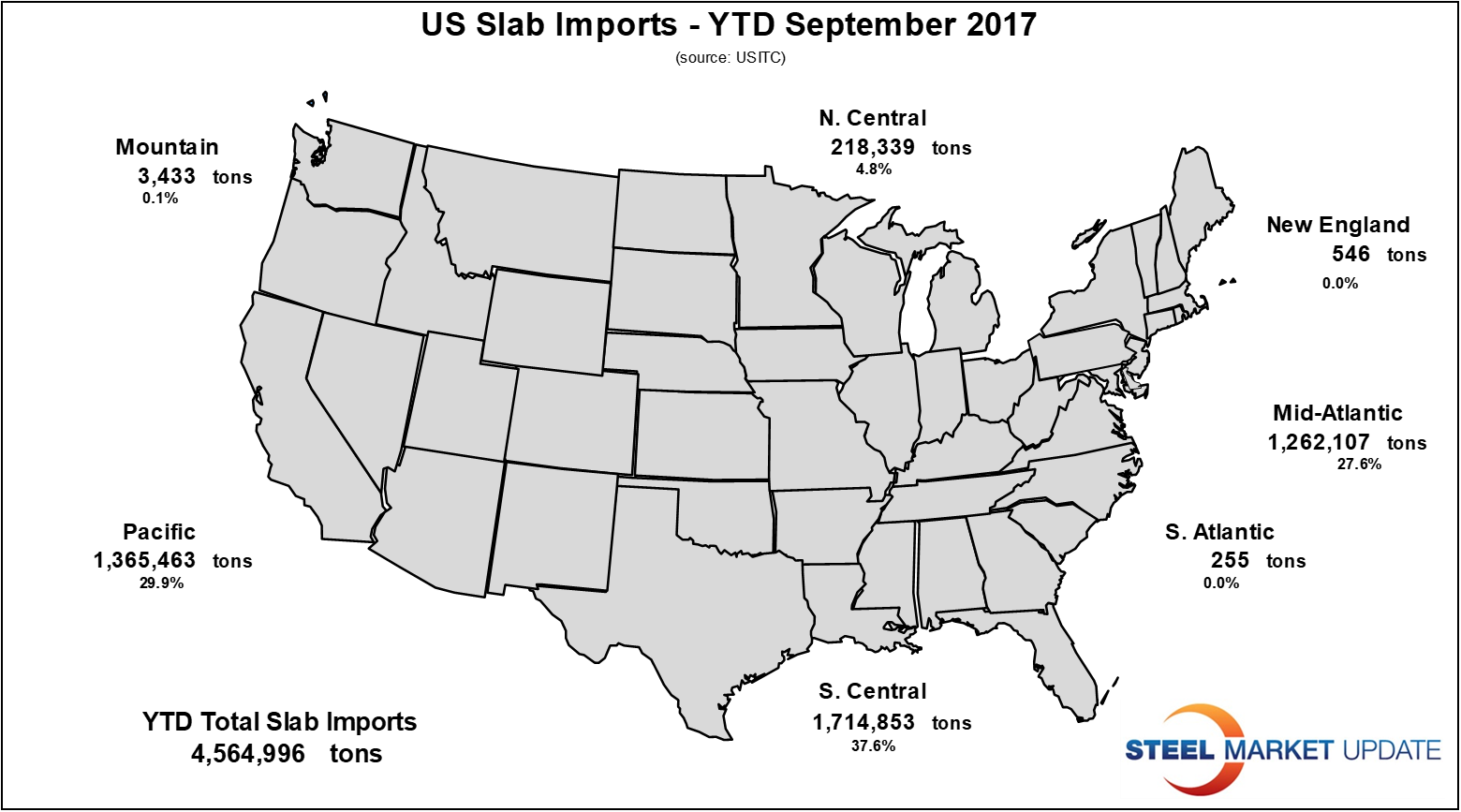

The U.S. map shows 2017 slab imports through September by port of entry. Figure 2 shows that 50 percent of the steel slabs imported to the U.S. this year came from Brazil, entering the U.S. at the ports of Mobile and New Orleans. As India began shipping steel slabs through the port of Houston-Galveston, Mexico increased its slab exports into Texas, as well.

Mid-Atlantic slab imports were led by the port of Philadelphia’s 37 percent year-over-year increase, including large volumes of slabs from Brazil and Russia to the eastern region of the U.S. Pacific U.S. steel slab imports rose as Brazil and Japan increased material to Los Angeles, and Russia increase slab cargoes through Columbia-Snake River, Ore. In spring 2017, the Slovak Republic began shipping steel slab tonnage through the port of Houston, while the Netherlands shipped more than 40,000 tons through the port of Philadelphia.

Semi-finished imports are expected to fall in November, as indicated by SIMA import licenses, down 18 percent month over month. The seasonal need for U.S. mills and service centers to destock prior to the end of the year is expected to slow production and deflate December demand for rerolling materials. The 2017 appearance of steel slabs from India, the Netherlands and the Slovak Republic indicate a shift in steel exports driven by either low semi-finished steel demand from European and Asian mills or a shift in the country/port of export only. These emerging trends will be closely monitored by Steel Market Update in 2018.