Prices

November 30, 2017

Hot Rolled Futures See Post-Thanksgiving Pause

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

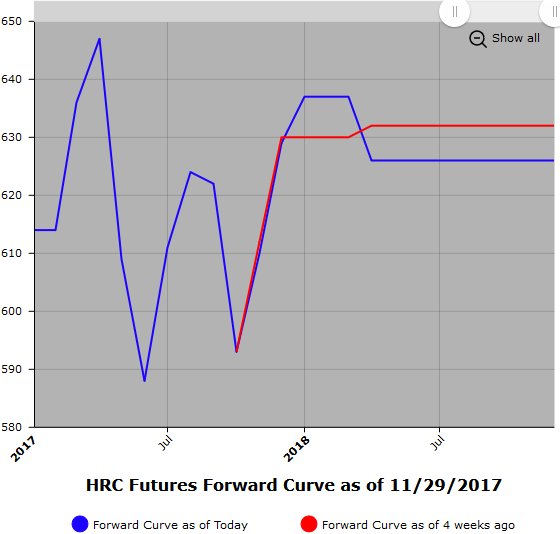

HR futures markets have paused post Thanksgiving. While the HR spot prices have retraced $27/ST in the month of November to approximately $620/ST, they are still shy of the $630/ST level spot was trading at in the beginning of September. The declining upward momentum in spot prices has kept buyers sidelined as reflected in the thinner volumes traded between $635 and $640/ST this week in Q1’18. However, sellers appear cautious as they only have interest at or above this recent price resistance in the low $640 area.

While we have seen some transactions in Q2’18 and beyond at discounts to Q1’18, the volumes have been small and it is difficult to say whether the recent backwardation will maintain should the market start to press higher.

Less than 8,300 ST traded this week in the HR futures with Open Interest just above 300,000 ST or 15,000 contracts.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

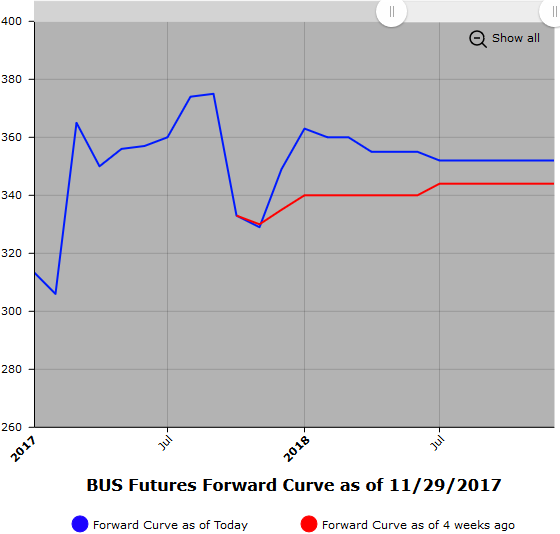

Seeing a bit of upward price pressure in the offshore scrap markets both from Asia and Turkey. Decent demand and market expectation that this will continue through year end.

Turkish buyers re-entered scrap markets and have helped push spot prices and futures prices higher for 80/20 in the last week and a half. Spot cargoes have risen from mid teens to $334/MT just in the last day or so.

LME SC futures have also trended higher as both Q1’18 and Q2’18 have pushed up into the $340/MT range following a healthy increase. The pivot point for the backwardation has moved out a quarter on this latest price move higher.

On the domestic front, BUS prime scrap prices for Dec’17 are anticipated to be $15-$20/GT higher. There’s anticipation of higher demand due to the Nucor DRI plant shutdown and approaching winter weather, as well as rising prices for 80/20. Current buying interest in Cal’18 BUS points to higher expected prices in the new year as the latest bids are coming in around $350/GT.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.