Market Data

November 19, 2017

SMU Market Trends: Mill Price Increases Surprise Many

Written by Tim Triplett

Were you surprised by the price increases announced this week by the major mills? If you were, don’t feel bad. You were among the majority of steel buyers who could foresee no clear direction for steel prices.

On Monday, Steel Market Update sent its market trends questionnaire to 650 steel buyers asking, among other questions, “Where do you see the price direction right now?” On Wednesday, a number of the flat roll mills raised prices by $30 per ton. Earlier in the week, the plate mills led with a $40 per ton increase. The close timing of the questionnaire and the price hikes makes respondents’ comments particularly revealing.

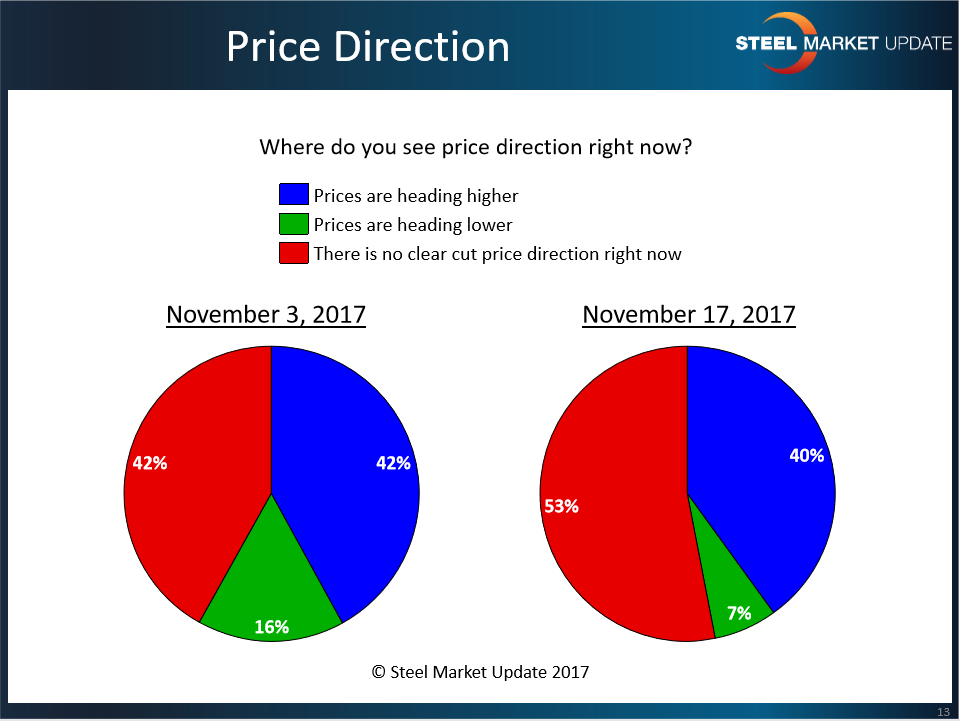

Overall, 53 percent of the steel buyers said they saw no clear-cut price direction. About 40 percent predicted correctly that prices would head higher. The other 7 percent expected prices to decline.

Among the group with no clear perception of the price direction, one service center executive said: “Prices are up in the air. They should be going up, but….” Added a manufacturer: “It’s very confusing. Mills are holding firm on pricing, and there’s no HR imports inbound, but I keep hearing deals are being done below the spot number.” Commenting on galvanized products, another OEM said: “The mills will all get on board with zinc increases, but pricing will be stalled. In March 2017, the galv base was $43 per ton and it’s been digressing ever since. After 2017 closes out, the mills will attempt another increase, but all the past ones have failed. There’s no true demand.” Another service center executive noted “there’s too much inventory” in the system. “Once you get a feel that prices are on the rise, the rug gets pulled out from under you,” said another disgruntled distributor.

Many who foresaw a price increase were surprised by the quick timing. Most did not expect new prices to take effect until the New Year:

· “Mills are closing up shop for the year and trying to get contracts finalized. We’ll see a seasonal bump in Jan/Feb, but the outlook beyond that is cloudy.” Service Center/Wholesaler

· “Prices are flat for the moment, but will trend higher when we start to get into the first quarter and seasonal demand picks up.” Trading Company

· “Prices will head higher as soon as December books are full.” Service Center/Wholesaler

· “Zinc extras, scrap availability, good demand. I see prices up in Jan/Feb 2018.” Service Center/Wholesaler

· “I believe the mills will announce a price increase soon, once they open January 2018.” Service Center/Wholesaler

· “But it will not be off to the races. There is a lot of flux in the market at this time and it could take another few weeks to begin establishing a clear direction. A number of question marks hang over the market.” Steel Mill

In their defense, the 7 percent who saw lower steel prices may yet prove correct. It remains to be seen if the mills can collect the higher prices or even head off a price decline.